Using a grid to plot buy and sell orders is a very popular trading method among forex traders. It’s easy-to-visualize and highly informative at the same time. A forex grid lies at the bottom of multiple trading strategies and grid robots.

In this article I will provide you with a detailed explanation of how do traders effectively use the Grid tool and overview two useful MT4 indicators: Grid_v1.0 and it’s modification – Simple Horizontal Grid. You will find the download links below.

Table of Contents

Two types of a forex grid

In trading, grids come in two major types:

- static grid with a fixed step;

- dynamic grid.

Why do you need a grid?

A Forex grid can serve two purposes.

- If you need to lock in a price, you should use a static grid with a fixed step. This type of grid is plotted at some distance from the current price.

- If you need to maximize your profit, you should use a grid that will help you capitalize on a price movement.

If it all seems like rocket science to you, don’t worry. Let’s zoom in on each of the two methods.

Great Video Explaining the Grid Trading Systems

Here is a great Youtube video with a simple explanation of how grid trading strategies work. I strongly recommend you to spend 15 minutes to watch it so you understand if you need the indicators or not.

Static grid with a fixed step

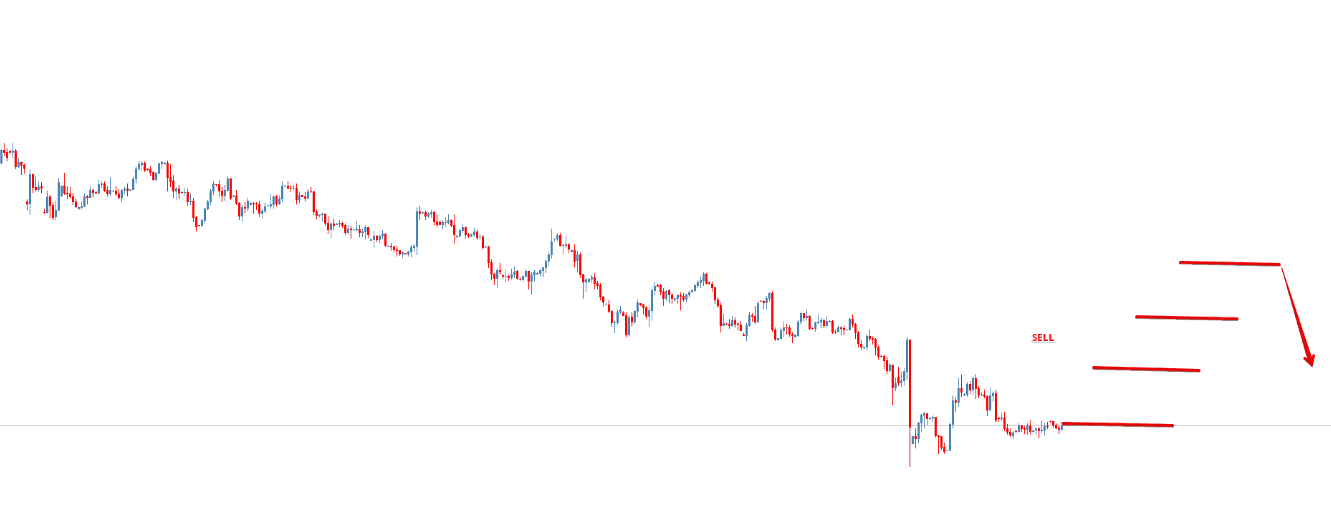

Let’s open a long and a short position at the same price. Then we need to plot a static grid with a fixed step. Above the price, we place pending Sell Limit orders. Below the price, we place pending Buy Limit orders.

This method allows you to cover a wide price range, which makes it very profitable and very risky at the same time.

How to use a static grid to lock in a price

To be able to lock in a price, you first need to identify the direction of a trade and entry price. As the next step, you need to plot a grid with a specific step based on the current market situation.

To benefit from this approach, you need to understand how the market works and have a good knowledge of technical analysis. Plus, you need to have a clear trading plan and follow it to the letter.

Keep in mind that the two static grid methods described in this article are countertrend and based on mathematical and statistical properties of a price. Since the external factors affecting the price aren’t taken into account, there is no need for sophisticated market analysis.

How to use a static grid to lock in a profit

This method is a little trickier. You need to increase profitable positions as the price moves. Paired with the Anti-Martingale technique, this strategy can generate some juicy profits.

Before you apply this method, make sure you have enough trading experience and a good understanding of the market.

How to determine the distance between orders

When it comes to a static grid with a fixed step, the distance between pending orders is always the same.

Orders are usually placed at the psychological levels, i.e. price levels that end in 00. In a grid-like that, a step equals to 100 pips. For day trading, a 50-pip step is used.

It has been found out that the optimal step for day trading equals to 42-46 pips. A smaller step would increase the pressure on your deposit, and a larger step would result in reduced profitability.

Open Live

Leverage

for

Dynamic grid

Since a static grid with a fixed step has enough shortcomings, many traders give preference to a dynamic grid, where orders are placed based on technical analysis and current market situation. Note that using a dynamic grid requires a great deal of trading skills.

Orders are placed at the key technical levels which can be identified using technical indicators (Fibonacci levels, Pivot Points, Moving Averages, etc.).

A dynamic grid is plotted step by step, following the price. The distances between the orders vary depending on the currency pair, market volatility, and trading session.

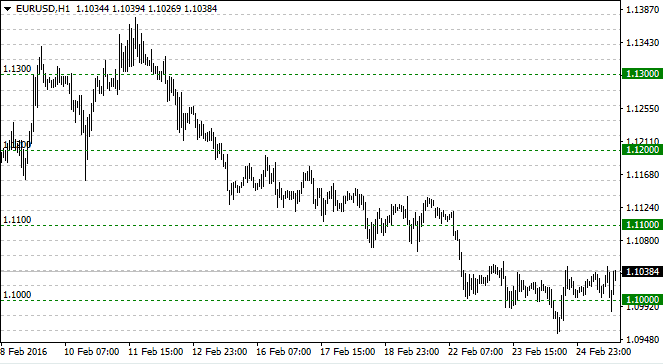

Forex Grid Indicator for MT4

The Grid Indicator For MT4 displays a more convenient grid than the in-house grid of Metatrader4. The Indicator can be used on all timeframes below the weekly timeframe. It uses vertical lines to separate your chart into month, weeks, days, and hours. It is easy to spot the different types of lines because they are displayed in different colors. The start of a new hour is displayed by gray vertical lines, the blue vertical lines show the start of a new day, the red vertical lines show the start of a new week and the yellow lines show the start of a new month.

The visibility of the different vertical lines depends on the timeframe you are currently using. On the M1 and M5 timeframes you can see all the vertical line types. If you switch to the M15, M30, or H1 timeframe, the gray vertical lines disappear. On the H4 timeframe you can see the red and the yellow lines, meaning the start of new weeks and month. Lastly on the Daily timeframe you can only see the monthly vertical lines. This simplification makes perfect sense since the indicator would start cluttering your charts with way too many lines if all the different vertical lines would be displayed on all timeframes.

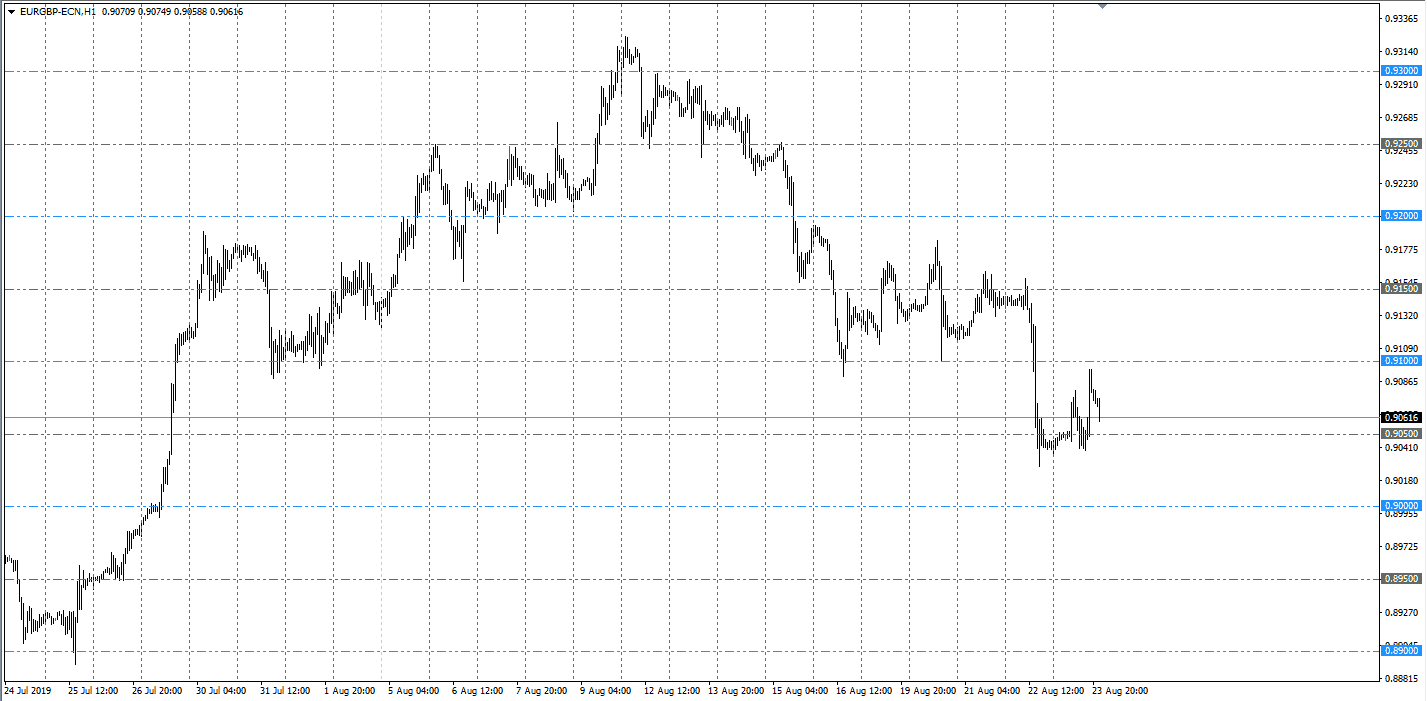

Simple Horizontal Grid Indicator

The indicator places a series of equidistant adaptive horizontal lines to a chart. The lines are updated with every chart change and are independent on symbols or scale. If the user changes the vertical scale, the indicator adds or removes lines accordingly.

The lines have two colors, the primary color is dedicated to lines glued to round numbers, the weak color is for secondary lines equidistantly placed between the round-number lines.

Bottom line

It should be noted that a grid is by no means a surefire way to earn a guaranteed profit. While some traders are successfully using it to make dizzying profits, others blow away their bankroll in the blink of an eye. Keep in mind that an incorrectly calculated step or opening prices may cost you your entire deposit.

As mentioned earlier, the Martingale method is a frequent “companion” of the Forex grid strategy. It allows us to reduce a step before closing the grid and boost profitability. At the same time, a fast-growing lot may cause big losses, so be careful.

Unfortunately, there is no one-fits-all Forex grid strategy. To view it as a goldmine would be a mistake. How you choose to capitalize on the Forex grid depends on your skillset and market situation.

Thanks Tony, will try the horizontal lines

Thanks for the indicators