In this short lesson, I will list a few terms that are good to know at the beginning of your training and which can be useful in the following lessons. I do not mention terms that won’t be used shortly. Feel free to write a comment at the end of the article in case you need help with any definition or any explanation of something from this lesson – I will answer!

Let’s start.

-

- Quote (rate) is the current asset, commodity (in our case, the currency pair) cost, usually specified in points.

- BID price is the price at which you (trader) can open a long position (buy an asset).

- ASK price is the price at which you can open a short position (sell an asset).

- Spread is a small difference between the BID and ASK prices, which is a broker fee. Thus, you will see not 0, but rather minus a few points while opening a position in the “profit” field of the trading platform. This minus is equal to the spread size, which is held by a broker.

- Pip is the minimum step of price change.

For example, the EUR/USD currency pair quotation may look like this: 1.7750. We’ll add 1 point to this quote and the new price will be equal to 1.7751. We’ll subtract 10 points from this price and we’ll get 1.7749.

Today, most brokers use a five-digit quotation system and the Eurodollar quotation in our example will look like this: 1.77590.

The minimum price change is now 0.00001, not 0.0001. One point in the four-digit system turns into 10 points and 1 spread point turns into 10 points.

Thus, if comparing the trading conditions of two brokers and you see one has spread in 2 points and the other has 20, do not rush to choose the first one. Check the quote display system. Most likely, the spreads are the same in both cases.

6. Gap is a price gap or a situation where the quotation differs from the previous one by more than the spread size.

It sounds a bit complicated, but you will understand this phenomenon when you see an example.

You can see the fact that the opening price on Monday differs from the closing one on Friday in the forex market almost every Monday when the market wakes up after the weekend. By the way, that’s why many traders do not leave trading positions open over the weekend.

I will also talk about the psychological side effects when a trader leaves positions open for the night or over the weekend in one of the following lessons. In general, the main risk here is that something will happen over the weekend and will affect strongly affects the price and, on Monday, the market will open with a big gap.

7. Lot – in trading, this term is used for measuring the trade volume. For example, you bought 1 lot of EUR/USD currency pair or sold 2 lots of USD/JPY currency pair. A lot has the equivalent in currency. For example, 1 lot of the EUR/USD currency pair is equal to 100,000 units of the basic currency (i.e. dollar).

I still need to add one detail: many brokers allow trades to be made for less than 1 lot to facilitate access to the market. For example, it is possible to buy 0.1 lot of EUR/USD. Due to this, you can start trading with a small amount and avoid assuming a large amount of risk.

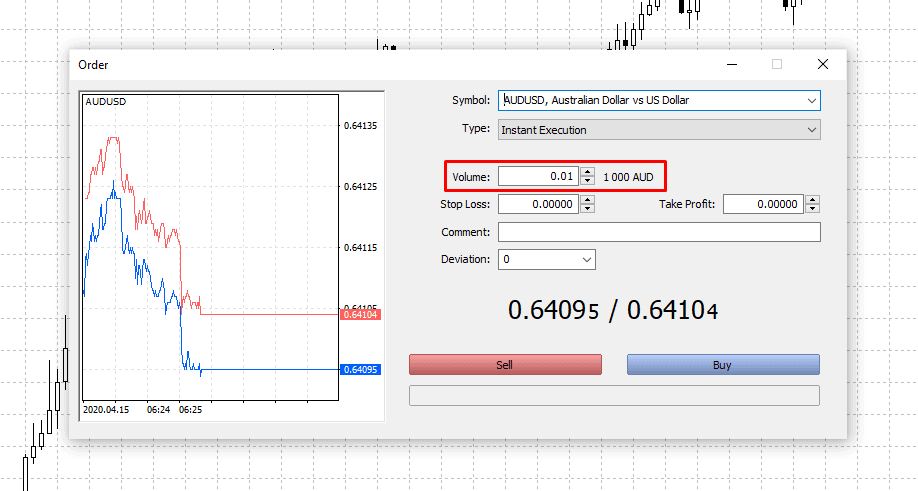

8. Order is a trader’s order to a broker (or stock exchange) to open a trading position. For example, you send an order to open a long position by buying 1 lot of the GBP/USD currency pair. There is nothing complicated since, today, position opening is made by clicking just 1 button, but the term should be known. The previous screenshot shows how the order opening looks in the Metatrader platform.

9. Trading terminal, trading platform – software provided by a broker, which is used for Internet trading. In the lessons on this site, we will use the Metatrader 4 platform, which is considered to be the best solution for forex traders since its emergence.

10. Trading session is a time interval (several hours, a day), during which the financial trading platforms of a particular country or region are operating.

The trading session concept should be understood to take into account at what time a certain instrument’s fluctuations (volatility) are higher (during the trading session where the instrument is actively traded) and at what time the volatility is lower (when the active trading session is closed).

In the first lesson, I noted that EUR/USD currency pair is the most popular instrument in the forex market. In this regard, intraday traders (those who make short-term trades) often work during the European (when the main sellers and buyers of the Euro are active) and American (when the main sellers and buyers of dollar are active) trading sessions.

It doesn’t make sense for me to attempt to make one large, comprehensive forex glossary. Instead, I will explain the new terms needed for the specific things that we are considering in each new lesson.

We will talk about practical things and learn the way to place trade orders in the next lesson. Soon we will learn the way to make trades.

See you in the fourth lesson!

Regards, Pipbear

I feel like forex is like a scam, the same broker am supposed to trust is charging a fee. Then I tend to think they will do everything in their power to make sure am losing.

@Mike, forex is not a scam, the brokers have to make something, they cannot do a pro bono, remember they have staff and bills to pay as well as make sure you access the market.

I don’t know if it is the right question to ask, but am asking this from a point of ignorance, is there a body or a group of people who sets these prices. And a second question is the spread constant among the brokers. How do they establish the right spread?

@Mike, forex is not a scam, the brokers have to make something, they cannot do a pro bono, remember they have staff and bills to pay as well as make sure you access the market

Hi pipbear, I have understood how the currencies are quoted, we have EUR/USD for example and USD/CAD. Why do we have sometimes the USD as the base currencies sometimes not? Why not USD/EUR or CAD/USD?

Hi there, I registered with a certain broker a few weeks ago. I found a platform they are calling C trader. Does it have the same functionality as the Meta trader? I found it to be having a more user friendly interface, should I drop and start using Meta trader?

Which is the best trading session? Which session can I make more money?

Hello Pipbear, thank you for the good work you are doing here, what leads to gap in the market? The market closed on a Friday, there were no open market over the weekend, how does the market open with a gap?

Does it mean the market was running?

The concept of pip and pip measurement is a little confusing, is pip a distance? How is it measure? If EUR/USD goes for 1 pip does it have the same value and effect as GBP/USD travelling the same distance?

This is a great article; it has laid a solid foundation and explained some concepts that were very confusing. I now more than ever feel confident to handle forex.

Great Knowledge!