A successful trader’s career depends on not only the trading systems or the styles used but also it depends on the intangible things such as the time zones in case of intraday trading. Comprehension of the market dynamic at different times of the day will help you to reach a higher level of your trade.

Before reading the article and writing your questions in the comments section, I recommend to watch this video. It’s not long but covers the biggest part of questions on the topic.

Analyze your trading history and see if there is a correlation between the number of the profit/loss trades and different time zones of the day. A day trader should understand that even if there is a perfect formation on the chart, the moment for opening a transaction could be in a time zone when a counter-trend movement usually begins. For example, many of those who trade breakouts within a day can soar to much greater success within the first two hours of the day than at any other time of the trading session. Usually, attempts to trade breakouts are unsuccessful and lead to a price reversal. Consequently, a trader feels frustrated and confused about his trading approach. Let’s have a look at different time zones and figure out the general market dynamics during each time zone.

Table of Contents

The opening bell – from 9:30 am to 9:50 am

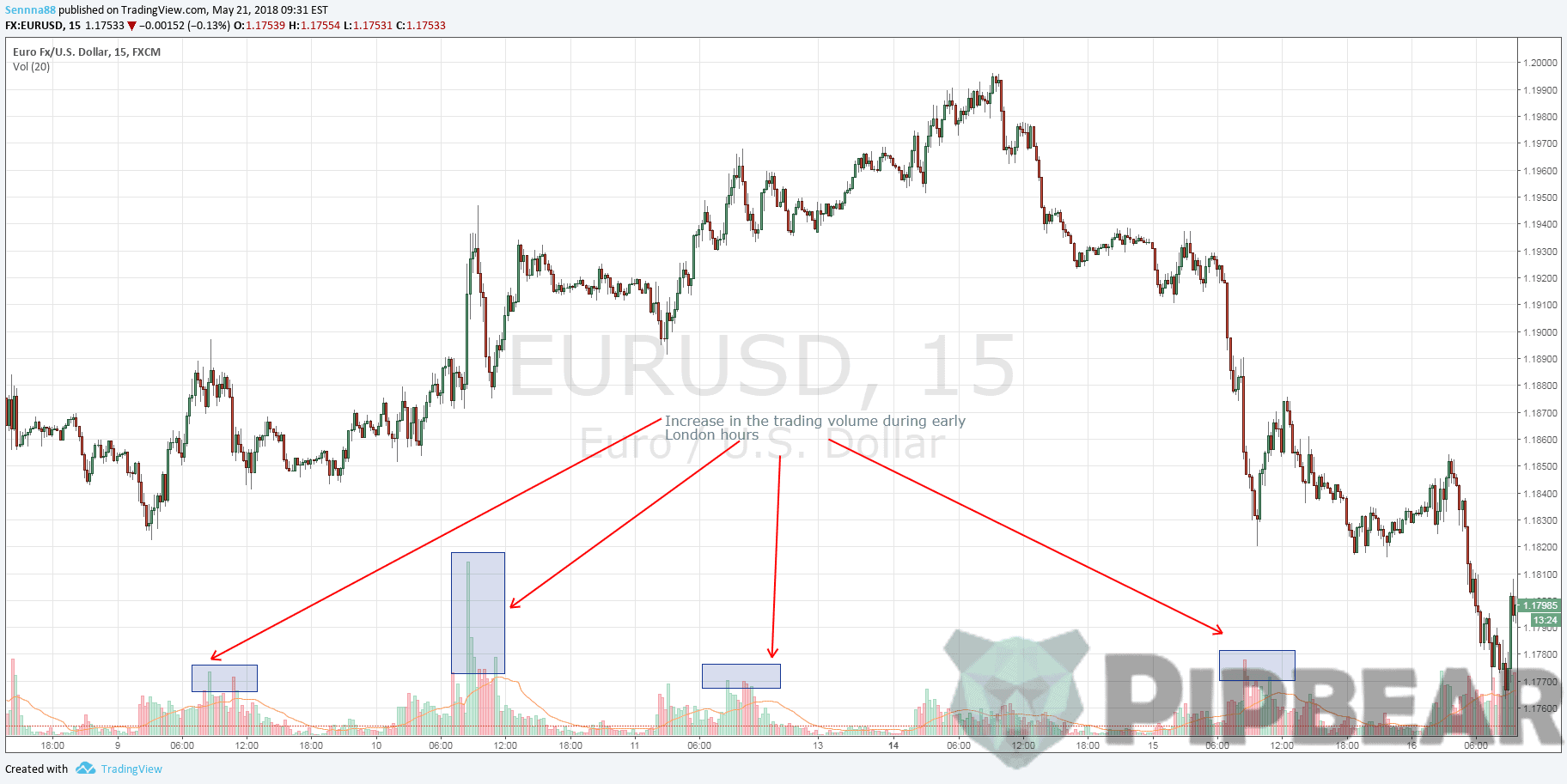

The first 20 minutes of the trading day is the time of the highest volatility (Picture 1). Despite this time zone is the most dangerous for day trading, it can bring the biggest profit if you know how to trade during this time frame. Usually the novice traders are highly recommended to stay out of this zone and wait for the imbalances created from overnight news or earnings releases to settle down. Many technical indicators do not work well at this time because the volatility is too strong. In most cases, trading volume will be the highest of the day during this time.

The Morning Reversal – from 9:50 am to 10:10 am

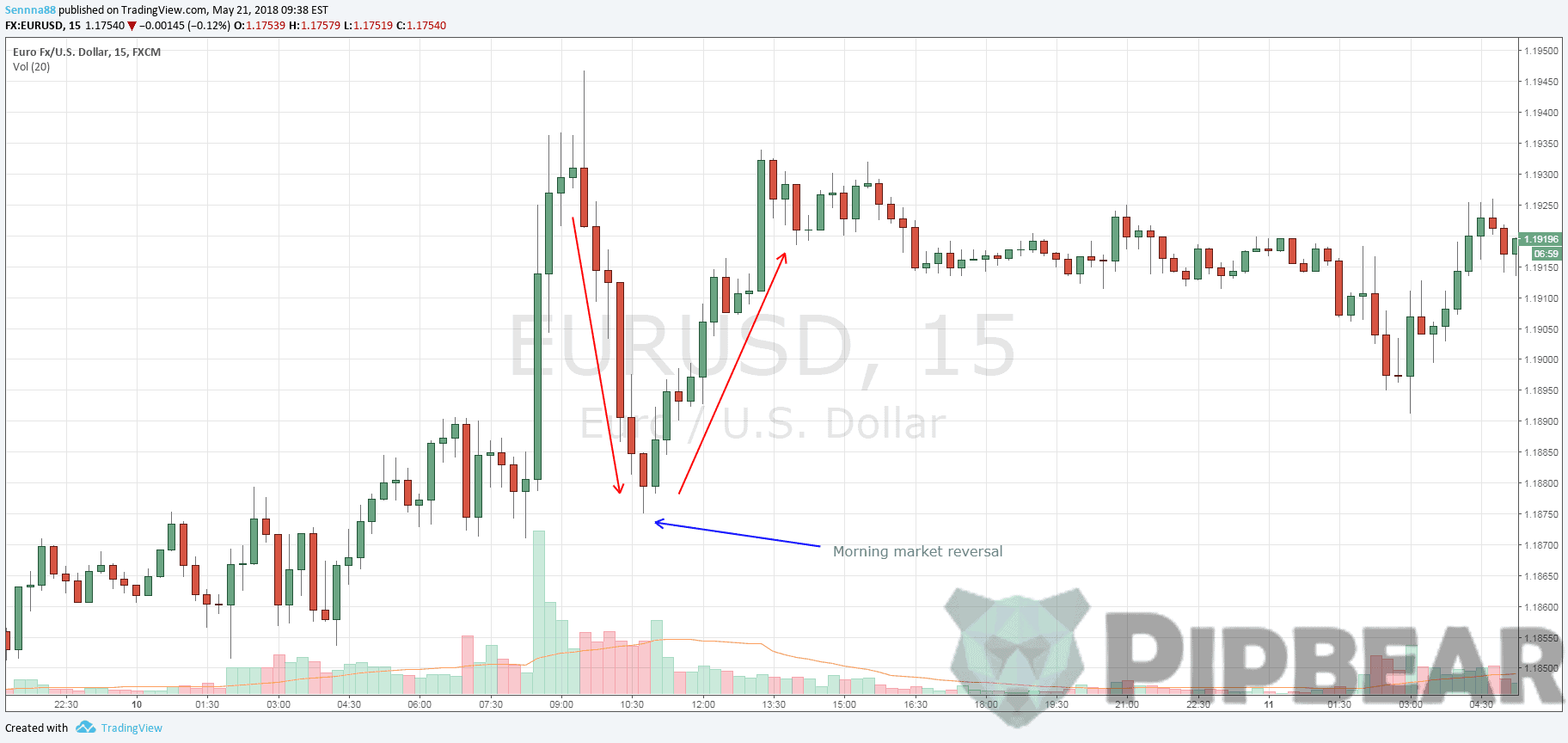

The first reversal zone of the day starts at around 9.50 am and lasts about 20 minutes. The day traders need to pay a lot of attention to this period (Picture 2). Many traders will put on trades that set new 30-minute highs and short stocks setting new 30-minute lows. Other traders may be looking to buy pairs that have had small retracements after a large morning gap and short those that have had minor retracements off strong gaps to the downside.

Once things have settled down, you will see what other traders want to do during this period. The trading volume will decrease within this 20 minutes but it will remain high enough. This time frame is the best for trading as the price stability returns to the market but volatility is still present for profitable trading. The strong trend markets may have small price reversals or a complete lack of them. This can especially be the case when an index gaps higher on the open and continues to break to new highs during this period.

Low-Risk Trading — from 10:10 am to 10:25 am

Volatility is shrinking again within this time zone and it is possible to find clues in majors and crosses to predict the market movement. This is a good time for the real money moving the market in the desired way. Watch the tape of the pairs that you track for any indications of direction.

Decision Time – from 10:25 am to 10:30 am

The market will be settled and the greatest volatility of the day will be over. There may have been a few reversals in the first hour but during this small zone, many traders will cash out of the profitable positions and finish the day while others will position themselves for the next move in the market. You should better get ready during this time. The market movements that occur after this time zone can last until lunchtime.

Final Move of the Morning – from 10:30 am to 11:15 am

This is the last major and quite safe time zone for morning trading. The technical indicators such as the slow stochastic or the RSI indicator will bring you better results than they could do in the previous time zones. Be careful at the end of this period as it leads right into the lunchtime that can start a bit sooner or later. It is proved that the higher volatility of the previous time zones of the trading day was, the higher the chances that this movement extends further into 11 am.

Eat your Lunch! – from 11:15 am to 2:15 pm

Lunchtime trading may be a very bad idea. You may see lots of false breakouts and choppy sideways moves during this period. If you are forced to trade, do it gradually until you are experienced enough to handle profitable trades within this time zone. The ratio between risk and profit is very high. The market volume will decrease because the floor traders and other institutional traders will take their lunches (Picture 3). Do not let this time zone turn your profitable morning trading into a loss.

Back to Work – from 2:15 pm to 3:00 pm

At this time of the day, the traders will be coming back to work. The trends are mostly established and now you can apply the technical indicators during this timeframe. Remember that the Chicago Mercantile Exchange closes at 3 PM so you can see a volume surge when some bond traders enter the equity and futures markets.

Time to move – from 3:00 pm to 3:10 pm

The bond market closes and bond traders are flooding the equities markets. You may see sharp price moves in both directions, which can be fast and large.

Be Careful and Stay with the Trend – from 3:10 pm to 3:25 pm

You should be extremely careful within this timeframe since you are approaching the 3:30 pm timeframe when the trends usually stop or reverse. Now you have to stay with the trend established from 2:15 pm or even from 3:00 pm but do not get attached to the positions.

Portfolio Re-balancing – from 3:30 pm to 4:00 pm

Trading during the last half an hour of the day is considered a bad idea. Many funds and institutional players re-balance their portfolios at this time, which can cause certain difficulties (Picture 4). If you are a day trader, you have no more than 30 minutes left to close the positions. I think it is best simply not to work under such pressure. However, if you prefer the active trading style and short-term transactions, you can see that the volatility is good enough for you to do so.

Conclusion

It is necessary to determine volatility corresponding to your trading style and character. That is the key takeaway from this article. Figure out what kind of a trader you are and trade accordingly. As you can see, chart setup or systems are not the only factors to rely on during the day trading. Remember that day trading is not absolute, and it is only a Game of Odds. Your task is to tip the balance in your favor. Different time zones of day trading will help you to trade with greater consistency.

Thanks buddy

Following

What a high spirit to begin from

Great stuff man, thanks for this!

Now this is insightful for me! Great content!

Thanks buddy you are smart be blessed

Any recommendations for a broker to start trading with?

Keep em coming ! You’re doing an excellent job and I like how you read clearly

Thanks man