Many traders already know well the capital management according to the Martingale method. It is also known for its high profitability and the inevitable loss of the entire deposit at the same time. However, there is an opposite method of money management, which the traders call the Anti-Martingale method. In this article, we are going to discuss it in detail and find out which “break-even” system is better.

Before reading the article and writing your questions in the comments section, I recommend to watch this video. It’s not long but covers the biggest part of questions on the topic.

Table of Contents

ABOUT THE SYSTEM

This money management system (just like most of the “break-even” systems) was taken from the world of gambling, where they call it Parlay. Today nobody truly knows who first decided to turn the rules of the Martingale method. Although, it doesn’t matter since it’s quite a simple thing to think about.

So instead of increasing the investment size after each loss, the traders need to double their rates after a profitable outcome. Thus, the Anti-Martingale system is safer than the original one but it also has lower profitability.

However, you should understand that the strategy still can bring you losses despite the risks are significantly decreased.

PRINCIPLES OF THE METHOD

The essence of the Anti-Martingale trading is very simple:

- Set the size of the first investment.

- If the transaction happens to be loss-making, do not change the size of the next investment.

- If the option happens to be profitable, double the next investments until there is another money loss.

Let’s take a look at the example of the table with a profit of 80%:

| Rate | 10 | 20 | 10 | 20 | 10 | 20 | 40 |

| Loss | -20 | -20 | |||||

| Profit | 8 | 8 | 8 | 16 | 32 | ||

| Total | 8 | -12 | -4 | -24 | -16 | 0 | 32 |

The Anti-Martingale strategy differs in the fact that it does not go into such deep drawdowns as the usual Martingale strategy does. Of course, it is much easier to bear psychologically. However, in this case, a series of profitable transactions may last for a long time but sooner or later the last transaction (the largest one) will bring a big loss. The thing is that the total of the previous positions should be larger than the last option size.

PROFITABILITY OF THE METHOD

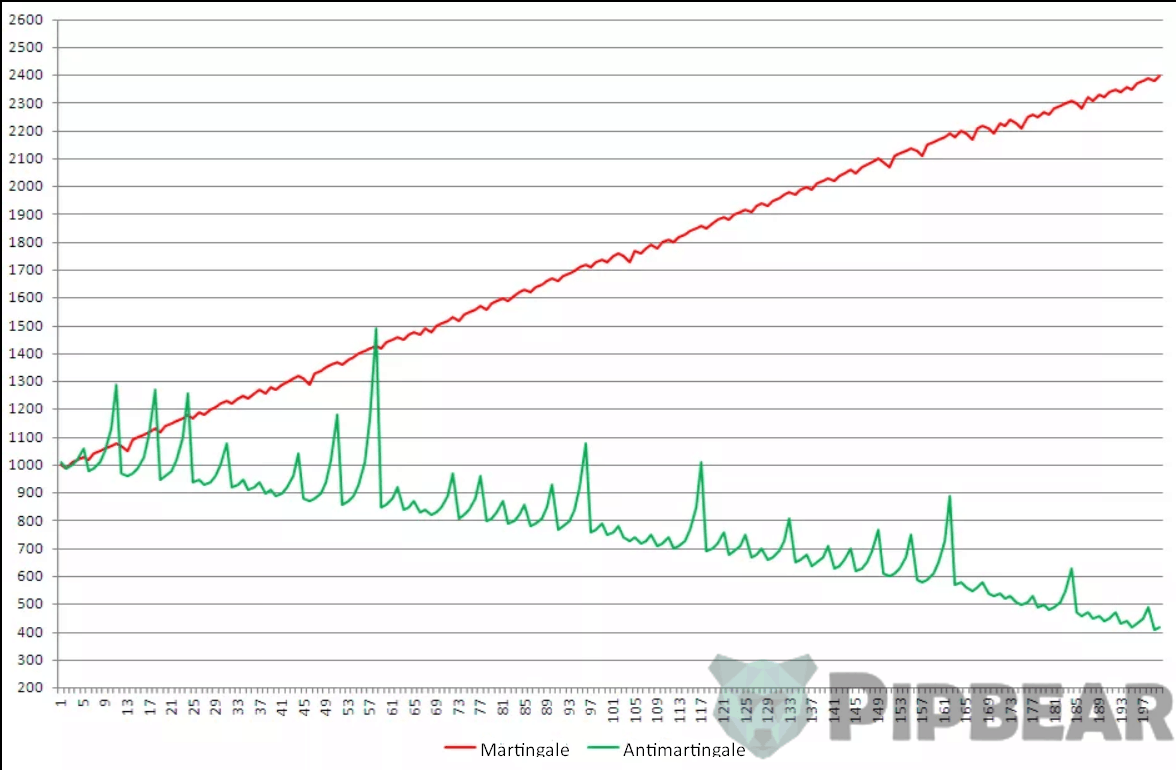

The original Anti-Martingale system is just not capable of making a profit, even if you have a very good ratio between profitable and loss-making options. Let’s exemplify this in comparison with the usual Martingale method:

This chart shows the curve of the capital balance changes in the case of performing 200 transactions. It is obvious that the Parlay system steadily brings the deposit to the red despite 70% of transactions are profitable. The problem is the large size of the last transaction in the series, the loss of which covers all previous income.

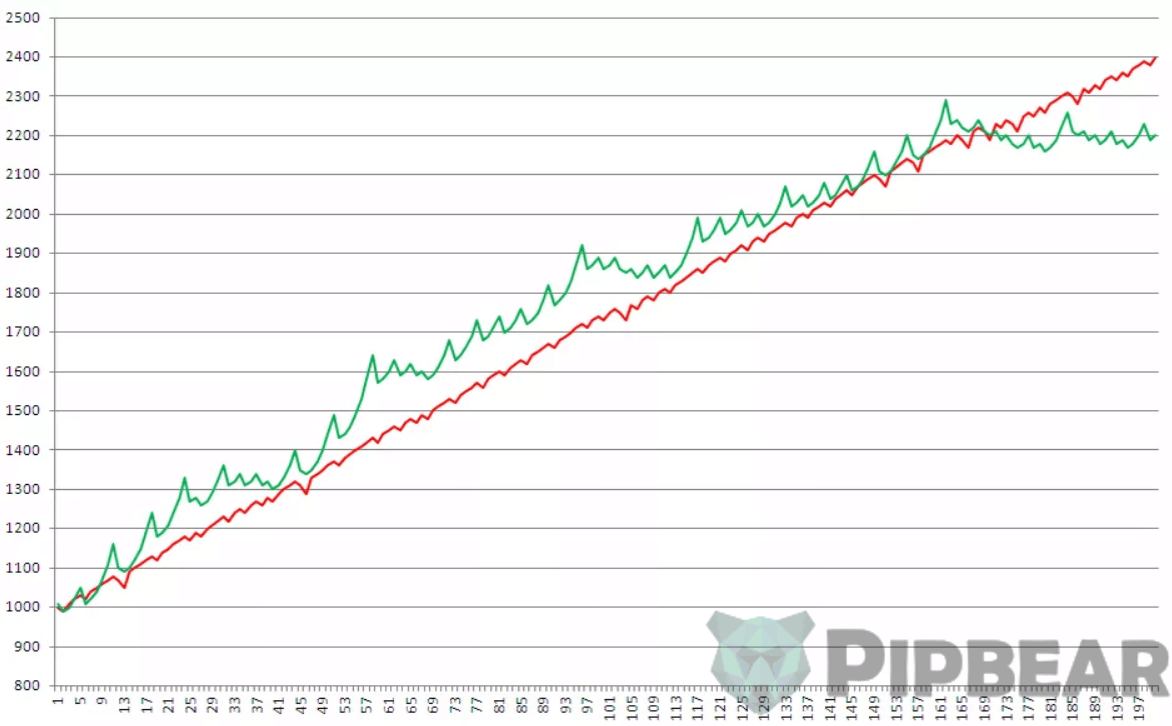

You can easily avoid this situation. Do not double it each time but just increase it by the size of the first investment. Let’s take a look at how the profitability chart looks like in such case:

The results are now much better. Take a look at the table to get a clearer view:

| Rate | 10 | 20 | 30 | 40 | 50 | 60 | 10 |

| Loss | -60 | ||||||

| Profit | 8 | 16 | 24 | 32 | 40 | 10 | |

| Total | 8 | 24 | 48 | 80 | 120 | 60 | 70 |

THE RISKS

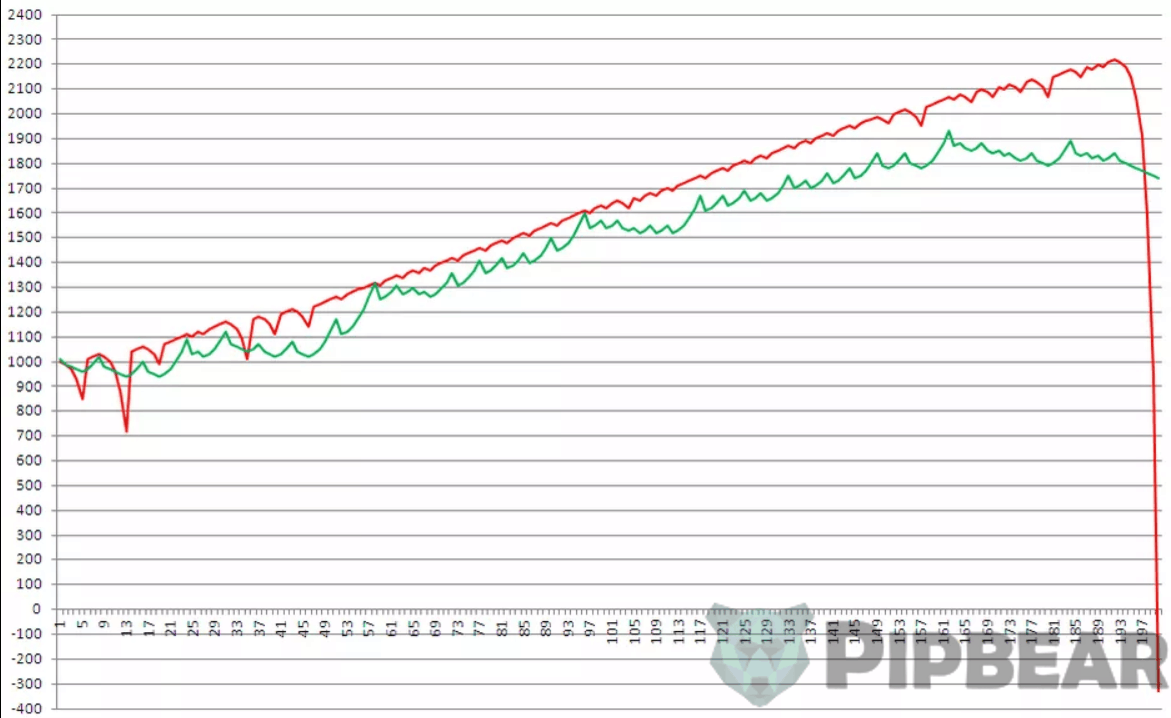

Now let’s see whether the Anti-Martingale method is good enough during drawdowns. We all know that the Martingale method will make you lose your deposit in case of a long period of unprofitable transactions. It is of no doubt that the original Anti-Martingale system will also take away your deposit. However, let’s consider how things will be if you decide to increase the investment following the second way:

If we take a look at the chart, we will see that the strategy shows good results in the long-term drawdown are. Instead of a sharp capital collapse (as it would happen in case of the usual Martingale strategy), the profitability curve has only slightly moved down.

SO WHICH STRATEGY IS BETTER?

You may often notice that the traders are disputing whether the Anti-Martingale or the usual Martingale strategy is better. If we talk about the original way to increase each subsequent transaction, then you should better use the classic Martingale strategy. However, if you increase transactions by the size of the first investment, then the Anti-Martingale strategy is safer and almost as profitable.

CONCLUSION

You should understand that the Anti-Martingale method is a way to improve the profitability of your trading strategy. It can not be treated as a magic wand, which will bring you a profit at any ratio. If you trade “at random”, your deposit will cease to exist and it will only be a matter of time. Therefore, use this method only after you obtain a working and effective trading strategy.

It doesn’t seem to work well in the long run….Just a short term strategy

nice. Anti-Martingale strategy. Never would have thought.This has inspired me. Thanks alot for the simple explanation!

This strategy might work in SOME systems, but not in all of them, especially the ones when your betting is based on pure gambling.

I’ve used this technique anti-martingale, and I’ve even sold out early because I saw that wasn’t going carry in direction I thought it would.

I use martingale since 3 years but i do not multiply by 2 you need to do the math and you need back testing before adopting it

You end up back at zero every time once the trend ends.

anti martingale can lead to an early day if employed correctly with the right strategy.

Well done sir

This is bae to me