In this lesson, we are going to learn trading orders’ basic principles in the forex market, the way to fix profits and limit losses, the way to monitor a trading position, tighten orders, and how to simultaneously use several order types within the same position.

We will consider various options at the second level of my course when we talk about trading risk management. There, we will practice with examples. Do not scroll past this lesson, it’s very important.

I will show real Metatrader 5 terminal screenshots even though this lesson is more theoretical. If you want to do everything yourself, download and install the trading terminal from my broker’s website. It is not necessary to open an account – all functions are available without connecting to the account. You can open a demo account for testing the orders (you can make an account right from the platform, you do not need to sign up on the website). I’ll tell you the way to open a demo account in Lesson 6.

All trading orders and basic principles, which I will talk about in the lesson, apply to both the forex market and any financial market where online trading is available. All popular trading platforms have the same principles of opening, maintaining, and closing positions.

Table of Contents

Main Principles of Opening and Closing of Forex Orders

Let’s go back to a few decades ago and imagine that you need to buy shares of any company to better understand what a trade warrant is. You call your broker.

– How are you? I would like to buy Microsoft shares

– Good day, excellent, how many shares do you want to buy?

– 50 shares

– I have an opportunity to buy 50 shares for 25 dollars right now

– Excellent, buy.

Your broker has just bought 50 shares for you at the current market price of $25. And here is another example.

– Good day, how much do IMB shares cost right now?

– 43 dollars, sir. Do you want to buy it?

– I would like to buy 10 shares for 40 dollars

– Well, I fixed your order; I will buy 10 shares for you as soon as the price drops to $40

You were not satisfied with the current market price, and you left an order to buy shares as soon as the price goes down to your broker.

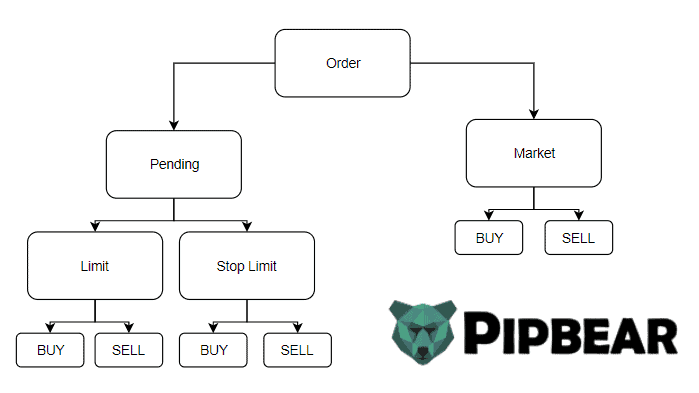

Thus, we can distinguish two trading orders types:

Market – when you make a transaction at the current market price.

Pending – when you are going to make a trade at a price higher or lower than the current level.

What Prevents From Trading with Pending Orders Only?

Nothing. If the current buy quote (bid) of the euro/dollar is 1.5000 and you have an opportunity to buy at 1.4950, do it.

The only issue is that, often, a trader doubts the price will fall lower and expects the market right now to move in his direction and will not return.

It hurts when you put in a pending order and the price doesn’t touch it but went sharply in the right direction.

Nevertheless, it is worthwhile to try to enter the market at the best price using a pending order if the market is in a flat state – lateral movement within a corridor, when there is no upward or downward trend – and you want to open a position.

Market Orders

So, you are already aware of the market order names: BUY (buy at the current price) and SELL (sell at the current market price).

The current Metatrader 4 or 5 trading platform allows you to buy and sell on the market in several ways. Right now we will not touch one of them – hotkeys – but let’s consider the other two.

Method 1

The buttons in the upper left corner of the screen.

Click the small switch in the upper left corner of the graph window, marked in the screenshot with an arrow, in case you download the terminal and do not see the buttons.

I do not recommend that beginners use these buttons or the hotkeys to avoid accidental clicks. (If you click the button several times, you open several positions, multiplying the trading volume and risks.)

Method 2

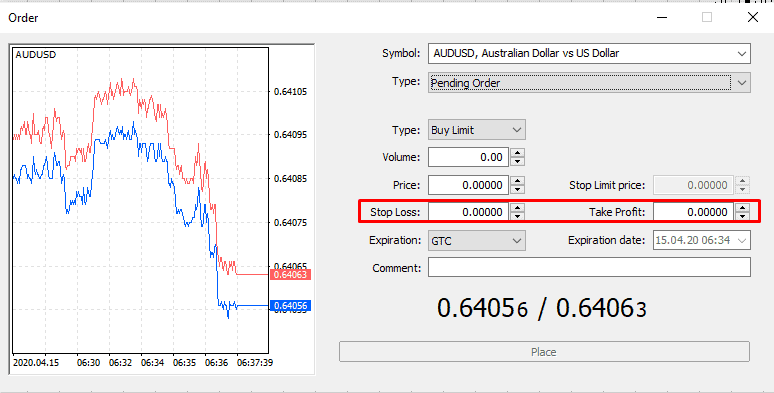

New Order tab. You can open it by clicking F9 or by right-clicking in the chart window.

You have an opportunity to specify the trading volume, choose the order type (market execution or pending order), immediately set the stop loss and take profit order (we will talk about them later) and open the position in this window.

I recommend using this method for opening trading positions.

Pending Orders

Pending forex orders often cause difficulties or confusion for beginners but there is nothing complicated about them.

When we leave the pending order, we essentially define only 2 options – remember the conversation with the broker from the beginning of the lesson.

- Do we want to open a trade above or below the current market price?

- Do we want to open a long or short position?

Thus, we have 4 different types of pending orders.

Buy Stop is purchase at a price higher than the current one.

Such orders are used, for example, in case of breakdown of the resistance level (don’t worry, I will discuss this in more detail later). This means we are opening a long position if we expect the market to confirm the upward trend has taken shape.

Buy Limit is a purchase at a price below the current one.

Such an order is used for buying at the best price. For example, the price is in the corridor and we release the buy limit order to open a long position when the price is at the bottom of this corridor.

Sell Stop is similar to the buy stop; the sale is below the current price.

We will use this order when confirming a downtrend, for example, in case of resistance breakdown.

Sell Limit is similar to the buy limit, selling at a price higher than the current one.

We release this order to more advantageously open a short position on the price rollback. Thus, we open a short position on more favorable terms.

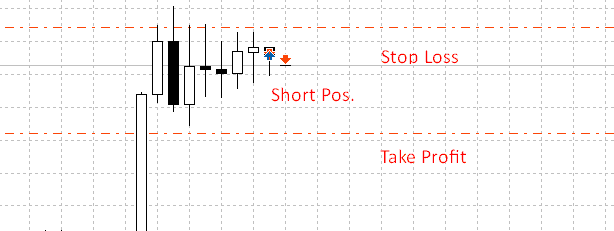

We close the trading positions with Take Profit and Stop Loss.

What is Take Profit and Stop Loss?

This is the simplest part of the lesson. You probably heard about these orders even before the classes began. It is clear when seeing the title that the first order—take profit—serves to fix profits and the second—stop loss—is to close a losing trade.

Stop loss and take profit are the same pending orders that we discussed in the previous section. When we open a long position, Take Profit is a pending order to sell above the current price (Sell Limit) and Stop Loss is a pending order to sell below the current price (Sell Stop).

Similarly, for a short position, the TP order is a pending order below the current price (Buy Limit), SL is a pending order at higher than the current price (Buy Stop).

Why is it necessary to use TP and SL instead of standard pending orders?

It’s much easier and faster to use TP and SL than to open standard pending orders for each position. There are three main advantages of take profit and stop loss:

Setting TP and SL is possible immediately when opening a position in the Order window (F9 key).

The system automatically determines the order type (you will not mistake Buy Limit and Sell Limit) and the trading volume (you will not buy/sell more/less than you need to close the position.

TP and SL orders are displayed in the main position line in the trading area.

And if you opened separate pending orders, it would look like this:

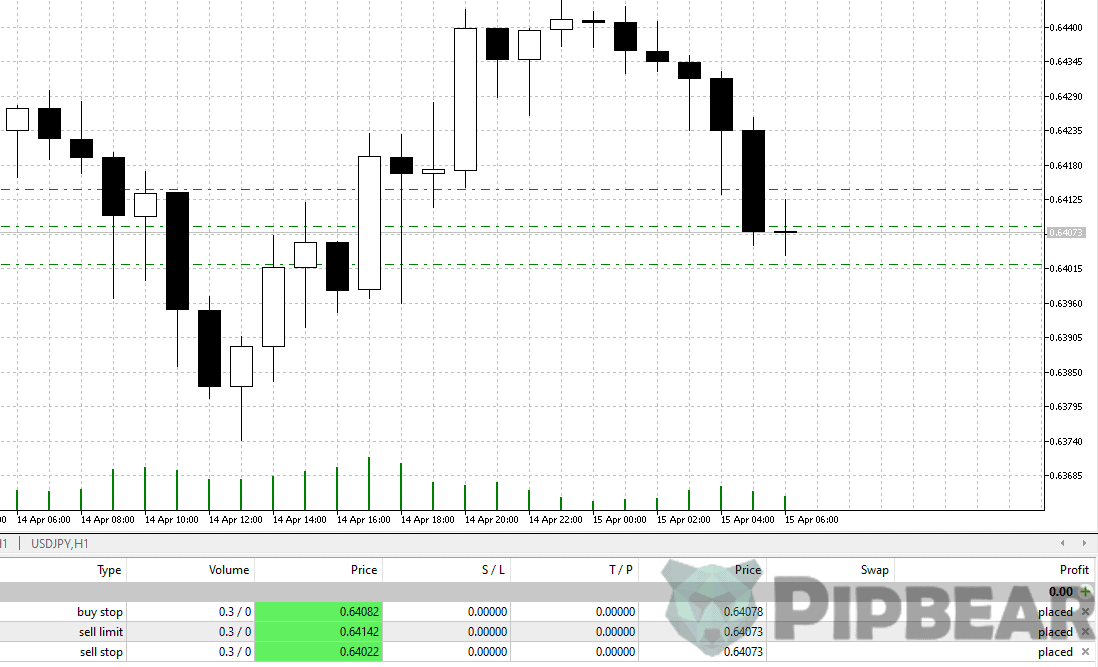

In what cases are pending orders better than Take Profit and Stop Loss?

It’s necessary to install a pending order instead of SL in case you want to instantly open the opposite position when a certain level is reached.

For example, you made a purchase of 1 lot on the EUR/USD currency pair at 1.5000. You think that if the price falls below 1.4950, the price will fall further to at least 1.4900.

What actions need to be taken in this situation?

You open a long position at a market price of 1.5000. Trade amount is 1 lot. Set Take Profit, for example, at the level of 1.5100 to this position. In this case we don’t need Stop Loss.

We set a Sell Stop order at 1.4950 with a volume of 2 lots. We add Take Profit to this order at 1.4900 and Stop Loss at 1.5000

What will happen in this case?

If the price does not go to your original TP and falls to 1.4950, the opposite position opens, which volume is x2 from the original. This means that, 1 lot will be for sale after reaching the price of 1.4950 if at the beginning you had a position equal to 1 lot to buy.

You will have Take Profit while fixing 50 profit points if the price drops another 50 points and reaches 1.4900. Thus, you will lose only spreads if adding two trades. If the price once again grows to 1.5000 after the opening of a short position at 1.4950, the SL order will trigger, and you will lose 50 points. You will lose 100 points plus spreads for 2 trades.

Reread the paragraph or leave a question in the comments to the lesson if something remains unclear. I will do my best to explain it once again.

Important! After one of the orders works (e.g., TP on a long position), you need to remove the opposite one.

Moving the Stop Loss level automatically—Trailing Stop order

At the end of the lesson, I will tell you about the order type that I do not use in my trading process. A Trailing Stop is a function that allows the Stop Loss to move automatically when the price goes in the direction that you expect.

While setting a trailing stop order, you specify the range between the current price and the wanted SL level. Stop Loss on your trade will automatically follow the price level after it makes a 15 pips movement.

For example, you open a long position on EUR/USD at the 1.5000 level. Trailing Stop is set at 50 pips, so initially at 1.4950

If the EUR/USD price rises to 1.5051, the Stop Loss level gets automatically changed to 1.5000.

What happens if the price rises to 1.5114 and then goes down to 1.4800?

When the price hit 1.5100, the Stop Loss got automatically changed to 1.5050. When the price turned back from 1.5114 and reached 1.5050, the Stop Loss got triggered and the trading position closed. As a result, the profit on this trade is 50 pips minus spread.

Important Feature

Often, when traders use a trailing stop that is following the price, they don’t set a Take Profit order. This means that any position will sooner or later close on SL. In such a case, you need to consider this when analyzing your trading journal and keeping in mind that close on SL is not always a losing trade.

Why don’t I use a Trailing Stop?

I don’t use Trailing Stop orders because, from my point of view, there are not many strong direct movements in the market. The price can make 50 pips one side, then roll 30 pips back, then make another 150 pips. It’s very hard to predict small price movements and these movements are what activates your SL orders. In the risk management lesson, I will tell better ways to control and manage a trading position.

Summary of the lesson

- There are 2 types of orders: market and pending.

- To open a position at a price that is higher or lower than the current one we use one of 4 types of pending orders.

- We set Take Profit and Stop Loss levels in the Order window using the F9 key.

- We need to have a Stop Loss order in each trade. If you don’t learn this, my course won’t help you.

- I don’t recommend using Trailing Stop order.

Terms of the Lesson

Flat market | F9 key | Buy stop | Buy limit | Sell stop | Sell limit

Did you like the lesson? Leave a comment below or ask a question, I will be happy to reply. See you at the next lesson!

Best regards, Pipbear

when using pending orders on daily bars slippage should not be a major concern

i normally trade by placing pending orders at fibo retracement levels ( 4 hour candles) and use market orders while trading news. about 80% times the trade takes place and i make profits in these trades 60% of the times. CAN YOU SUGGEST A BETTER METHOD?

How many pips from daily candle close do you advise one to use as buy stop or sell stop

Which is the best execution method when scalping

Thank you Admin

Very easy to understand….. You are doing a great job online

This has changed the way I view things, I think my trading is likely to improve. Thank you very much admin

Can you emphasize more on best entry method for pinbar

Thanks!!