If you are undertaking this training course, you are probably familiar with forex (or other types) of trading. For that reason, in this post, I do not intend to use scientific terms or relay the content of the economics textbooks. Let’s discuss what is Forex trading all about.

Let’s get something clear right out of the gate: Trading = speculation.

Online trading = speculation made via the Internet while using specialized technical means (trading platform, broker, and exchange infrastructure).

Forex trading = speculation with CFD contracts for various assets (I’ll talk about the CFD concept a bit later).

Stock trading = speculation with equity instruments, including stocks, futures on stocks, and so on.

Commodity trading = speculation with physical goods when you bought a product at one place at a low price and sold it at another place at a greater cost. I will not discuss the commodity trading business in this training; I mention it just to make an example to understand the logic.

Table of Contents

Where does the money come from when you trade forex (or something else)?

If you set out to start trading forex, you must understand that your earnings come from the difference between a financial instrument’s purchase price and its sale price (CFD contracts, in our case).

- Buy and then sell at a more expensive price => Profit

- Sell and then buy at a cheaper price => Profit

- Buy and then sell at a cheaper price => Loss

- Sell and then buy at a more expensive price => Loss

At this point, we will introduce some new terminology to describe the types of positions you can open: long positions and short positions. These terms will appear in the lessons that follow.

When we buy an asset and expect the costs increase to sell for a profit, we open a long position.

When we sell an asset and expect the costs decrease to buy for a profit, we open a short position.

What is the best way to sell and buy forex?

This is the most popular newcomer’s question. Yes, it is possible in the strange world of financial instruments. I see two ways to quickly explain this phenomenon to a newcomer:

- You must learn to think not in “buy” and “sell” terms, but “opened a long position” and “opened a short position”. Read the definitions above three times and commit them to memory.

- Although this may be painful for traders to hear, it’s necessary to draw a parallel with the rates. We do not buy an asset, but rather make a bet for the price increase while engaging in online trading. Likewise, we do not sell the asset, we make a bet for the price decrease.

If anything up to this point is not clear, please leave a comment below so that I can answer any questions that may arise.

What is the right way to choose a trading instrument?

Liquidity

Traditionally, we value each trading instrument for online trading based on several parameters. The biggest one is liquidity. Liquidity is the ability to buy or sell an asset at any time.

Let’s suppose you want to buy the shares of one little-known third-tier company for a million dollars. The current share price is $50. You have an opportunity to buy 20,000 shares at the current price for a million dollars.

In reality, however, the sellers on the exchange may only be ready to sell you just 100 shares at the current price, another 150 for $50.50, another 100 for $51, and so on. The result is that if you try to buy 20,000 shares at market price, your total position will be opened at a rate that is higher than you planned.

This means that the asset’s liquidity was not sufficient to meet your needs.

Volatility

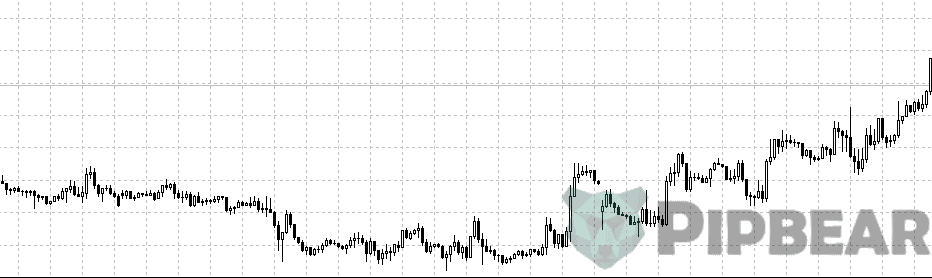

Volatility is a term that refers to price fluctuations. In other words, it is the range of price change security experiences over some time. Compare the following two charts:

The first chart shows a price which is situated at approximately the same level throughout the day. The trading opportunities are limited since large movements are absent.

The second chart shows a large movement. A trader has an opportunity to make a profit if he enters the market at the right time.

Thus, in the first case we are dealing with low volatility, in the second one – with high volatility. We are interested in the most volatile assets, first of all, even though they are considered as more risky.

Predictability

Predictability may not be the most obvious factor, but, with experience, you come to an understanding of what to expect from certain assets.

Syncing up Times

The schedule of trading sessions is one of the most common forex questions on social networks. You should know that most transactions in a certain instrument are carried out in a strictly defined period when sellers and buyers converge and make transactions. Most often, we focus on the exchanges’ schedule. For example, it’s necessary to track American stocks during the New York Stock Exchange’s working hours. The largest euro-dollar currency pair movements reliably occur during the European trading session.

- Asian: 23:00 – 9:00 GMT

- European: 6:00 – 16:00 GMT

- American: 13:00 – 23:00 GMT

- Pacific: 20:00 – 7:00 GMT

Be sure to convert time according to your time zone!

Asset cost

We will discuss this point in detail when we talk about risk management. If you have a limited budget, it makes no sense to choose the most expensive assets, right? The cost of 1 lot 50, 150 dollars or even more. The problem here is that you will not be able to comply with reasonable risk management rules if you risk the whole deposit in each transaction just because you do not have enough free funds.

Market Participants and What Forex Brokers Lie About

First, it’s necessary to understand what exactly do we speculate on to engage in a trade. We do not need to learn the history, activities, background, financial statements and Apple’s top management board to buy or sell its shares. However, it is necessary to understand what the shares are.

It is necessary at least to be aware of the fees and other costs you will incur during the trading process. Quite often, it happens that a trader who made 100 trades, having earned $100, realizes that he paid $100 or more in fees to the stock exchange or broker while he analyzes his reports at the end of the month.

So, let’s see what are the assets to choose from.

Few words about the stock market

According to Wikipedia, A stock market, equity market or share market is the aggregation of buyers and sellers of stocks (also called shares), which represent ownership claims on businesses; these may include securities listed on a public stock exchange, as well as stock that is only traded privately, such as shares of private companies which are sold to investors through equity crowdfunding platforms. Investment in the stock market is most often done via stock brokerages and electronic trading platforms. Investment is usually made with an investment strategy in mind.

Perhaps I should clarify the reason that I’m bringing up expenses in the very first lesson. In reality, your approach to trading depends on your expenses. For example, scalping, which we’ll discuss in one of the following lessons, means making quick trades and getting a small profit. Traders should make sure that their transaction costs are minimal if they choose to scalp!

Puzzle

As an exercise, try to solve the puzzle with the following conditions:

- You make 50% of profitable trades and 50% unprofitable ones.

- You earn 7 points on an average trade (I’ll tell about what this concept later, now it’s not so important) and you lose 5 points on each unprofitable trade.

Is your strategy profitable?

Of course, the answer is yes. Uncomplicated counting confirms that you are in a positive territory by 2 points after 1 profitable trade and 1 losing trade. The strategy is profitable on the whole since we have the same profitable and unprofitable trades number.

Now we’ll add the third condition to the puzzle:

- You are charged a 2 point fee for each trade.

What happens? Now, each profitable trade you are in positive territory by 5 points, not 7. You are in the negative territory in each losing trade by 7 points, not by 5 ones.

Expenses can make the seemingly profitable strategy unprofitable!

Online trading is carried out via an exchange, which a trader accesses through a broker. Previously, this used to mean a real, live person. Now, though, it happens through the global trading infrastructure. Today, almost everyone has the opportunity to buy and sell shares on the stock exchange: large funds, small companies, speculators, private investors. Also, the exchange is supported by a large infrastructure, a Clearing Houses (which bring the seller and the buyer together within the asset or contract purchase and sale), and “market makers” who support the asset liquidity and do not allow the price to slide hundreds of points in different directions, and so on.

Shares have ceased to be purely an investment tool due to brokers who allow customers to trade with leverage (we will discuss leverage in the following lessons).

The point is a trader has an opportunity to buy or sell more than his trade deposit balance allows due to increased risks. Almost all instruments that you can trade via a broker are subject to leverage.

Traders have the opportunity to open enormous positions thanks to huge Leverage in the forex market, where the basic contract value is huge (1 lot of most currency pairs equates to $100,000). The Leverage disadvantage is every item now costs several times more, and a small market movement is enough for the trader to lose his entire deposit.

Thus far, we have smoothly approached the concept of forex.

What is Forex?

Brokers and training companies say that FOREX is a global market which includes the world’s largest banks, financial institutions, and funds making the currency transactions. A trader is offered to take part in this Foreign Exchange…

In fact, the forex market doesn’t exist. At least, not a centralized one, such as a stock exchange, where sellers and buyers are brought together. Of course, you will not have to trade with any banks. But this doesn’t mean you shouldn’t participate in this market.

Now let’s speak about what assets we are going to trade on the market which Forex brokers offer us to enter.

What is CFD?

Formally, a CFD is a “contract for difference” is an agreement between two parties about transferring the asset cost difference to each other at the transaction’s start or end.

I try to simplify all terms as much as possible. It is enough to know that CFD is a financial instrument that allows betting on a basic asset’s price growth or fall.

Thus, a broker has an opportunity to create CFD for any asset whose price is interesting to speculate with.

This is neither good nor bad.

An important point to emphasize is that your broker is your contractor according to the contract. That is, you get money when you make a winning trade. When you make a losing trade, your broker gets the money.

Unfortunately, such a system is not used only by forex brokers. Some companies that provide clients with access to the exchange sometimes can be seen to “overlap” customers’ trades with their own money while opening opposite positions on the exchange. Thus, when a novice trader loses money, a broker can assign it.

Fortunately, today the market is much more civilized than in the early 2000s. Even if a broker, but not an abstract seller or buyer is the trade’s counterparty, it does not mean he will manipulate prices and force the trader to lose money. This is not needed – in fact, according to statistics, most traders lose their money in the financial markets.

Today, the most popular are CFDs for the following assets types:

- Currency pairs

These pairs include the three “majors,” which are the most commonly traded: EUR/USD, GBP/USD, USD/JPY. Each currency pair quotation is the rate of one of the world currencies (euro, pound, and yen) to the dollar rate. We’ll discuss the quotations in detail in the next lesson. There are several dozen other currency pairs in addition to three main ones which can be divided into 2 types: dollar-linked (for example, USD/CAD or USD/CHF), as well as those not pegged to the dollar (for example, EUR/CAD).

2. Commodities

Brent and WTI oil are the most popular here. A contract for natural gas is a bit less popular among traders, although the interest quickly returns at moments of interesting macroeconomic events associated with this asset.

3. Crypto Assets

Recently, crypto is one of the most interesting instruments. Crypto assets have a frenzied volatility. Today, Bitcoin, Ethereum and Litecoin are the most popular cryptocurrencies represented by forex brokers. Nevertheless, a new currency may appear at any time, and I’m sure brokers will quickly adopt it.

The key advantage in trading such instruments through a forex broker is the ability to open both long and short positions. Thus, it is easy to earn on a profit after a sharp increase – most traders use it. Of course, this applies to both cryptocurrency contracts and all other instruments.

4. Shares

Forex brokers allow you to earn on the changing stock prices of the world’s largest companies. Of course, the choice is usually not so clear as at NYSE, where thousands of companies are represented. Typically, brokers choose the most popular companies: Apple, Google, Microsoft, General Motors, etc.

5. Indices

The stock index is the securities market state indicator calculated in a certain way based on the most liquid ordinary shares or bonds.

For example, the DAX index, which is calculated on German companies’ basket price basis, is a German stock market indicator. The situation is similar to the French CAS, American S&P, Brazilian Bovespa and so on.

Forex traders rarely trade these instruments. It’s useful to keep index graphics in front of the eyes in a separate trading platform window, though. We’ll discuss the way to use it in the market analytics section.

To sum up, we can see a trader actually gets 24/7 access to the most relevant financial instruments from around the world and the opportunity to earn money on their changing prices while trading via a forex broker.

WHAT ARE FUTURES AND OPTIONS?

This lesson training will not cover the futures and options topics in detail. Nevertheless, it’s necessary to have a general idea. Futures don’t differ much from a CFD contract, which is offered by forex brokers. The most important idea to note for a trader is that futures are an exchange tool.

This imposes certain restrictions. For example, the trading leverage: the maximum trading leverage of exchange brokers is several times lower than forex brokers. Besides, the futures liquidity is provided by the participants of the exchange, which also makes a significant contribution to the trading process.

The option is one of the most difficult things to understand among traditional exchange instruments. It will suit people who are inclined to build mathematical models, have good spatial thinking, and love to count – if you are among them, learn more about exchange-traded options!

WHY IS IT BETTER FOR A NEWCOMER TO CHOOSE FOREX MARKET?

To conclude, I will tell you the reason a newcomer should start with forex and why I still trade through a forex broker even though I am an experienced trader. Here are a few basic reasons:

First, a trader shouldn’t care what he’s trading. Derivative financial instruments (derivatives), which, in essence, include both futures and CFD contracts, are essentially the same. The ultimate goal is to buy low, sell high and vice versa – to sell high, then buy low. A trader is guided by several basic parameters when choosing an instrument, which I will describe in detail in one of the following lessons.

Secondly, forex is the easiest way to start trading. In my opinion, trading platforms are one of the key advantages which novice traders never think of. Metatrader is a real miracle compared to some platforms for trading on the stock exchange – it has a clear interface, excellent speed, and a convenient mobile version. All forex brokers give customers the same program, while many stockbrokers often make their own, which usually leads to terrible technical difficulties.

Third, forex has a very low entry threshold. A trader has an opportunity to trade on a demo account for any amount of time until he is ready to risk real money. $100-$1000 is quite enough to start, while the same amount is hardly enough to open a position on an exchange.

Well, are you tired? This was the first, introductory lesson of my training. Once again, I do not sell anything on this site. I don’t have paid lessons and closed sections. All I would like to share with the novice traders is presented in 22 lessons. Just take your time to carefully read the lessons doing all the calculations and exercises that I present to learn the material.

MAIN ARTICLE CONCLUSIONS

- Easy start, opportunity to understand and learn to trade for free, ability to quickly disperse the deposit, ability to choose any from a huge number of different trading tools, the opportunity to do everything (open an account, trade, and withdraw profits) without leaving your house are the main forex market advantages for newcomers.

- There are 2 types of trading instruments: exchange and over-the-counter. Forex refers to over-the-counter one.

- Each market has its fees and costs. These costs can significantly affect the trading system and general effectiveness.

- The forex market allows you to open both long and short positions on any asset. This means you have an opportunity to earn on both price rises and falls.

- You do not trade with banks or investment funds in the forex market – you trade with your broker. But there is nothing wrong with that.

FIRST LESSON TERMS

Trading | Volatility | Stock (share)| Forex | CFD | Currency pair | Commodities | Crypto currency | Stock indices

Very nice article! Will keep reading the course, you have a nice style sir!

What are the best currencies to trade?

I hear that a person’s losses are someone’s gains, is it the case? I tend to think one persons loss is a gain to the broker. That is why some brokers trade against traders.

Well said

Between stock forex, cfd, commodities which is likely to show some levels of stability. Which one is more stable?

A nice read, thank you for sharing

How about options, would you consider options in your trades?

Why is it that some brokers offers more currencies and commodities than others… are there limitations.

A friend of mines always warns me from trading crosses. Would you recommend trading in crosses?

You are doing a wonderful job online… keep sharing your skills and experience

Great effort Keep it up! .I tried to down load the book but I couldn’t could you please assist me further….