Currency pairs correlation is the relationship between the movement of one pair about another. There are positive and negative correlations.

Before reading the article and writing your questions in the comments section, I recommend to watch this video. It’s not long but covers the biggest part of questions on the topic.

- Positive – the charts of currency pairs move almost synchronously in one direction.

- Negative – the charts are moving in opposite directions.

You have an opportunity to check all online without trading platform installation on our online charts.

A striking example of a negative correlation is EURUSD and USDCHF currency pairs. Take a look at the screenshots.

You can see the charts are almost mirrored copies of each other. This is the negative or reverse correlation of the currency pairs.

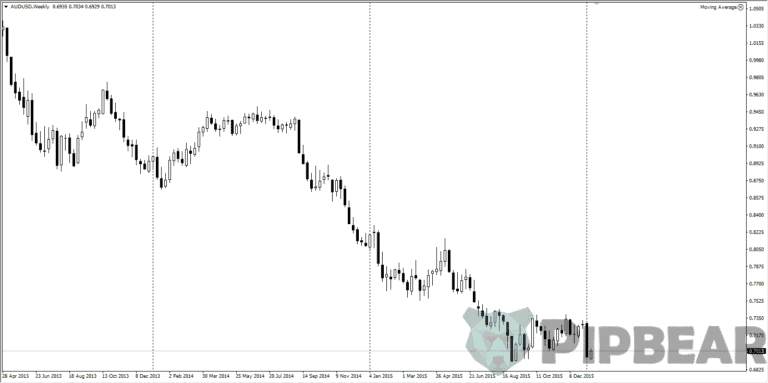

Here is also a positive correlation, for example, NZDUSD and AUDUSD currency pairs correlation

Of course, the carts will be similar, but the overall picture is visible right away, there is a strong relationship. There are less dependent pairs and the dependence coefficient can be found, but we’ll talk about this later.

How to Benefit From Currency Pairs Correlation

Of course, we all are interested in correlation from the earning point of view – whether it is available? Directly – no, in any case I do not know such a method. But this does not mean that correlation knowledge is useless. In addition to information for general skills improvement, there is a way to apply the interrelations of currency pairs in practice.

CURRENCY COUNTRIES CORRELATION STRATEGY

The strategy is to obtain confirmation signals for their inputs into the market. Let’s say that our trading strategy, for example, let it be a “Guppy” strategy, gives us a signal to open a position for sale on the EURUSD currency pair on the D1 timeframe, but we want to make sure whether this signal is false. It’s possible to use correlation for this.

We know that EURUSD has a strong reverse correlation with the USDCHF currency pair, respectively, the price should go in the opposite direction to the EURUSD direction in the letter. If the pairs move in one direction – this is a signal for us that it is possible to open the position and the EURUSD signal is not strong enough. I think the idea is very clear.

Another way will be useful for traders preferring to trade currency baskets. There is not much point to include in the basket those currency pairs which have a strong correlation since if having such interdependent, all the pairs will become either positive or negative. It is better to open a trade for a single pair and the costs for the spread and fees will be lower.

Example: EURUSD gives a sell signal and USDCHF – buy signal at the same time. Since these pairs have a strong inverse correlation, the two positions opening is almost meaningless, it is better to choose something one.

CURRENCY PAIRS CORRELATION TABLE

Fortunately, there is no need to remember all these relationships, instead, it’s possible to use the correlation table of currency pairs.

I think the most convenient and clear currency pair is Oanda’s website, below is a screenshot of this table: currency pairs correlation table. Choose a currency pair, it is highlighted by a green band. Next, a circle appears opposite the other pairs which reflects the degree of correlation and its appearance relative to the selected pair – positive or negative online.

One more good interactive correlation table. Provided by MyFXBook service for our site.

Here, the closer the correlation value to zero, the correspondingly weaker correlation. Positive values (+x percent) – positive correlation, negative values (-x percent) – negative correlation.

very nice educational tips Pipbear but one more bother in my mind is the equity management i wish i could have a more exposure on this very important lesson

Great article Very concise and precise. Thanks for sharing

Just wonderful, been searching for “100 pips per day forex” for a while now, and I think this has helped.

Thankful to you for this stunning instructional article. I like the way you clear up everything. I would trust you will continue giving us more videos.

What would make a currency correlated to another? Can we trust such currencies will continue being correlated

Thank you Sir, You are my mentor!!

Greatful for sharing this

Sir what if i am still a student in college from Indonesia, can I trade Forex? Would it affect my studies?

Thank you