The tunneling strategy is a multicurrency trading system for which the recommended time interval is considered to be one hour (H1) chart, but, if desired, it can be used on M15 charts for scalping purposes. When trading at shorter intervals, you should clearly understand that there will be more false signals. The following standard indicators are used in this strategy:

- Exponential moving average EMA (Period 18) should be painted red;

- Exponential moving average EMA (Period 28) — it is necessary to also paint it red;

- Sliding average Linear Weighted — WMA (Period 5) — should be painted blue;

- Sliding average WMA (Period 12) — yellow;

- Indicator of RSI (21).

The tunnel, consisting of two red lines, forms the moving average EMA, the periods of which are 18 and 28. With their help, the beginning, as well as the end of the trend, are determined.

The WMA moving average with 5/12 period will indicate when you need to enter the trend.

There are the following rules for concluding a trade on this strategy:

A trade needs to be opened only when the red tunnel on the chart is severely narrowed or the red lines intersect. The buy signal is given at the moment when the average WMA, the period of which is 5 and 12, crosses the red tunnel emerging from the two EMAs upwards (Picture 1).

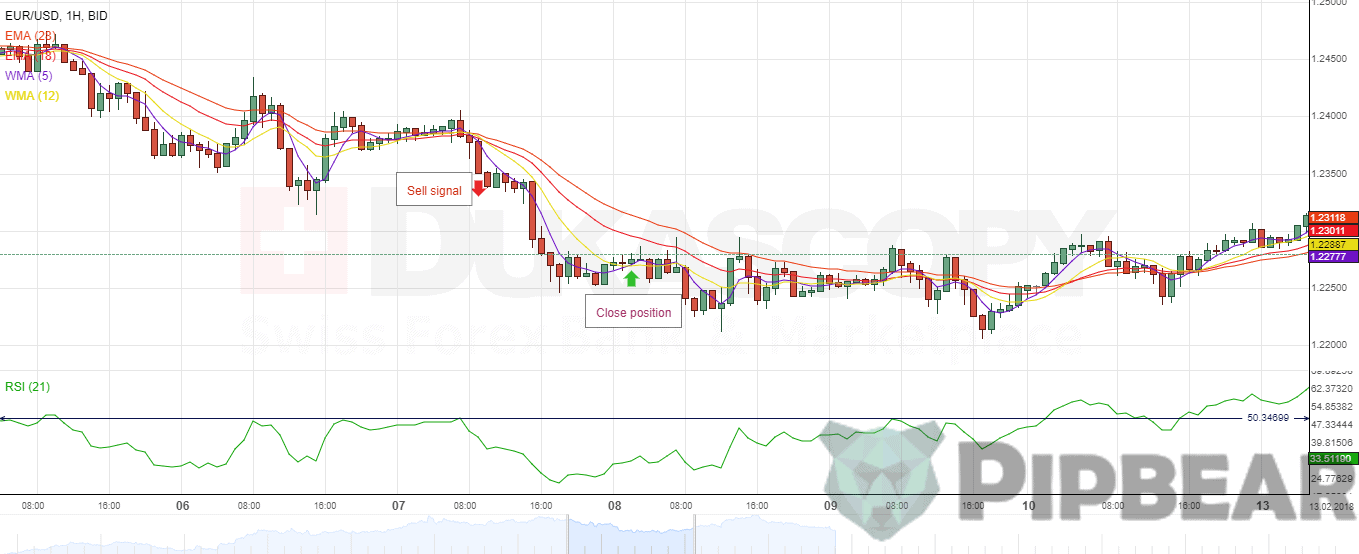

The strongest signal is considered to be the moment when the installed moving average WMA with period 5 crosses from the bottom up WMA with period 12. In a situation where the average 5 and 12 WMA cross the red tunnel from the two EMAs from the top down, a short trade should be concluded (Picture 2).

A particularly strong signal is indicated by the moment when the average 5 WMA and 12 WMA are cut from top to bottom. Please note that in both scenarios – RSI for sale should be below the value of 50 and for buy above the value of 50 (Picture 3).

The basic rules for closing a trading position

The end of the trend is indicated by the following signals:

- long positions — when the price peaked on the chart, and the moving average WMA (5) crosses the WMA (12) from the top down. In this case, it is necessary to close the trading position at the current market price.

- short positions — when the price has reached the bottom on the chart, and the moving average WMA (5) crosses the average WMA (12) from the bottom up. In this case, it is necessary to close the trading position at the current market price.

It is also necessary to immediately close the trading position just after the boundaries of the red tunnel cross each other or there is a significant narrowing. This moment is a clear sign of a reversal of the trend. Close the position after this signal appears, open to the other side (reverse). Do not close the trade until the red tunnel lines cross each other.