The hype around Forex is justified. It’s one of the most profitable markets in the world. In 2015, its turnover reached $5.3 trillion per day. Just think about that! Every second, traders make thousands of transactions worth millions of dollars.

Before reading the article and writing your questions in the comments section, I recommend to watch this video. It’s not long but covers the biggest part of questions on the topic.

The Forex interbank market accounts for the largest trading volumes. It’s a wholesale currency arena where commercial banks, investment banks, top corporations, hedge funds, and other large trading institutions participate in big-volume transactions. The participants of the Forex interbank market trade via such major platforms as Reuters Dealing and Bloomberg, as well as ECNs. The interbank market plays an important role by providing liquidity to other market players.

The interbank market features a self-regulation system, which means that prices are determined by a certain party’s interest.

Did you know that common traders have nothing to do with this large market? They trade in the retail Forex market which is a small segment of the interbank market.

The retail forex market has come a long way. Fraud is becoming less and less common. Nowadays, an increasing number of brokers trade their clients’ positions in the interbank market via ECNs. If you want to trade with big liquidity suppliers, be sure to put some effort into finding an honest broker working via ECN. In trading, a good broker is half of success.

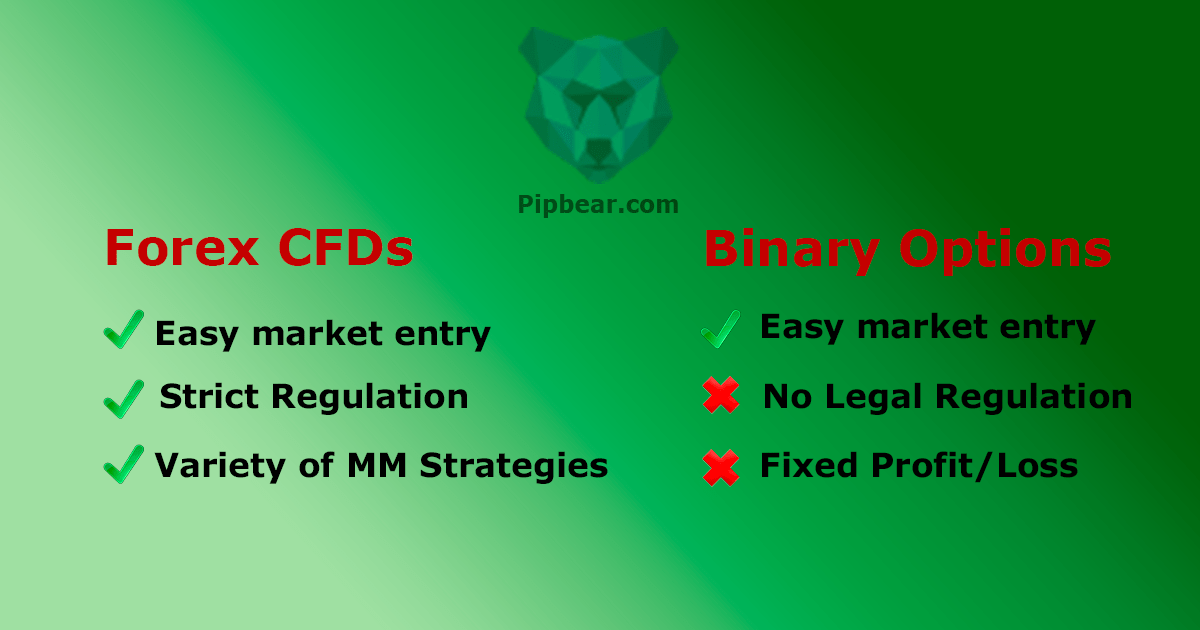

Binary options or forex? Which instrument is more profitable and easy to trade? This question is a subject of hot discussions in a trading community. You must’ve noticed that a growing number of forex brokers are now adding binary options to their selection of traded assets.

Brokers work hard to make binary options more available to the public. Some brokers even allow to trade binary options right in the Metatrader platform. All you need to do is to install a plugin.

So which asset is better? The answer to this question lies on the surface. Take a look at the chart below:

Here you can see indicative quotes in the interbank market. Both forex and BO traders can trade based on these quotes. While your positions won’t be traded in the interbank market, you’ll still be dealing with interbank market prices.

Binary options trading and forex trading are the two different universes. Which one to choose depends on what your trading goals are.

Table of Contents

Forex and BO: Differences

When it comes to trading binary options, you need to know three main parameters:

- option size;

- direction (up/down);

- expiry time.

If during an expiry period, a price moved at least 1 pip in the right direction, a trader will get a fixed profit. As you can see, everything is very simple. No calculations, no pitfalls or other difficulties.

In forex trading, you need to:

- choose a lot size;

- choose leverage;

- choose the right type of account (with fixed or floating spread);

- understand what ECN, NDD and STP accounts are;

- find out the size of a spread (there is no such term as “spread” in binary options trading)

- choose the type of order execution (market/instant);

- choose the type of a pending order (buy stop, sell stop, buy limit, sell limit)

In Forex, your profit is determined by the distance covered by a price, minus a spread.

Furthermore, forex traders risk their entire deposit.

As you can see, the forex list is much longer than the BO list. The forex market has higher barriers to entry. If you’re a novice trader, trading forex may be quite a challenge for you.

Binary options: Pros and Cons

Now let’s weigh all pros and cons of binary options trading.

Advantages of binary options:

- Easy market entry.

- Fixed profit.

- You can get a partial refund in case of a losing trade.

- Your profit starts from 80% per trade.

- To be in the black, you need to have 57% of winning trades.

Disadvantages of binary options:

- Blinded by seemingly easy trading rules, novice traders often forget that a chart displays a real currency or stock market that is pretty hard to predict.

- If you’re trading with a trend, you can make more profits trading in the forex market. In binary options trading, your profit is fixed and is not affected by the distance covered by a price.

- In binary options trading, you invest 100% and only get back 80-90%. If you’ve had a losing trade, the next winning trade won’t cover your losses from the previous trade.

- Binary options trading stirs up excitement and encourages traders to open random trades.

However, the main problem has to do with dishonest and misleading advertising. To attract naïve traders, brokers fool them into thinking that trading binary options is a piece cake and requires no knowledge or rational thinking.

What BO and Forex have in common

Unfortunately, both industries aim to squeeze money out of inexperienced traders. Brokers deceive novice traders by promising them sky-high profits with zero effort. It never ceases to surprise me how easily people buy this nonsense. If you have a good head on your shoulders, you must understand that a common person lacks special knowledge to predict price movements in the interbank market. You can’t become a pro overnight. Mastering the art of trading takes years of hard work.

Here comes another drawback. A Call/Put option, whether binary or regular, is designed to achieve the set tasks. In other words, this is an “all or nothing” trading tool. However, options are promoted as an alternative to sports bets. BO companies are sponsoring sports teams and football clubs to “convert” sports betting fans to traders.

Contact any Forex broker, and you’ll hear sweet promises about the interbank market, reliable investments, and so on. In reality, the number of successful traders in both forex and BO markets hardly reaches 5%.

After losing their savings, traders quit trading without making a dime. Most of them don’t even know what there is the “real” forex market somewhere out there.

Advantages of Forex trading

Although Forex trading is tough for beginning traders, it’s still worth considering due to several advantages.

- The forex market provides ideal opportunities for trading with a trend. While BO traders receive a fixed profit, forex traders get paid for every pip covered by a price. The bigger the distance, the better for a trader!

- Forex is a highly flexible trading tool. Thanks to pending orders, you can open/close a trade any time, once a price has hit a certain level.

- You can exit the market at any time. Thanks to stop losses and take profits, you can close a trade at any price level.

- High-profile forex brokers, which operate via ECN, have no problem paying out big amounts to their clients. You can easily withdraw $100,000-200,000 at a time.

Disadvantages of Forex trading

The biggest shortcoming is that trading forex is much harder than trading binary options. This is the obstacle that drives away most aspiring traders. As a result, traders switch to the BO market, where there are only two buttons for trading, Call and Put.

Another disadvantage has to do with potential losses. While BO traders risk the size of one trade, forex traders risk their entire deposit. In BO trading, you can’t lose more than the size of your option. Plus, you can get a partial refund if your binary option expires “out of money.”

When it comes to forex trading, you put all your money at stake. By choosing the lot size and margin leverage, you choose the speed at which your deposit will be increasing/decreasing as a price is moving in your favor/against you.

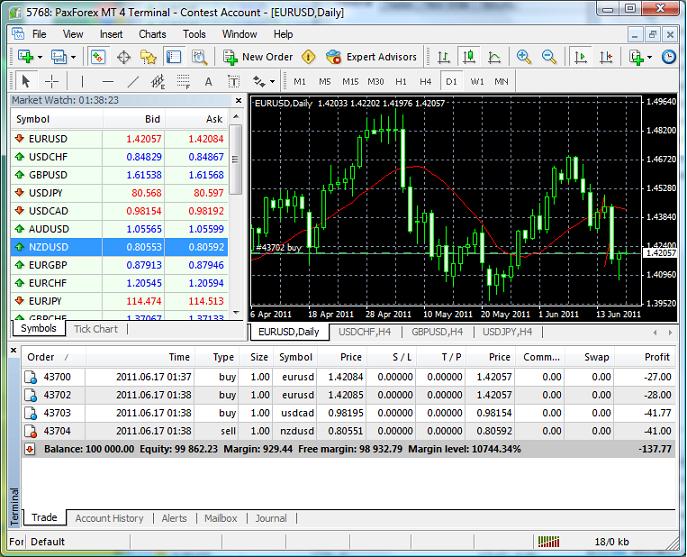

Spread

Spread is the difference between the bid and the ask price of a trading instrument. Forex brokers make money from spreads. In the chart below, the difference between 1.0641 and 1.0648 makes up a spread.

In binary trading, you can forget about spreads. For example, you open a trade by hitting the “Up” button. If a price goes up at least 1 pip, you’ve already made a profit. All you need to do is to wait till your option expires.

Stop loss and take profit

By setting a stop loss at a certain price level, you tell your broker when you want your position closed. Pretty simple, right? Nevertheless, stop losses often get hit by a price.

It’s usually caused by major news releases. Following a news publication, a price makes a large leap and hits a stop loss. As a result, a trader suffers losses. You may leave your trading desk for a minute and come back to find that your deposit has been “eaten” by an unexpected price move. Welcome to Forex!

The same can happen with your take profit.

Forex flexibility has its reverse side. As you know, forex traders are free to open and close their positions at any time. If a trader opens too many positions, they start to overtrade.

When it comes to forex trading, it’s very important to calculate the proper risk/reward ratio, stop losses and take profits. Once the market starts moving against you, you must close a trade immediately. If you choose to wait out a losing period, you’ll probably never see your deposit again. In BO trading, your loss will never exceed the size of your option.

BO or forex: Which one to choose?

Torn between the two options (no pun intended)? I have good news for you. You don’t have to make a choice right now. To assess all pros and cons of each trading instrument, you need to trade each of them. Only by trading forex can you understand the benefits of binary options. And vice versa. To get a deeper understanding of the forex market, you need to spend some time trading BOs.

As mentioned earlier, plenty of brokers offer the opportunity to trade both forex and binary options. Open a cent account and off you go!

Cent accounts

A cent account is a trading account with balance measured in cents (and not in US dollars). If your deposit 100 cents to your cent account, your balance will be displayed as “100 dollars” (which is not the real 100 dollars). Cent accounts offer an opportunity to open small-size positions. For beginners, it’s a cheap and straightforward way to get the hang of trading. You won’t even need a demo account!

As for binary options trading, the minimum lot starts from 1 dollar.

It’s not uncommon that professional traders trade both forex and binary options. As for me, I trade binary options when trading forex is unprofitable, e.g. during consolidation periods. When the market is trending, I switch to forex. With correct analysis, you can ride a strong trend and multiply your deposit.

Two different assets. Two different approaches to trading. One chart. It won’t be an exaggeration to say that forex and binary options are two related instruments. It’s only natural that an increasing number of forex companies are adding BOs to their selection of trading instruments.

Bos and forex: Markets

I use BOs and forex in different market situations. If a price is moving sideways (consolidation), I trade binary options:

If a price is trending, I trade forex.

Sideways movement offers great money-making opportunities for BO traders. Due to spread and low volatility, consolidation is hardly the best time to trade forex. The only exception is scalpers, who can apply their talents in tick and M1 charts. During consolidation, other forex traders apply robots and advisors.

If a price is moving in a strong trend, don’t think twice before switching to forex. By the way, binary options can be also traded within a trend but this is the topic of another article.

As you can see, the secret is to find the right market for each instrument.

From BOs to Forex and back

Here are the two questions I get asked regularly:

- Why do BO traders switch to forex?

- Why do forex traders switch to BOs?

Each of these questions contains the answer to the other one. Traders start trading forex because they’ve failed in the BO market. And vice versa. If a trader isn’t happy with their forex trading results, they decide to test their luck with BOs.

If one of the assets were more profitable than the other, all traders would trade this asset. In reality, traders are divided into two groups:

- “Who needs binary options when you can make a fortune in forex?”

- “Who needs forex when you can safely trade BOs?”

Let me give you a piece of advice. Don’t try to find an “easier” instrument to trade. Whether it’s BOs or forex, 90% of traders give up and quit trading. If you want to win in the trading game, you need to be disciplined and consistent. Give both BOs and forex a chance and then decide which asset fits your trading style best.

A selection of trading instruments is huge. Along with BOs and forex, you can capitalize on:

- futures;

- vanilla options;

- stocks;

- indexes;

- bonds;

- mutual funds;

- exchange-traded funds (ETFs).

Remember that no asset on this list that would outperform the others. Otherwise, all traders would trade this amazing instrument, me included. We’re all chasing profits and financial independence, after all.

Your task is to explore each asset, from binary options to futures to multi-leg options. This is the only way to assess the weak and strong sides of each instrument. As a conclusion, I’d like to share some parting words of wisdom: you can make money on any asset if you know-how.