I’m frequently asked whether you can make a living from trading and, if the answer is “yes”, how to make it a reality.

Before quitting your day job and pursuing trading for a living, you need to make sure that your trading performance is good enough. If you’ve been making consistent profits with trading for a year or so, you’re ready. This is not all, though. You also need to make sure you can cope with the pressure and manage your emotions.

Trading can take a toll on your psyche, especially if you’re using high-risk strategies.

Plus, you need to have a time-tested trading strategy that shows consistently good results on both historical and real-life data. Don’t set unrealistic goals. Making 5-7% of your trading capital is considered a pretty good profit. As for the size of your starting capital, it depends on your financial appetite. Anyway, you can start with a small amount and increase it gradually. For example, set a goal to double it the following year. As for me, I started with $500-700. This is the minimum amount that allows you to make the first steps in trading.

Here is another important factor worth considering. You need to have a safety cushion to keep you afloat if your trading results go south and you hit a lengthy losing streak. The larger your savings, the better. It will take off some pressure and allow you to trade with more confidence. It’s good to have other passive sources of income, in addition to trading.

Keep in mind that you can’t predict how much you’ll earn in a day or month. You must put up with the idea that your income will be inconsistent until you gain enough experience and develop your gut feeling.

For those with a good head on their shoulders, trading offers lots of money-making opportunities. While you can make pretty good (and consistent!) profits with trading, you shouldn’t rely on it alone. Try to find other ways to make a living.

This way, if trading fails, you’ll be financially safe!

Plus, you can’t be sure that you’ll be as passionate about trading in 10-15 years as you’re now. Diversify your risks by opening accounts with different brokers. Experiment with trading styles and instruments. If something doesn’t work, don’t be afraid to switch to other options! Buy long-term stocks and bonds. If traded properly, they can secure a stable passive income in the future. Don’t confine to commodities, stocks, and currencies. Who knows, maybe real estate trading is your thing?

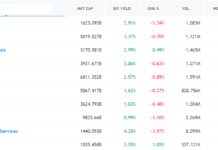

Stocks make up the bigger part of my trading portfolio. Plus, I buy governmental bonds, both short- and long-term ones. You can sell short-term bonds anytime and buy them at a lower price.

One common problem is that many people fail to take trading seriously. If trading is your main source of income, it requires plenty of time and effort, just like any other job. Eventually, your hard work will pay off multifold. One of the biggest benefits of trading is that it offers the freedom and flexibility to work from anywhere in the world. My tip is to give trading a chance. If you manage to master this art, you’ll end up with a valuable skillset and a reliable revenue stream. Good luck!