Nonfarm payrolls (NFP) is a report on the number of new payrolls created in the US non-farm sector. This is the second most important (after GDP) financial indicator that causes significant fluctuations in currency pairs and other instruments, including gold and stocks.

Before reading the article and writing your questions in the comments section, I recommend to watch this video. It’s not long but covers the biggest part of questions on the topic.

Since NPF is extremely hard to predict, you never know how its publication will affect the market. Before the news release, beginning traders are advised to close their positions and avoid trading throughout the day. In this article, we’ll learn how to make money on NPF. Don’t think that we’ll place pending orders and just sit there waiting. We’ll take a pro-active approach. We’ll analyze the current market situation, read the stats, and take weighted trading decisions like true pros.

Table of Contents

What is the Nonfarm payroll report?

As mentioned earlier, the Nonfarm payroll report is a US labor market indicator that shows the number of new workplaces created outside the US agriculture sector over the last month. NFP is released on the first Friday of each month. The most important thing to remember about this indicator is that it causes high volatility within several hours after release. Normally, the market is calm before NFP release, with a price moving in a narrow range. Several minutes before the release, a price may start making strong leaps.

How to interpret NFP stats?

Trading NFP is not only about placing pending orders. You need to understand what is going on in the market and how to avoid unnecessary losses. Half an hour before the release, start to prepare for trading. Open your trading platform and economic calendar. Make sure your Internet connection is stable. Once the report is released, you’ll have to make trading decisions fast. Any delay caused by Internet connection failure or any other reason may have unpredictable consequences, including disappointing losses.

If you open an economic calendar, you’ll see that any indicator has three values: previous value, forecast value, and actual value. The NFP indicator has a great effect on the US dollar. If the actual NFP is higher than the forecast by more than 40,000 payrolls (today the figure is different), you should buy currency pairs with the USD in the first place (e.g., USD/JPY) or sell currency pairs with the USD in the second place (e.g., EUR/USD).

If the actual NFP is lower than the forecast NFP by more than 40,000, you should sell USD/JPY or buy EUR/USD. If the difference between the actual and forecast values is less than 40,000, NFP is unlikely to affect the USD. This means that you should cancel your pending orders before they are triggered. Otherwise, a price will activate two orders one by one, resulting in a double loss for a trader. It’s important to understand that 40,000 is an approximate number. Ideally, the difference between the actual and forecast values must be about 100,000 payrolls. In this case, you can capitalize on a 100-150-pip price move.

Which currency to choose?

When it comes to trading NFP, there are no strict recommendations as to which currency pair to choose. For higher profits, choose high-volatility pairs, such as GBP/USD, USD/JPY, GBP/JPY, and other pairs with the Japanese yen. Volatility is not the only factor worth considering. Several hours before NFP publication, be sure to monitor your selected currency pair. If the pair moves in leaps or a strong trend, you should better pass on it. While trading a high-volatility pair is more attractive in terms of profits, there is a big risk that a price will touch on the wrong order and cause losses.

Our tip is to choose the pair that is trading in a narrow range before the NFP release. (Normally, this is EUR/USD.) Low-volatility pairs are associated with lower risks. Plus, placing orders, in this case, is much easier. A buy stop order is placed above the upper boundary of the consolidation zone. A sell stop order is placed below the lower boundary of the consolidation zone. The reason why a price is moving in a narrow range is because multiple traders are placing pending orders, waiting for the news.

NFP strategy

Now let’s look at how to effectively trade Nonfarm news. Once you’ve chosen the right currency pair, the next step is to place pending orders. Ideally, you should place your pending orders a few seconds before the NPF release to prevent them from activating ahead of time. This is very tricky, though. A price may start moving and your broker won’t allow you to place the orders at the desired price. So let’s play it safe and place orders 2-3 minutes before the release. We place a Buy Stop order 35 pips above the current price. A Sell Stop order is placed 35 pips below the current price.

We don’t place to take profits and stop losses. Activation of one order serves as a stop loss for the other order. We lock in a loss. Now, wherever a price went, our loss won’t get bigger. Now you see why it’s important to trade low-volatility pairs. For high-volatility pairs, pending orders may be placed too far from the current price. It’s not uncommon that during NFP release a price moves in one direction comes to a halt, and continues to move in the opposite direction. When a price comes close to the opening price, you can unlock the trade and walk out with a profit. When locking in a loss, your goal is not to make a profit, but to break even. If you don’t know how to work with locks, you can place regular stop losses at the levels of your pending orders.

Now let’s talk about take profits. If you’re a beginner, you can place a take profit of 50 pips from the opening price. Alternatively, you can place two pending orders, one with a 50-pip take profit and the other with a 100-pip take profit. After the first take profit is triggered, you need to move your second order to break even. If a price moved just 30 pips and then stopped, you should better close your trade with a small profit instead of waiting till a take profit is activated. A hovering price is an indication of an upcoming reversal. In this case, moving your order to break even is useless, because a price will reverse, hit your stop loss and you’ll walk away empty-handed.

Unless you’re an absolute novice in trading, you should avoid placing stop losses and take profits. Right after the NFP release, you need to check an economic calendar or news feed to find out whether the actual value is higher or lower than the forecast value. If the actual value exceeds the forecast value, you need to keep your Sell Stop (for EUR/USD) and remove your Buy Stop. If the actual value is lower than the forecast value, you need to keep your Buy Stop and remove your Sell Stop. If the difference between the actual and forecast values is less than 40,000, you need to cancel both of your orders. If the difference falls in the range between 40,000 and 100,000, you can forget about big profits. If the actual and forecast values differ by more than 100,000, you can count on 100-150 pips. You can use support and resistance levels as your target levels.

Case study

To make the strategy clearer for you, let’s take a look at the historical NFP publications. On investing.com, you can see all the NFP release dates, forecast and actual values.

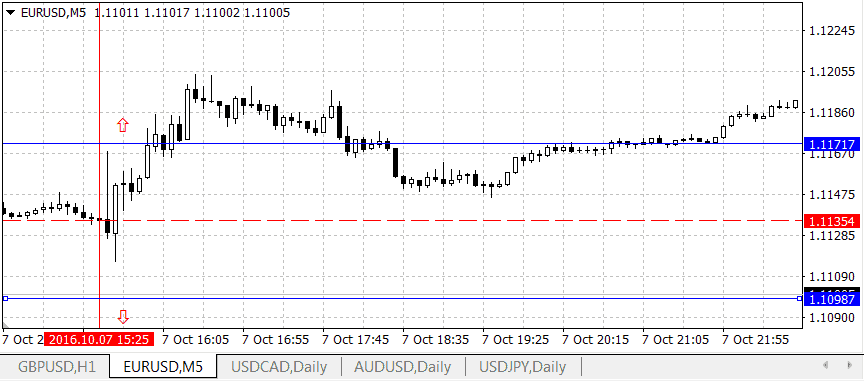

Let’s focus on the NFP report from October 7, 2016. The difference between the actual and forecast values only amounted to 19,000. A difference so small is not worth trading. As you can see from the chart in MT4, there were no significant price moves in the market that day.

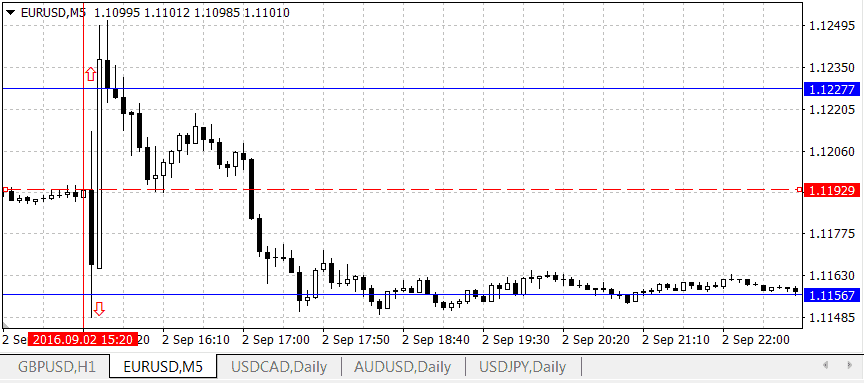

The next NFP report was released on September 2, 2016. The difference was only 29,000, so no trading again. If you look at the chart, you’ll see that a price triggered a Sell Stop, reversed, triggered a Buy Stop and went down. Our decision not to enter the market would have been right.

The next release was on August 5, 2016. The actual value exceeded the forecast value by 75,000. If we had traded that day, we would have been only interested in selling. As you can see, a Buy Stop wasn’t activated but a Sell Stop was. Before a price reversed, we could’ve earned 70 pips.

This is how you trade NFP news in Forex. As you can see, this is not a game of roulette when you place pending orders and wait for one of them to be executed. To succeed in trading news releases, you need to combine fundamental and technical analysis to determine whether the news is worth trading and which of the two orders to keep. If you follow the guidelines to the letter, you have all chance to minimize your losses. However, this strategy is not without drawbacks. One of the most common risks is slippage when your order is opened at a price that is different from your expected price. Large slippages can be very dangerous for your account. If slippage happens too often, you should probably consider changing a broker.