Most Forex mid-term traders are confused by the swaps when conducting the overnight trades. That often pulls them back to day trading. They are frightened by the fact, that holding the position overnight will cost them an additional fee. However, the swaps may be good. So what is a swap? Is it an extra loss or an opportunity to make additional profit? Is it possible not to pay a swap? You will find all the answers to these questions in this article.

Before reading the article and writing your questions in the comments section, I recommend to watch this video. It’s not long but covers the biggest part of questions on the topic.

Table of Contents

WHAT IS THE SWAP ON THE FOREX MARKET?

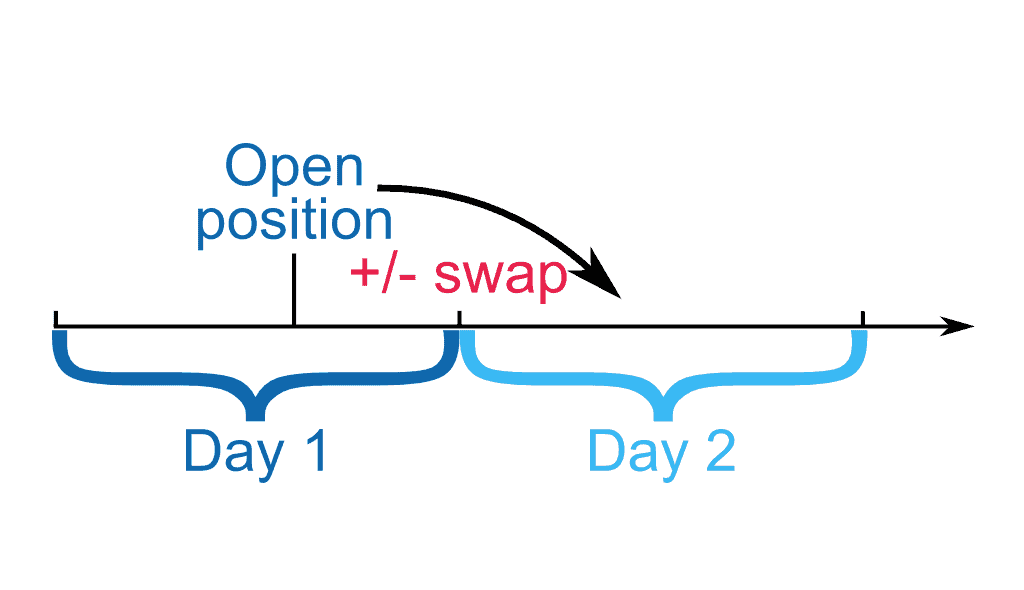

So what is a swap? The swap is the difference between the interest rates for the loans of two currencies, credited to the account or charged from it when the trading position is transferred to the next day. The swap can be either positive or negative.

WHY DO YOU PAY FOR TRANSFERRING THE POSITIONS TO THE NEXT DAY?

First, you do not want to get a real currency supply. Let’s suppose that you bought the EUR/USD currency pair. The idea is not to buy the euro and sell the dollar. All you need to do is to speculate a bit on the currency pair’s price. You want the price to go up or down depending on the opened position. You do not want to get a real supply of the currency. Since you are simply speculating and you do not need real money, your position (your order) will be simply transferred to the next day without delivery of the real currency. And a swap is charged during this transfer.

Let’s take a look at the example. Imagine that you are buying the EUR/USD currency pair. You are buying the euro and selling the dollar. If the interest rate on the euro is 2% and 1% rate on the dollar, then you will get a positive swap of 1% at the rollover (transferring positions to the next day).

2% — 1% = 1%

If you sell the EUR/USD currency pair, then you are buying a dollar and selling the euro. If the interest rate for the euro is 2%, and 1% rate for the dollar, then you will get the 1% negative swap at the rollover.

1% — 2% = -1%

Why are you charged with these percentages?

When you sell the dollar, you borrow it since you do not have it initially. Consequently, you pay a 1% interest rate for it if you hold the position while transferring it to the next day. If you sell what you do not have, you pay an interest rate for the use of the borrowed funds.

Why do you get a certain percentage depending on the interest rate? Why do you get paid while buying any currency?

The thing is that when you buy, for example, the euro, you automatically agree that your position can be used to provide a loan for other players to sell the euro. So, when you buy a currency pair, you get an interest rate. When you sell a currency pair, you pay the interest rate for the loan since you are allowed to sell something that you don’t have. This interest rate difference is called the Swap. I hope you are getting that now.

WHERE CAN YOU FIND THE SWAP IN THE TERMINAL?

The swap is displayed on the platform while opening a trading position. If you keep the position to the next day (usually more than one day), then the swap is displayed in the same place as the profit/loss on the current positions, the opening and closing prices. You will find the Swap column right there. It can be either positive or negative. The profit graph may vary in dependence on the number of times the swap was changed or added to the position.

Pay attention that on Wednesday night, a triple swap is changed or added. That’s because the banks are closed at the weekend but you still have to pay or get the loan rate. That’s why it is the time of a triple swap. You should always remember and pay attention to that.

As I have mentioned before, the swaps are added/charged at 5:00 pm New York time (USA) or noon Trading Terminal time. It is approximately 1:00 am Moscow time.

HOW DO YOU MONITOR THE SWAP?

You can find data about the swaps on the brokers’ websites. For example, in the case of my broker’s website, it’s “Trading products – Forex – Contract Specification”.

You can monitor the swaps for the short and long positions. If the value is displayed with the minus, then the swap is negative. The same pattern is used for all currencies.

You should notice that the interest rates of the Central Banks are different. The spreads for different currency pairs can be either insignificant or very noticeable.

The swaps for the short positions are almost 13 points positive. If we look at the long positions, we will see 13 points negative. It may become sufficient if you hold the position for a week.

You can also see the swap in the terminal by hovering a mouse pointer at the “Market Review” window. Right-click, select “symbols” and then click the required symbol.

The swap for the long and the short positions will be indicated here. On the screenshot below, you can see that the swap for the USD/JPY currency pair is negative both for the long and for short positions.

So now a question arises. Should you pay attention to the swaps? The swaps are one of the obstacles that pulls back the budding traders who want to trade intraday, that is, to open positions once a day and analyze the positions on the D1 charts (one candle is one day).

A budding trader thinks “Since I pay the swaps for transferring the positions to the next day, I will lose a lot of money on it”. They are completely wrong about that if they trade the main currency pairs. If you do not trade any extraordinary currency pairs, you can ignore the swaps.

As for me, I trade on the daily charts and do not pay attention to the swaps. Since the Central Banks of the largest countries have very low-interest rates, positive or negative swaps are not significant. If we swap the EUR/USD currency pair, it will be very small and it doesn’t make any sense to pay attention to it. Even if you were holding the position for 10 days, you would get, for example, 5 points. You set the goals of at least 100 points at the day charts so you can see that the swap is insignificant.

If you do not hold the positions for more than 2 weeks, you may skip the swaps. If you are a position trader (more like the investor) and you hold positions for several months (maybe a year or more), then you do need to pay attention to the swaps. If you hold a position for a year, the swap may become very significant.

WHAT TO DO IF YOU HOLD YOUR TRADING POSITIONS OVER ONE MONTH?

In this case, you will need to use the swap-free accounts. Nowadays almost all brokers can provide you with an opportunity to create such an account. You just need to specify that you want a swap-free account when you decide to open one. However, you should never forget that you will be charged with the enlarged commission for the positions since the broker needs to cover his losses.

Thus, if you do not keep positions open for longer than a month, then you don’t have to pay attention to the swaps. Of course, that is true if you trade the classic currency pairs, not the exotic ones.

If you are more like an investor and you hold positions open for several months, then you should take a look at the swap-free accounts.

If you want to go deep to the essence of the swaps, you can check an online table of the interest rates of the Central Banks of different countries. Use the search services to find such information:

The table contains data provided by the European Central Bank, Australian, Canadian, Indonesia, etc. You can find there all the required data such as the current bid, the previous value, as well as the date of the interest rate change.

CARRY TRADING

Of course, there are the strategies designed for operating the swaps. In general, they are called the Carry Trade strategies.

The idea of the Carry Trade is to hold the position as long as possible and get a positive swap. Practically, the strategy is designed to get a profit on the swaps rather than on the price movement towards the required position.

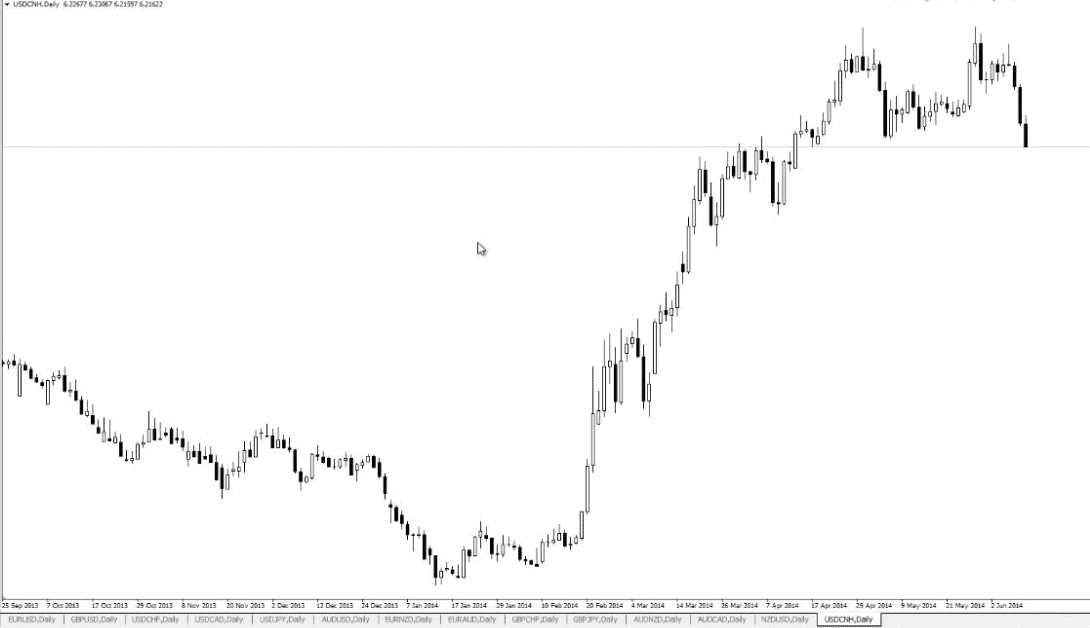

You can apply such strategies to the currencies that have a significant positive swap. It is useless to apply this strategy to the EUR/USD currency pair since the swaps are very small. You should pick the high swap currency pairs for the Carry Trade.

Once again, use the contract specification page to pick the necessary currency pairs:

For example, take a look at the AUD/DKK currency pair. It has a negative swap on the short positions but we are not interested in that. The swap for the long positions is 2.5 points. Consequently, if you hold the position for a long time, you may make good money on the swaps. However, this pair has a big spread of 23.9 points, which is why it is of no interest to you. The commission for opening a position is too high.

The EUR/NOK currency pair has a swap of 2.5 points on the short positions.

The spread is of 0.1 points, which is very small. That is good since it won’t interfere with opening the positions. However, does it make any sense to open a short position and hold it for a long time? What if the currency pair has an uptrend? In this case, you won’t get a profit if you hold short positions for a long time as you will lose money in the long-term perspective. That is why you need to find a high swap currency pair with the long-term global trend that has been moving towards the position we are about to trade.

Let’s take a look at the EUR/NOK currency pair. Does it have any global downtrend?

The currency pair has no trend on the weekly chart. But if you take a look at the day charts, you will notice a downtrend movement.

In general, this currency pair can be applied for the Carry Trader. You may open a short position and hold it for a long time (maybe a month, or a year or even longer). Of course, you should not simply open the position but I hope that you have understood the essence of the Carry Trade from this example. We will discuss it in details in one of the following lessons on our website.

In the short span of time I have been in forex I have known swaps as little charges imposed on a trade that ran past mid night.

I am so enlightened today !!

Takes me back to financial management class, and now its application

forex is my thing

thankyou for this…

-Very well explained in a simple way

-Knowledge is power.keep sharing