Many of you have heard of the Gartley patterns: butterfly, crab, bat, three movements, shark, cipher, and also have seen and used various technical indicators for their search on the charts. Today, we will figure out what these setups are, how they look at the chart of the instrument, and, what is important for us, how they can be traded. In conclusion, we will consider the advantages and disadvantages of this method of work.

Before reading the article and writing your questions in the comments section, I recommend to watch this video. It’s not long but covers the biggest part of questions on the topic.

No matter how colorful trading is represented in our minds, we have little influence on the market. In the context of trading on Forex, we do not have such levers at all and are concentrated in the hands of large money depositories.

In any case, sooner or later comes an understanding of the existing reality of the collective mind of the market and what exactly the market says:

information about how to trade and when is available to everyone, you just need to understand the language.

If we accept the natural foundation of the market as the sum of the opinions of all traders, then everything becomes much easier. The nature, at first glance, is chaotic. But even in this chaos there is an order reflected in the golden proportion. We make a logical conclusion: if the behavior of the society is subject to a golden ratio, then the market can be explained by the same rule. We can only find harmony with the market.

The figure shows a sample of an ordinary Trader. As you can see, his proportions fully correspond to the proportions of the golden ratio. Similar mathematical relationships can be traced to other living beings, plants and astronomy. Since we cannot deny the fact of the trader’s natural origin, the market acts according to the laws of nature, and no other.

It is not a secret that the market is striving for a golden ratio, like the rest of the world surrounding us. As it is known, the ratio of numbers in the Fibonacci sequence also tends to this value. The division of the next number by the previous one in the sequence is approximately equal to 1.618, the previous one by the subsequent one is 0.618. The Fibonacci series describes the entire living world around us, accordingly, the market can also be described by mathematical sequence.

Of course, the desire for harmony does not abolish the chaotic nature of the market, but it allows us to streamline its intentions. Then, the first step on the path to finding harmony with the market is to accept its random nature. Regardless of the complexity of the analysis, you can never be 100% sure of your forecast: there is always the possibility that the price will go to the wrong place. Many use their “sixth sense”, thinking that they thus get the clearest idea of price movement and any other tools can only hinder the clarity of the forecast. Of course, most often this leads to unsystematic trade and losses.

The second step is training patience and getting rid of emotions. You can never fixate on one particular trade. If we perceive every trade as something independent, the fact of losing will be much more difficult. Trading in the market is a game of numbers. The effectiveness of any trading system can be determined only on a large sample of transactions and not on one.

The market, in itself, has no idea of either you or your intentions. Then, it is always necessary to make an objective assessment of the market and trade in harmony with its current state. That is, wait for the moment when the market says for itself, and not try to impose your system of rules. Do not rush; sometimes the market is more random than usual, for example, during low liquidity or news.

Before you develop your objective picture of the market, you need to accept one single fact: the market is always right, and, hence, there is always the possibility of losing. Only by accepting this idea, one can proceed to a detailed study of harmonic patterns.

Table of Contents

Harmonic patterns

The basis of harmonic patterns, as a trading method itself, was laid by Harold Gartley in his book “Profit in the Stock Market”, where the idea of a five-point pattern known as the Gartley pattern was set forth. Larry Pesavento improved the pattern, adding the Fibonacci coefficients and setting the basic rules of trade in his book “Fibonacci Coefficients and Pattern Recognition.”

Many minds worked on the theory of harmonic patterns. Probably one of the most famous is Scott Carney, the author of the book “Harmonic Trading”. He is also the author of the patterns Crab, Bat and Shark. It was in his works that the principles of risk and money management were developed, which, facilitated the transformation of the harmonic theory into its concrete practical implementation.

Harmonic patterns are the development of the idea of ordinary geometric patterns, with the use of Fibonacci levels for more accurate determination of turning points. The trading process combines visual patterns and a mathematical component. The main task of harmonic patterns is to predict price movements. What makes them different from traditional reactionary trading methods? On the basis, again, the golden proportion is laid down. By finding patterns of different lengths and magnitudes and applying Fibonacci coefficients to them, we can try to predict the future movement of the market.

Harmonic patterns are a very precise instrument, characterizing very specific price movements. There are a lot of patterns on the market, but not every figure corresponds to Fibonacci proportions, it is a reliable signal in the harmonic approach. This approach teaches patience since only perfect setups can guarantee a good result.

Nevertheless, do not forget that even perfect patterns can not guarantee 100% success, like any other tool. All the advantages of the approach are known only on a large sample of transactions. Therefore, you need to not only observe the correct proportions of the figures in question but always use the right risk management. The size of the stop loss, as well as the location of the targets, is determined by the figure itself, but other tools can be used as an acknowledgment.

In this case, patterns can overlap each other and thus form more complex structures. This applies not only to harmonic patterns, but ordinary geometric shapes can also take place in the context of harmonic patterns. Such formations can also be used to further confirm the forecast.

Even in a single knee several price waves may be contained. Therefore, it is important to choose a suitable timeframe, not too short and not too long. For example, if you are going to trade on the daily chart, keep in mind that one figure can occupy a large enough area, and it can take months to form it. At the same time, thanks to the fractal nature of the market, patterns can be applied to any timeframe – from the smallest to the largest.

Identifying Patterns

Determining harmonic patterns with the naked eye is quite difficult and not easy for every beginner. The basic harmonic patterns (Gartley, Butterfly, Crab, Bat, Shark and Cipher) are based on 5 key points, including the ABC or ABCD figures. The fluctuations in prices within the figures are always interrelated and based on certain harmonic coefficients.

Each pattern to some extent resembles the shape of the letter M or W. 5-point patterns begin formation at point X, followed by a pulse wave XA, after which the price corrects, forming the leg AB. Then the foot BC follows in a direction parallel to the initial impulse. The pattern ends with the correctional leg CD.

Harmonic relations between waves determine whether the wave is corrective or expanding: the uniqueness of the individual figures is exactly in these ratios. In this case, all the patterns combine the presence of the ABC figure. Therefore, it is enough to understand the principle of constructing only one of the figures, after which all the rest will be defined much easier. First, you can use automated tools there are many indicators in the free access which recognize the patterns on the chart. But, keep in mind that such indicators cannot identify all the patterns, and the final result is not of the best quality.

The head and shoulders are one of the first harmonic patterns. With a harmonious approach, a symmetrical figure with a head at the level 1.618 from the left shoulder and a right shoulder at the level of 0.618 from the head should be obtained. This precise structure makes it easy to determine the moment of completion of the figure and the point of entry into the market.

Preparatory work

The main tool for identifying harmonic patterns is the Fibonacci grid. To do this, you can use almost any modern platform. We will be guided by Metatrader.

So, to start with the standard Metatrader Fibonacci grid, you need to add the following factors: 0.786, 0.886, 1.13, 1.272, 1.414, 2.0, 2.24, 3.618. As you have noticed, the Fibonacci grid does not consist of a pure Fibonacci sequence, but derived coefficients. The coefficients are calculated in this way:

• 0.382 = 1 — 0.618

• 0.786 = the square root of 0.618

• 0.886 = the fourth root of 0.618 or the square root of 0.786

• 1.13 = the fourth root of 1.618 or the square root of 1.27

• 1.27 = the root of 1.618

• 1.41 = the root of 2

• 2 = 1 + 1

• 2.24 = the root of 5

• 2.618 = square of 1.618

• 3.618 = 1 + 2.618

To add additional coefficients, apply the Fibo object to the chart. You can do this through the menu Insert – Objects – Fibonacci lines. Select the object with a double click and select Properties from the shortcut menu.

Now add the desired levels through Add. The first field indicates the level itself, in the second the level description of the level displayed on the graph. All added entries will be saved even after the removal of the object with the graphics, so you can use the saved icon for the newest figure.

AB=CD

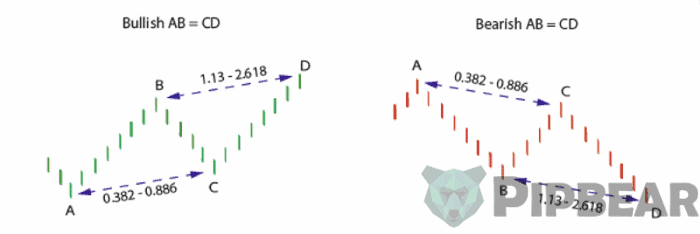

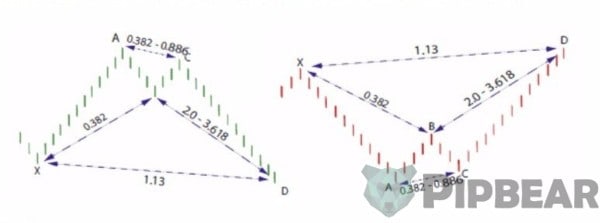

Pattern ABCD is the simplest harmonic model, consisting of three knees – AB, BC and CD. The point is not that the figure represents the essential bricks on the part of the guiding principle of the harmonic figures and, if any, turns into a large part of the niche.

ABCD is a reversal pattern, predicting the shift in market trends. You do not have to figure out how the price falls, and when prices are set, the price will go up or down, and will go on and on.

The key feature of the pattern is the symmetricity of the arc and AB. Outwardly such a formation resembles the English letter N.

The pattern has two varieties: bullish and bearish. In the first case, we are dealing with an upward movement and a short trade. The bearish pattern has two falling minima and a maximum, after which a long trade is opened.

So, the figure begins with the rise or fall of the price on the segment AB. The segment BC is usually a sharp correction, the size of which should fit in 38.2% – 88.6% of AB. Ideally, the correct size should be from 61.8% to 78.6%.

At point C, the price unfolds and continues to move parallel to AB. At the same time, point D should be within the limits of 113% – 261.8% of the BC knee.

The main rule is the observance of the symmetry of the pattern. Ideally, the length of the CD knee should fully correspond to the length of AB. That is, there is a correspondence both in time and in price.

In practice, there are very different variations of the pattern. But, it will be a good rule to observe the appropriate sizes of AB and CD corrections, as trading an asymmetric pattern is much more difficult.

Thus, if the correction BC corresponds, for example, to 61.8% of the AB knee, then the CD knee should correspond to the extension of 161.8% of the BC. Correction in 78.6%, in turn, should correspond to the expansion of 127.2%. By the same analogy, an 88.6% correction would correspond to a 113% expansion from BC. 38.2% will equal the maximum expansion of 261.8%. It is necessary to enter the market at point D, or a little beforehand.

As a minimum, we use the Fibonacci extension from AD points to 38.2%. The second goal is 61.8%. As more risky goals, you can use the points of the pattern itself – A and C.

Stop the loss close to point D. A good rule is to set the trade risk in relation of 1 to 10. That is, we risk a tenth part of the potential profit. But, it is worth considering that the figure does not always work out perfectly, so the stop should be at a sufficient distance from the price. Here you need to find some balance – the stop should be short, but not too much.

This is the whole essence of harmonic patterns: we are looking for the perfect figure that forms the right proportion and has a natural symmetry. Then, if the figure is formed correctly, we can count on a big profit. If the proportions are violated, you need to close the deal as soon as possible.

How to Trade:

• First, visually determine the zigzag motion of ABC on the chart;

• Next, measure the size of the correction BC, which should be from 38.2% to 88.6%;

• Determine the location of point D. To do this, stretch the Fibonacci grid from point C to point B so that the level B corresponds to the correction BC (for example, 88.6%). Point D will be at 100%, forming a completely symmetrical figure;

• Next, stretch the grid from point A to D. At the levels of 38.2% and 61.8%, the first and second goals will be found, respectively;

• At point D, we establish a pending order, with the ratio of stop loss to profit 1 to 10.

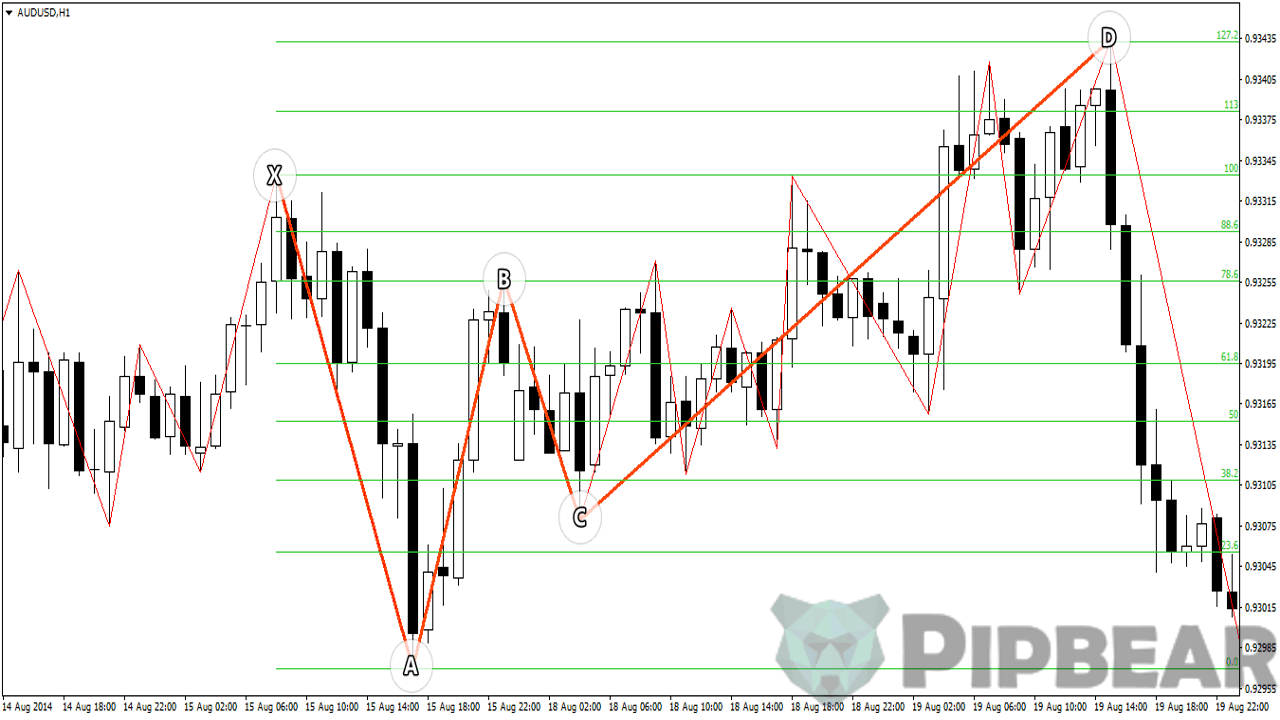

Gartley

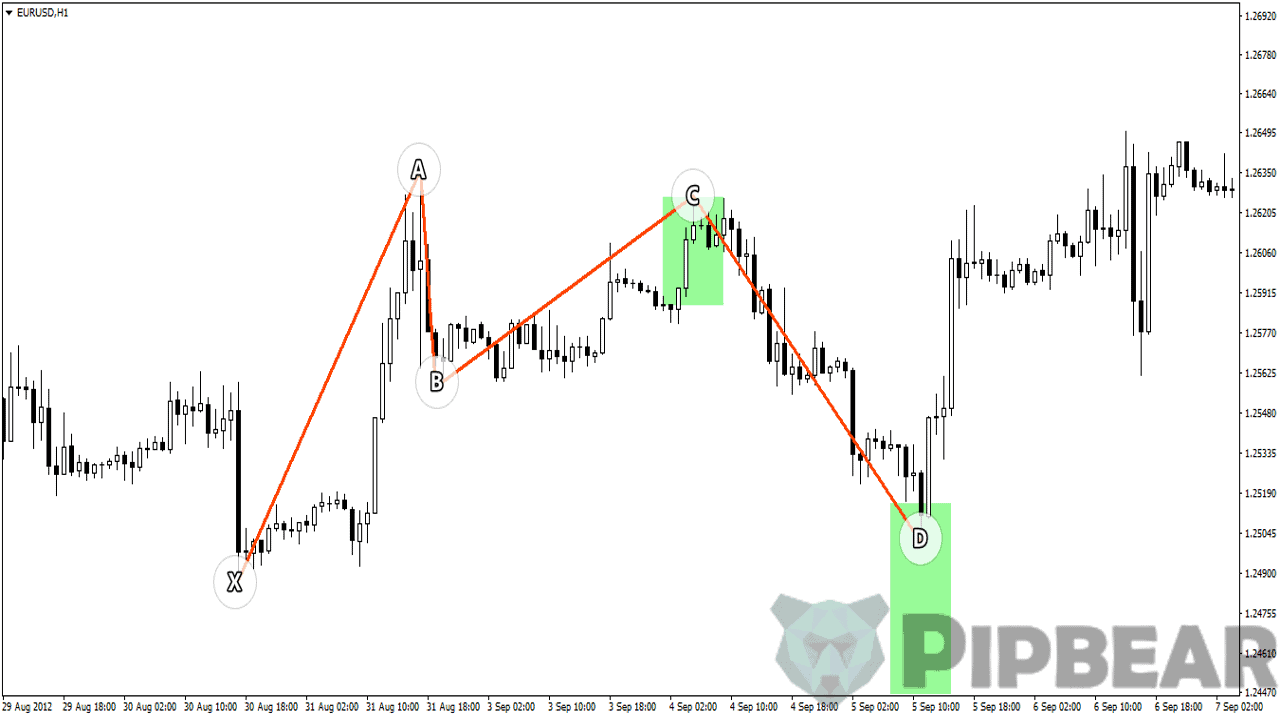

The Gartley pattern is a correctional figure, indicating the continuation of the existing trend. The main trend, in this case, temporarily changes its direction, before returning to the started movement. That is, there is a temporary correction in the form of a figure ABCD. The deal is opened at point D.

The first stage is the visual determination of the figure on the chart. The bullish pattern looks like the letter M, bearish resemble inverted M, or W. As soon as we notice a suitable figure, we begin to check which the pattern we found in fact.

In the beginning, you can simplify the task a little by adding a small step to the ZigZag graph. This will help visually highlight important extremes on the chart, after which it will only be necessary to select the desired figure.

So, note the potential pattern on the chart and measure the knee A-B. In general, the Gartley pattern resembles the figure AB = CD, except for the additional XA. XA is the longest knee of the figure, directed downward in the bearish performance, and upwards – in the bullish.

After that, the price must correct, passing some distance from the knee XA. In this case, we have a net correction of 61.8%. This means that this is either Gartley or Crab since all other patterns have either a larger or smaller correction size. In this case, the knee AB must never exceed the point X, otherwise, the pattern can be considered invalid.

Further, we mark the projection zones for points C and D. Point C should be within 38.2% – 88.6% of the segment AB. Here the price again changes direction and partially compensates for the movement of AB. Ideally, the range is reduced to 61.8% – 78.6%.

Point D must correspond to 127% – 161.8% of BC. In this case, the correction level in 78.6% of the XA knee should fit in the projection of point D, otherwise, the pattern can not be considered valid. Also, point D should never go beyond point X. That is why at the point X it is customary to put a stop loss.

In this case, the projection zone from the points BC just folds back from XA, which means that we are dealing with a valid Gartley pattern. The chart shows its bearish variation, which indicates the continuation of the downward trend. So, we will open long.

Then stretch the grid from the points AD. The nearest target is at the level of 38.2%, the long-range goal is located at 61.8%. The first goal can be used for conservative trading or partial profit-taking. Also, the points of the pattern, in particular, points A and C, can be used as goals, but the price does not always achieve these goals. It is also good to consider important trading levels if there are any nearby. Stop-loss is placed just above the X point.

How to Trade:

• Determine the massive movement down or up, depending on the direction of the pattern;

• Movement AB should correspond to 61.8% of XA;

• Correction BC should be within 38.2% – 88.6% of AB;

• Finally, the length of the CD should correspond to 127% – 161.8% of BC. In this case, point D should be at the level of 78.6% of XA – this is the opening point;

• We enter the pending order at point D, stop loss after point X.

Butterfly

Butterfly is a reversal figure that allows entering the market on large extremes within the chosen timeframe. In similarity to other figures, the butterfly has two varieties – bull and bear.

This is one of the most popular harmonic patterns. First of all, this is due to a high degree of working off. In general, the figure is very similar to the Gartley and the Bat, but it has its peculiarities.

In the case of a bearish pattern, the first thing we look for is a sharp drop from point X to point A. For the bullish pattern, on the contrary, we are looking for a sharp increase in the price. If you still have difficulty in recognizing the waves, you can add ZigZag to the chart.

At point A, the price changes its direction and continues to move up to 78.6% of the XA movement.

A correctly formed pattern has points C and D located in green zones. Specifically, the correction BC should be from 38.2% to 88.6% of the movement AB. CD is the final and most important movement within this pattern. First, point D should be within the expansion of 161.8% – 261.8% of the BC motion (green zone). Secondly, point D should not exceed 127.2% of the first knee – XA. This level should also be located in the green zone. The chart shows an almost perfect situation.

Stop-loss is set at 161.8%. The first goal is at the level of point B. The second goal is at the level of point A.

How to Trade:

• Determine the tipping point of the previous trend, forming the figure X-A-B;

• Check the correspondence of correction AB 78.6% to XA;

• The next correction should fit in 38.2% – 88.6% of AB;

• Further, we note the expansion of 127.2% of the movement XA, where, eventually, the point D. At the same time, point D should fit into the zone 161.8% – 261.8% of the BC knee;

• Set the order to 127.2% of the XA, with a stop loss of 1/10 from the far goal.

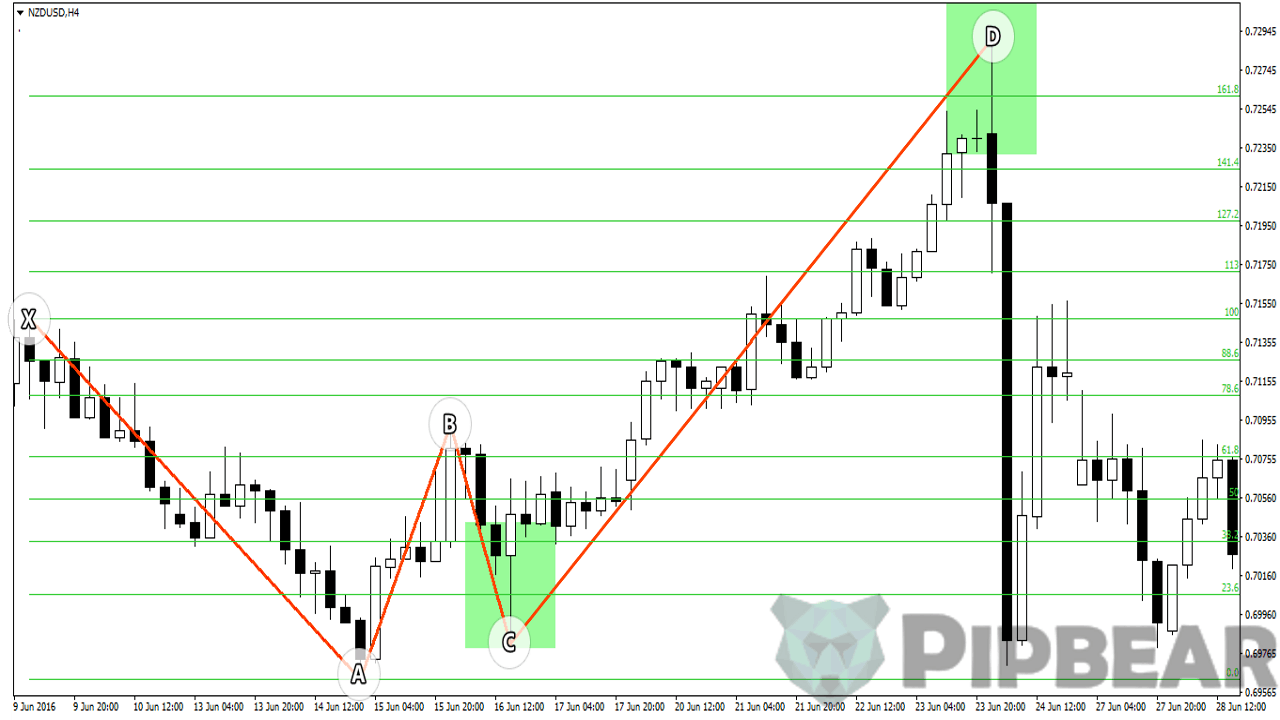

Crab

In general, the Crab is very similar to the Butterfly, being, in fact, its twin brother. It consists of four knees, including the ABCD pattern. Just like the Butterfly, the pattern is a reversal, indicating the completion of the current trend. The main difference is the elongated leg of the CD. If the butterfly completes at an expansion of 127.2% of the initial movement of the XA, the Crab has an extension of the trailing knee by 161.8%.

On the chart, the pattern can be determined from the characteristically long leg of the CD. Bearish pattern begins to form with the movement of XA, where at point A changes direction. The correction of AB should be within 38.2% – 61.8% of XA.

Further, another small correction before continuing the upward movement is no more than 88.6% of AB. Point D will be at 161.8% of XA. At the same time, the level should also fall into the green zone – 224% – 361.8% of BC.

The first and second goals are set at points B and A, respectively. If you cannot decide which goal to choose, choose the far one, but watch the movement of the price. In this case, you can additionally use a trailing stop. As an option, half the position can be closed at the first level and the second half at the second level is the safest option. Stop-loss is set just above point D.

How to Trade:

• Determine on the chart the knee X-A-B – the turning point of the previous trend;

• Correction AB should be from 38.2% to 61.8% of XA;

• Repeated change of direction in the knee BC should fit in 38.2% – 88.6% of AB;

• The final and largest movement of the CD continues smoothly to 161.8% of the XA. In this case, point D should be in the zone 224% – 361.8% of BC;

• Set the pending order at point D, the stop-loss is a little higher.

There is another variation of the Crab pattern – Deep Crab, which mainly differs in the size of the correction AB, which is 88.6% of the XA movement. In other respects, the pattern is identical to the usual Crab.

Bat

This pattern is very similar to Gartley: the trend temporarily changes its direction just to continue the main movement. This approach allows you to go into the trend at a good price, during a partial correction.

If Gartley is considered formed at 78.6% of the XA tribe, then the Bat implies a slightly larger rollback – 88.6%. Also, the size of the internal corrections is slightly different. This is the main difference between the two figures.

The formation of the pattern begins with the XA knee – the longest movement in the figure in question. On the correction, we expect movement in 38.2% – 50% of the XA. Thus, the point B can not turn out to be below the point X. In the case of a bullish formation, the point C is a decreasing maximum or an increasing minimum in the case of a bearish pattern. The amount of correction for the ratio to AB should be from 38.2% to 88.6%. The final knee of the CD should be within the expansion of 161.8% – 261.8% of BC. At the same time, the entrance is made when the price reaches 88.6% of the XA knee.

The chart shows a variant of a bullish pattern. The first thing you should pay attention to is the sharp increase and subsequent consolidation of the price. Then, draw on the chart the formation and check the correspondence to the required proportions. First of all, we check the location of point B within 38.2% – 50% of XA.

The green color marks the zones forming points C and D. Note that the correction in 88.6% should also be in the green zone. Otherwise, the pattern is not correctly formed.

To determine the goals, stretch the grid from point A to D. The first goal will be at the level of 61.8%, the second at the level of point A. Stop-loss is set just below point X.

Setting objectives is a very subjective activity, and again, many factors, such as important trading levels or other formations within the trading zone, need to be taken into account. Then, for a lesser risk, choose a near goal. To capture more traffic, you can use a trailing stop.

How to Trade:

• First, we determine the direction of the main trend and draw the foot XA;

• After this, a correctional wave in the form of a figure ABCD begins to form;

• Correction AB should fit in 38.2% – 50% of XA. BC – in 38.2% – 88.6% of AB. The last knee of the CD completes the movement by 88.6% of XA. At the same time, this level should fit into the zone of 161.8% – 261.8% of BC;

• Place an order at point D, stop loss after point X.

There is an alternative version of the pattern with a longer leg CD. The pattern mainly differs by internal corrections and the location of point D, in this case, it is located even below the point X. That is, in general, we are dealing with a stronger correction – a logical extension of the usual Bat.

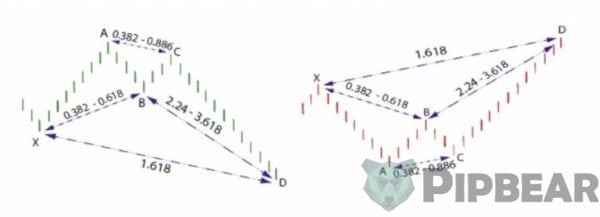

Three Movements

Three Movements is somewhat different from the rest of the harmonic patterns since it does not include the figure ABCD, as such. The pattern itself is a variation on the Elliott waves theory. By analogy, the pattern consists of 5 knees, with three key vertices and two corrections.

The bullish pattern is a series of falling highs and lows. The bearish figure, on the contrary, represents a series of rising extremes. In general, the figure signals the depletion of the current movement and the readiness of the market to change direction.

The green color marks the formation zones of the vertices of the pattern. However, do not rely solely on these zones, as the pattern shows itself better if the symmetry of the knees is observed. That is, with identical corrections of the second and third vertices.

Stop-loss is set at 161.8% of the final knee – exceeding this value means breaking the harmonic figure. Then, stretch the grid from the extreme points of the pattern. The first goal will be at the level of 61.8%. The second is at the level of 100%. These goals are just a recommendation. You can also use the remaining extremes to partially fix profit.

How to Trade:

• Visually define on the chart a characteristic zigzag movement;

• The size of the rollback from the second vertex should fit in 61.8% – 78.6%;

• The second and the third extremum of the pattern should go to the same distance. That is, if the second vertex corresponds to an expansion of 127.2%, then the pending order is placed in the area of the third vertex at the same distance;

• Stop loss is set for the maximum expansion of 161.8%.

Shark

In appearance, the figure resembles an expanding triangle – this description is the easiest to determine on the chart. In appearance, one can find some similarities with the shark’s mouth.

It is quite easy to determine the figure on the chart. In most cases, the final knee includes the entire preceding figure.

The chart shows an example of an incorrect pattern, as the key points do not fall into the green zones, although they are close enough to them. Point C should be within the range of 113% – 161.8% of AB. Point D within 161.8% – 224% of BC and at the same time enter the zone of 88.6% – 113% of the first knee of XA.

To determine the goals, stretch the grid from the last knee – CD. The first target is at the level of 61.8%, the second at the level of the vertex C. Stop loss is set at 113% of the XA level. If the price goes lower, it’s better to close the trade right away. And although the pattern worked, the opening can be considered risky.

How to Trade:

• Visually determine on the chart the formation of an expanding triangle;

• Point C should fall into the zone 113% – 161.8% of AB. Point D – 161.8% – 224% of BC and 88.6% – 113% of XA;

• You need to enter at the intersection of the two zones. Stop-loss in any case is set below the level of 113% of XA.

Cipher

This figure is often called a reverse butterfly. The difference is that the change in the main direction occurs at point C, and X is the extreme point of the pattern. That is, unlike a butterfly, a bullish formation is an upward movement, and a bearish is a descending one. This pattern allows you to find a good opening point at a time when the trend has already changed its direction.

It is not difficult to determine the pattern on the chart. First of all, you need to determine the change of the main movement – this will be the beginning of the pattern.

In this case, we are dealing with a bull formation. Movement XA is the turning point of the main trend, the point of change of direction. Correction AB should be from 38.2% to 61.8% of XA. Point C should be within 127.2% – 141.4% of AB. The input is carried out at point D, at the level of 78.6% of XA. The pattern presented on the chart can not be considered valid since points B and C do not fall into the green zones allocated to them. Then, I would miss such an opening.

If we are dealing with a properly formed figure, the goals can be set at the level of points A and C. Stop loss is set after point X.

How to Trade:

• First, determine the moment of the change in the basic motion and the subsequent expanding formation. In the Cipher pattern, all movements are calculated from the main knee – XA;

• The first correction should fit in 38.2% – 61.8% of the XA knee;

• Continuation of movement on the segment BC should correspond to the extension 127.2 – 141.4% of XA;

• The final correction corresponds to 78.6% of XA. Here put a pending order with a stop loss, located beyond point X.

Conclusion

Harmonic patterns describe the paramount desire of the market – they desire for correct forms. Thanks to this feature, we can make a profit even from the chaotic wonder of the price.

The main rule in the construction of harmonic patterns is a strict adherence to the correct proportions. It is better to wait and not enter the market, but to wait for the perfectly formed figure – this is the essence of the correct relations. Traditional geometric patterns have only an external resemblance to regular figures, but it is much more difficult to determine the entry and exit points – the beginning and the completion of the formation of the figure.

Nevertheless, if a harmonic pattern is superimposed on any key levels or other constructs, it is only a plus. Formations, which are formed in this way, can serve as a stronger signal for opening. With experience comes the understanding of this technique, and the identification of figures on the chart becomes a trivial task.

Advantages of the harmonic approach:

• Harmonic patterns predict the future price movement, which greatly simplifies finding the entry point, setting goals and stop-loss;

• Patterns are often found on the chart, give a sufficiently reliable signal and are highly profitable setups;

• Almost all the figures have clear standardized construction rules, which eliminates uncertainties;

• One principle works for all timeframes and types of tools;

• Can be used in conjunction with other technical indicators/trading techniques.

Disadvantages of the harmonic approach:

• The figures are quite complex in identification and construction, it will be difficult to apply immediately;

• The second problem follows from the first one: there is still no good automatic tool for identifying harmonic patterns;

• Sometimes patterns of different directions can be formed on one or different TF;

• The ratio of risk to profitability is not always perfect, especially for asymmetrical patterns.

please can you help me with free down load link of the harmonic indicator..?

Which pattern has the most winning percentage?

Where can I obtain the Harmonic Scanner? Or do I have to pay and then pay every month for the service?

Where is the template for this harmonic indicator?

what do the harmonic ratio numbers represent? as in how can I calculate them manually and what unit of measure are those numbers in?

Very nice explanations, great writing style

Scott, your tool is only for forex, you have anything for equities?

I use harmonics all the time. I like them.

Thank you….

Great explanation…. Easy to understand.