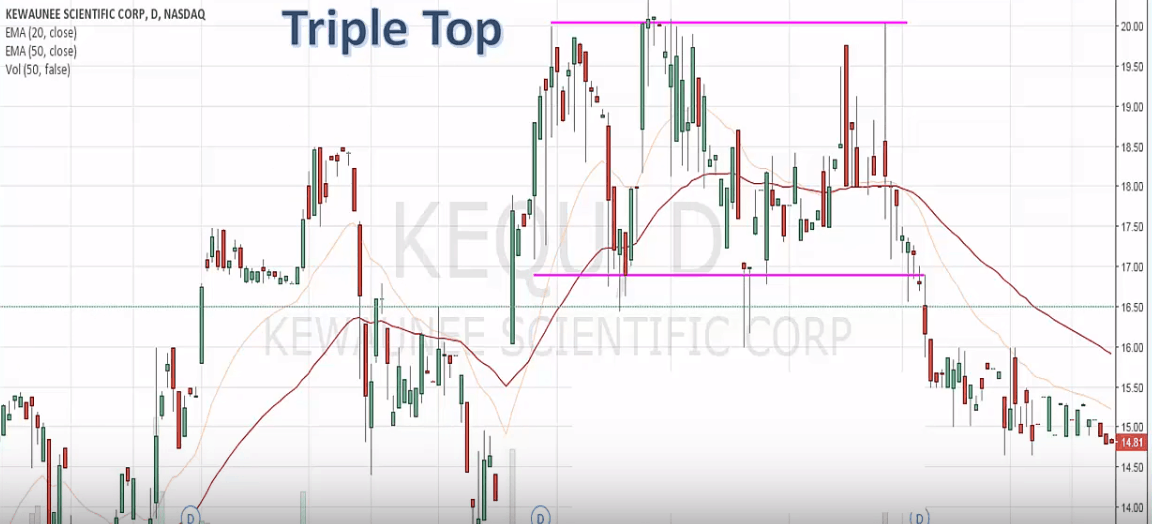

Triple Top is a reliable pattern that signals the reversal of a bullish trend. In a chart, the pattern is plotted as three consecutive highs of about equal height. Triple Top is a special case of the Head and Shoulders pattern, with the head located at the same level as the shoulders. The differences between the two figures are purely theoretical since both of them indicate a change from an uptrend to a downtrend.

It’s not without a reason that we referred to Triple Top as a reliable pattern. If you think about that, the pattern tells us that a price made three consecutive attempts to break a resistance level and failed every time. Each new attempt confirms that the bulls are losing their grip and enhances the likelihood of a reversal.

Identifying a Triple Top formation can be tricky. There are a few important things (price levels, trading volume, etc.) that need to be taken into account.

- Triple Top is preceded by a strong long-term uptrend that has been going on a month, at least (the longer, the better).

- Three consecutive highs must be prominent and occur at the same level (1-2% deviations are OK). The three peaks form the upper resistance level.

- The lower support line goes through either of the two lows that follow the first two highs, depending on which one is lower.

- As Triple Top is forming, the overall trading volume is falling. (At the same time, local increases in trading volume around the highs are acceptable.) It’s an indication that the bullish pressure is slowly fading away and a trend reversal is nearing.

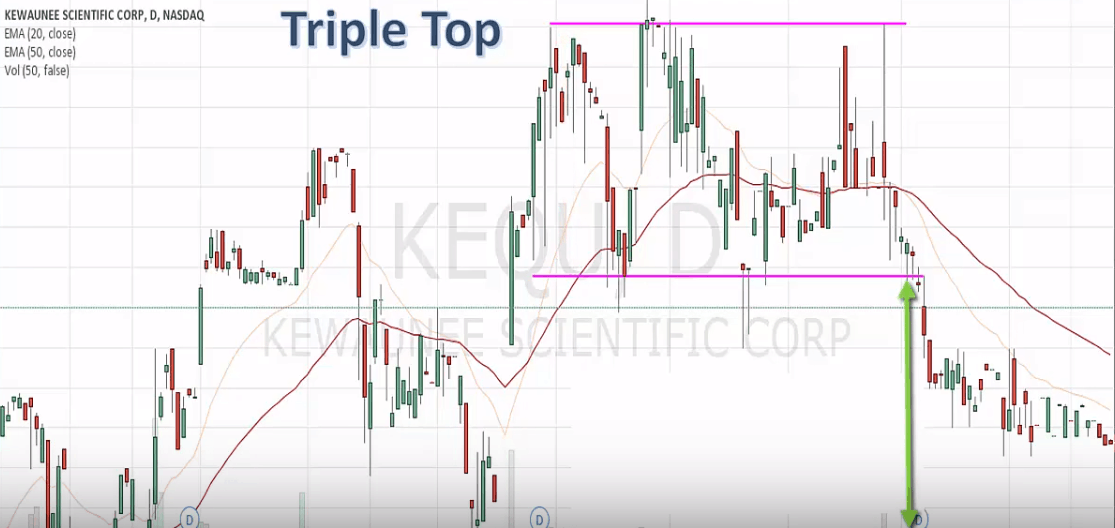

- The final confirmation is when a price breaks the lower support level after the third peak has appeared. The breakout comes with a spike in trading volume and, sometimes, price gaps. Following the breakout, the support level becomes a new resistance level.

- To determine a price target, you need to measure the distance between the lower support level and the highest of the three highs, and then deduct this value from the breakout level.

- How reliable Triple Top depends on how long it took to form. In the best-case scenario, the three-peak pattern needs several months to take shape.

Out of all technical patterns, Triple Top is one of the hardest to recognize. As you can see, it requires a trader to do a great deal of analysis. Until the third peak appears, the pattern looks exactly like Double Top. Furthermore, three same-level highs in a row are also characteristic of such figures as the Ascending Triangle and Ascending Rectangle, which indicate trend continuation. Triple Top is only confirmed when an asset falls below the support level, which is accompanied by a leap in the trading volume.