In one of the previous articles we have already got acquainted with the indicator moving averages. We also analyzed one of the representatives of channel indicators, namely Bollinger Bands. These indicators are deservedly of great popularity among the traders of financial markets. They are included in a huge number of trading systems and brought more than a dozen percent of profits. And what if we combine the ideas of these indicators? This time, we will disassemble such a simple but universal classic indicator, like Envelopes, or Moving Average Envelopes.

Before reading the article and writing your questions in the comments section, I recommend watching this video. It’s not long but covers the biggest part of questions on the topic.

Table of Contents

Characteristics of the indicator

- Platform: any

- Currency pairs: any

- Timeframe: any from H1 and above

- Trading time: round the clock

- Type of indicator: trending

Description

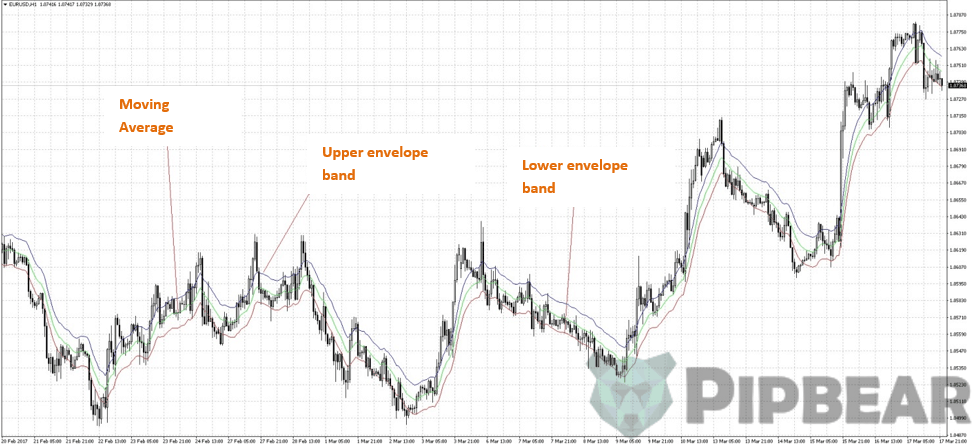

Envelopes Technical indicator for Moving Average, or simply Envelopes for short, are formed by two moving averages, one of which is shifted up, and the other is shifted down. The choice of the optimum relative value of the displacement of the band is determined by the trader based on the average volatility of the market: the higher it is, the greater the offset.

Envelopes determine the upper and lower limits of the normal range of price fluctuations of the instrument. The simplest interpretation is that the signal to sell occurs when the price reaches the upper limit of the band, and the signal to buy when it reaches the lower limit. The application of the technical indicator Envelopes is based on the natural logic of market behavior: when under the pressure of particularly zealous buyers or sellers, prices reach extreme values (that is, the upper or lower limit of the band), they often stabilize, returning to more realistic levels. This logic has spawned a whole family of trading systems, called reversal return systems, or Reversal Systems. The same principle is used to interpret the Bollinger Bands indicator, about which the blog has already had an article.

History

As you know, there are several different approaches to trading in financial markets. These are different types of arbitration, and modern types of systems based on the Big Data and Data Mining analysis, this is an analysis of macroeconomic indicators and so on. But three universal simple approaches have proven their profitability for many years. This is Trend trading when the trader determines the presence of the trend, waiting for a pullback from the main movement and opens a trade with the expectation of a continuation of the trend:

Trend trading is good when there are these very trends. When the market is protracted flat, trend trading brings a long drawdown.

This is the system of Mean Reversal trading when the trader determines the average (fair) value of the instrument price and waits for a deviation from this value to enter the transaction in return for the price to its average value:

To understand when to open a trade, when the price has already gone far enough from a fair price, usually different methods are used to build channels around the middle and various filters, like this or that oscillator. This kind of trading is good in its turn when everything is calm in the market. Under a trend, the systems built on this principle will merge or trample in place. Generic is built on this principle (it uses the Bollinger bands), while it uses the feature of the Forex market – a quiet market in the Asian session.

If you try to trade using such a strategy in any market, including the European session, you will suffer losses. Depending on the current volatility, the price can go very far from the moving average, also, such systems work well when this fair price does not change much in time (it is approximately on the same level). In the case of a trending market, a fair price always follows a trend, which is not always easy to take into account in trading.

There is one more simple concept that we will need today. It is momentum trading, that is trading in momentum, trading in impulses. Impulses, unlike a trend or a flat, do not require additional training. That is, you do not need to analyze and decide whether the trend is now or if it is flat if it is the right time for trading momentum. It is always suitable – there is an impulse, so we are trading it.

That is, in the general case, we recorded an impulse that broke something, and entered the breakdown side, counting on the continuation of the movement. Such trading is very similar to the trend, but it is of a more short-term nature. Typically, this trade is characterized by the use of channels or local extremes. The entrance to the trades is mostly done by deferred stop orders. The most famous example that comes to mind is the trade by the method of Turtle trading by Richard Dennis.

Unfortunately, the author of this indicator is unknown. It is only known that Envelopes were designed to help traders trading at the breakdown of moving averages, to filter false signals. Like that:

This was the original logic of the application of the indicator. But nothing stands still, and traders found that Envelopes can be successfully used in Mean Reversal trading. Also, the indicator is used for trend trading: by finding the price at the border of the indicator, you can judge the completion of a rollback from the main trend. So, as you can see, the scope of Envelopes is very wide.

Calculation

Before you start the research, you need to find out what we are dealing with after all. How this indicator works, what is the formula for calculating it? Here, everything is simple:

UPPER BAND = SMA (CLOSE, N) * [1 + K / 1000]

LOWER BAND = SMA (CLOSE, N) * [1 — K / 1000], where:

- UPPER BAND – the upper line of the indicator;

- LOWER BAND – the bottom line of the indicator;

- SMA – a simple moving average;

- CLOSE – the closing price;

- N – the averaging period;

- K/1000 – the deviation from the average (in tenths of a percent).

The indicator includes three moving averages, but the average of them (that is the fair price) in many platforms for some reason is not applied. As you can see, the formula is quite simple.

Parameters

Indicator period – the change in the number of periods n averaging MA, default = 20. Periods are set in the same way as for moving averages.

- Shift – similar to the moving average, you can move the envelopes relative to the current bar into the depth of history (negative number), or the right to the future (positive number).

- Method MA – method of calculating the moving average;

Apply to – the price for calculating Envelopes. Just as in the moving average parameter, it is recommended to build an indicator for the closing price (Close); - Deviations are the amount of shift k, the default is 0,1. The optimum value of the shift (expressed as a percentage) depends on the volatility of the tool. The more volatility, the higher the shift value. The parameter should be selected visually for a specific market and timeframe, but usually apply from 0,05 to 0,5.

Advantages and disadvantages

The disadvantages of the indicator are the same as for moving averages – the indicator lag in determining the trend. Nevertheless, the indicator is still a channel, so it is rarely used as a normal moving average. Most often, however, Envelopes are used in impulse systems and reversal systems to the middle one. By the way, as for the latter option, to determine the turning point, the more sophisticated channel indicators are better suited, in the formula of which the channel width is adapted to the current market volatility.

Band breakdown

A simple long signal occurs when the price closes above the moving average, and the short signal occurs when the price falls below the moving average.

We have already discussed what problems arise with trading based on the Moving Average. To limit the number of losing trades, some technical analysts suggest adding the filter to the sliding ones. They add lines which are a certain distance above and below it, forming envelopes. Transactions are concluded only when the price moves through these lines, called “envelopes” because they surround the original moving line. If one of the Envelope lines breaks down, you can more confidently judge the presence of a new trend.

In the figure above the green circles indicate the breakdowns, which continued, and from which it was possible to take at least a small profit.

The red color indicates false breakdowns. As you can see, both are approximately of the same number, so the correct ratio of risk to profit comes to the fore, which will generate the trader’s profit. As we see, if the price has broken through the channel and has not returned to the next few candlesticks, you can often expect a long trend. Therefore, it is important to use pending orders, put as shortstops as possible, rather sooner move stops into a breakeven, and not to limit profit by position. It is perfect to set the stop loss a little further than the level of return to the channel, and the cover at a short distance from the breakdown plug. If the breakdown candlestick is closed at too great a distance from the channel, it is better to skip such a trade. Take profit is better not to use at all, but use a neat trailing stop on the shadows of the candles after the price. Well, the use of a stop transfer to a breakeven will save from Stop Losses in half the cases of false breakdowns.

Bounces from the Envelopes lines

Among the first supporters of this countertrend strategy was Chester Keltner. Back in 1960, in his book How to Make Money in Commodity Markets, he described the idea of the Keltner Channels, using slightly more complex calculations. Instead of using the closing to calculate the Moving Average, it used a typical price, which is defined as the average of the high, low, and close. And instead of building envelopes with a fixed percentage, Keltner changed the width of the envelope, adapting it to a 10-day simple moving average of the daily range (maximum minus the minimum).

Envelopes define the upper and lower limits of the normal range of price fluctuations.

When you reach the upper limit, it is a signal for a short trade, when you reach the bottom, it is a signal for a long trade. The signal for short trade occurs when the price reaches the upper limit of the band, and the signal to buy – when it reaches the lower limit. The choice of the optimum relative magnitude of the displacement of the boundaries of the strip is determined by the volatility of the market: the higher it is, the greater the offset. The use of envelopes is based on the natural logic of market behavior: when under the pressure of particularly zealous buyers or sellers prices reach extreme values (i.e., the upper or lower limit of the band), they often stabilize, returning to more realistic levels. The same principle is used in the interpretation of the Bollinger Bands.

Later, John Bollinger, based on the idea of Moving Average envelopes and the Keltner Channels, developed his bands, which surround the simple moving average and are located two standard deviations above and below the moving average.

In the figure above, breakouts are indicated, after which the price returned to the channel and went at least until its middle. It is easy to see that, once the trade goes inside the channel, the potential profit, in this case, is limited. But the stop loss, on the contrary, should be wider, to allow the price to go a little longer before turning. False breakdowns of channels happen more often, but they are more difficult to trade because of the ratio of profit to risk, not in favor of profit.

Therefore, they leave at such a trade precisely at the accuracy of the entrance, on the percentage of profitable trades. If the breakdown system may well be only 40 percent of profitable trades, then there must be at least 60%. If you look at the chart of any tool, then it is easy to make sure that true breakouts are accompanied, as a rule, by increased volatility, whereas false ones happen in quiet times – this is what you need to start with when building your system.

By trading “at the right time”, you can significantly increase this percentage of profitable trades. A striking example is the vast majority of night scalpers. They use false channel breakdowns at night when volatility in markets is small in combination with broad stops and small profit targets. An unpleasant moment when trading according to this principle in the case of an unsuccessfully designed trading system, maybe a too wide stop loss, which, in the event of a force majeure situation (and in the markets, this is not uncommon), eats up all the profits accumulated over the month.

To not let this happen, everything should be reasonable. The system with an average profit of 6 points and an average loss of 40 points is quite difficult to work in the psychological sense, and in the future can bring a lot of losses with a slight change like the market. Of course, it is desirable to strive for a ratio of 1 to 1, but more often it is unattainable in this type of system. What else is worth bearing in mind is the maximum loss on the system. If it is more than three times the average, it is worth considering before trading such a system.

Conclusion

Moving average envelopes are a useful tool for determining the trend when it is formed. Also, envelopes can come in handy for recognizing of turning points in short-term trends with high probability. Traders in any financial market can profitably apply this technical tool with due skill and experience.

Your explanation is simple and straight forward, new tool added in my tool box

I’ve been trading for a couple years but i still for some reason still like reading these kinds of tutorial. and this is the BEST one to clarify exactly what people should know.

This is so easy to understand for a newbie like me thanks a lot.

Finally one clear and no bs explanation. Gonna use it tonight for trading. Thanks.

Thank you so much for this. As chinese say, “give the man a fish and u feed him for a day. teach him how to fish, and u feed him for a lifetime

All, I want are the basics. I’ll keep watching this over and over again. Thank you.

great explanation, straight to the point.. the one that im looking for. thank you, more powers and god bless.

many people make forex a complex thing,this videos explains and demonstrate it so well… love it

Great explanation!!!