Dots indicator was developed 10 years ago. It is based on the calculation of the current price change cosine, for which Moving Averages, popular indicator’s data is used. Moving Average tool’s goal is to provide Dots indicator with the prices, specified by the user in the settings section. What does the chart look like with the indicator set? What is the way to use them in trading?

Before reading the article and writing your questions in the comments section, I recommend to watch this video. It’s not long but covers the biggest part of questions on the topic.

Table of Contents

Dots indicator description and setting

The indicator’s appearance is a consecutive chain of blue and red circles located in the area of certain candles located on the chart of the currency pair. This is the way it looks in reality:

You will fail to find the tool in the standard section for the MetaTrader 4 platform. Initially, it’s necessary to download it, then install it in the terminal by the standard way. For this, you need to put the file you’ll find in the archive into the root directory of your broker.

Open the platform, enter the main menu, select the “File” item and click on “Open data catalog”. You will be taken to the root directory of the installed platform. Now you need to find a folder called Indicators and put your file from the archive here. The trading platform must be restarted for the tool emergence in the list. Close it and open it again. Then put the indicator onto the chart and use its indicators.

Downtrend dominates the market if the red dots appear on the currency pair’s chart. The reverse situation is observed with an uptrend. In this case, blue dots appear on the pair’s chart.

Basic settings

Dots indicator has few settings. First of all, you can change the dots’ color on the chart from blue and red to the one convenient one for you. The remaining settings relate directly to the instrument operation. The window with the settings looks like this:

The length parameter is responsible for the Dots indicator period. The preset parameter is at the level of 10. If you increase this period, the indicator reliability will increase, there will be less false signals, but the delay will also increase.

The parameter in the Applied Price settings is responsible for the price type which is used to calculate the indicator. Here you can specify the price of opening, closing, minimum or maximum candles.

The Filter property allows us to cut off sharp price jumps when calculating the Dots indicator’s results. The results are smoothed out thanks to it.

The item in the Deviation settings at the set value shifts the indicator vertically and if selecting a value other than zero in the Shift settings, the tool’s results will be shifted horizontally.

When working with the indicator’s results on different timeframes it’s possible to experiment with the settings, and then test the data while using the strategy tester in the MetaTrader terminal or a third-party program.

Example of use

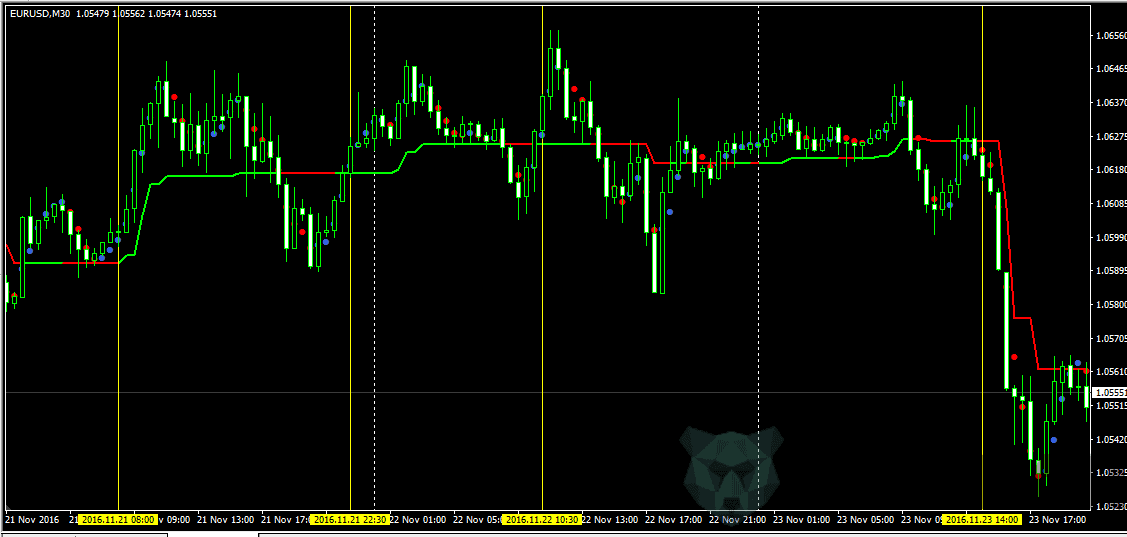

The Dots indicator has proven itself with the well-known SuperTrend indicator (download it here). The latter is a broken line, which, depending on the trend’s direction, changes its color from red to green and vice versa. When trading with the indicator described above, it’s necessary to wait for the moment when the SuperTrend line changes color to red and the red dot of the Dots indicator (for sales) appears below it.

Similar conditions are actual for purchases with only one difference.

It’s necessary to see the change the curve’s color to green and wait for the blue dot formation above the Super Trend line.

It’s possible to see the trading strategy’s example in the figure below. Successful entries into the market by the conditions described above are marked with the yellow vertical lines.

If looking closely at the chart, it’s possible to see the trading system works well during the trend. It’s no wonder since its components are trend indicators. Therefore, it is recommended to use a tool as a false signal filter which can determine the phase in which the currency pair is located, or manually do it yourself.

Dot.MMS indicator

Dot.mms indicator is often confused with the Dots indicator, but these are two completely different tools. The first is intended primarily for working in the market of binary options and has a completely different operation algorithm. It will look the following way after installing it in the trading platform and on the schedule of the working pair:

The indicator provides two signal types. First, it warns the trader about the upcoming input into the market by the dot emergence above or under the candle. Then there is an arrow that is directly a signal to enter in the direction it is directed to.

Points and arrows appear at the points of the trend reversal or the correction start against the existing trend, but, as you can see on the chart, the indicator does not always manage to correctly determine the location. That’s why it’s better to use it together with others, for example, Bollinger Bands or Moving Average.

There is an additional indicator’s component in the lower part. The curved lines’ essence is they change color when reaching their peak values. Usually this moment coincides with the input signal emergence.

Besides there is also a new improved version – DOT.MMS 3.9. indicator. It has advanced options for trading binary options. In particular, you can set the risk level, your capital, expiration date and much more. This tool-based system is distributed on a fee basis.

Both indicators look promising from the finance’ point of view, but they need additional setting and optimization for a specific market. False signals’ filter in the form of other technical analysis tools strengthens the Dots and DOT.MMS indicators’ signals reliability. So, regardless of what you trade (binary options or forex), look for confirmation and then enter the market. Remember that trading profitability depends on the broker you choose very much!