After the previous lesson, you are probably afraid to assume what exactly I will have to say about risk management. Indeed, what I am writing about is my personal experience, which is a far cry from risk management materials written by analysts at the beginning of the 2000s. Many of the risk recommendations that you can read on the Internet, firstly, repeat each other, and secondly, they are suitable for portfolio investment, and they are not good for a private trader, especially for the beginner.

Of course, at the beginning of my career, I read through all the existing literature on trading, but eventually my own rules had to be created based on my own mistakes.

So, my first thesis is that universal rules of risk and money management do not exist. The only rule that is applicable to everyone is that, in the end, you have to earn something because otherwise this all makes no sense.

By the end of this lesson, you should be able to set up your own rules with which you will collect your trading strategy in pieces. So, let’s move on to the main part.

Table of Contents

LET´S ANALYZE RISK MANAGEMENT USING THE EXAMPLE OF A SPECIFIC TRADING SYSTEM

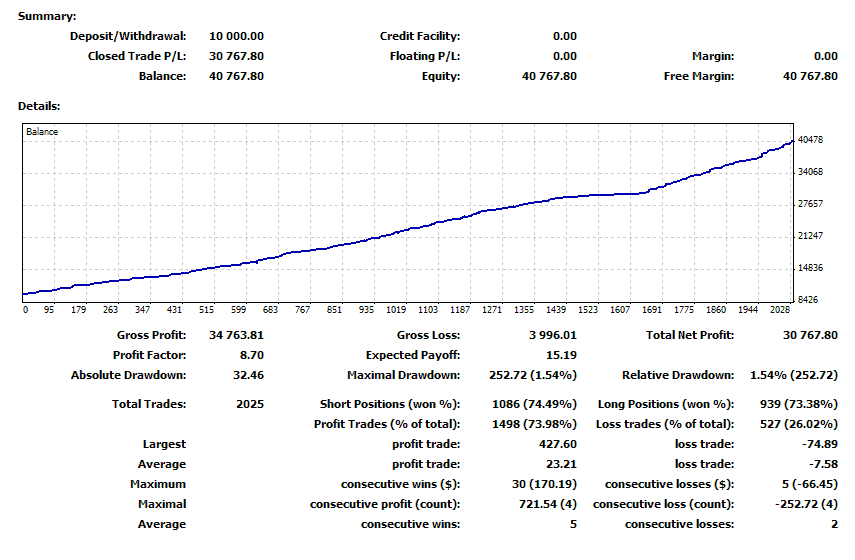

Here, you can see a detailed report on trading activity and results from the MetaTrader 4 platform. Don’t worry if the text is not visible from the phone, I will describe each item in detail and You will be able to easily analyze your trading.

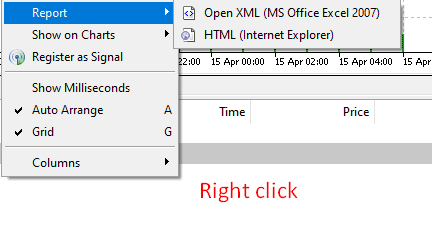

After the lesson on setting up the trading platform, you had a homework in which you needed to make 10 transactions on a demo account. If you have completed it, you can upload your report by clicking the right mouse button on the Save Detailed Report on the History tab. In MetaTrader 5, just click on the Report and choose a convenient format.

In this example report, we will analyze the main parameters that characterize a certain strategy in terms of its risks.

Before you continue reading, stop for a moment to study the picture. You will notice that you see a perfect trading system report. I found this screenshot on Google because I considered these numbers to be an interesting example. Regardless of whether the report is real or fake, let’s see what the statistics say.

If you upload your report, in addition to statistics, open positions and already closed ones may also appear there. We will consider the key statistic indexes of the detailed MT4 (MT5) report, so let’s focus on them.

I have developed an automatic report analazer where you can upload the report and see the strong and week spots of your trading strategy. Try it!

DETAILED MT4 (MT5) REPORT

In the first line we can see the following parameters:

- Gross Profit is the total profit on all the lucrative trades.

- Gross Loss is the total loss for all the red trades.

- Total Net Profit is the amount of how much was earned during the reporting period, taking into account all the profitable and unprofitable trades (gross profit minus gross loss).

From the perspective of statistics, this line will tell us only whether our trading approach is profitable. In general, it is useless for assessing risks.

Even if you gained profit during the reporting period, it does not mean that everything is alright in terms of risk management.

THE SECOND LINE

• Profit Factor is the ratio demonstrating the correlation of Gross Profit and Gross Loss. For me, it is useless.

• Expected Payoff is the Total Net Profit divided by the number of transactions. It may seem like an interesting indicator, but I have not figured out how and for what it is used.

THE THIRD LINE

- Absolute Drawdown is the drawdown to the initial balance. Absolute drawdown is not a very useful parameter.

- Maximal Drawdown is a maximum drawdown on the account. This parameter describes the degree of risk of your trading strategy and it is exactly this parameter that we will analyze as the basis of the trading strategy.

Even if the strategy showed profits (Total Net Profi t> 0) as a result of the test, the presence of too high maximum drawdown should indicate its non-viability. Sooner or later there will come a moment when a protracted series of losses or too much loss at one moment will bring to naught all the work of the trader.

The report below shows the total number of transactions, the percentage of long and short ones. I do not think that such an analysis is useful.

Even if you find out that short transactions are statistically more profitable than the long ones, you are unlikely to decide to completely abandon the long ones.

- Profit Trades and Loss Trades are several most useful sections of the report. Here you see two lines:

- Maximum is the largest profitable an unprofitable transaction.

- Average is the average profitable an unprofitable transaction.

Let’s think about how these parameters can help us. One would think that the maximum profitable and unprofitable trades are not very useful indicators because statistics are usually smoothed out for considering the average values. I recommend looking at these indicators in direct comparison with the average ones.

For example, the loss in your most unprofitable trade is 10 times bigger than the average trade loss. What does it mean? Perhaps this deal was a breakdown and you did not carry it out according to your strategy. The most probable scenario is that you are poorly controlling the potential losses or your stop losses are too large.

I recommend doing the following:

-

- Find this transaction in your trading journal and the transaction ledger of MT4 (after dragging the transaction from the journal to the chart, the entry and exit points will appear) you can understand whether the transaction is fully consistent with the system and what has caused such a large loss. Again, I will remind you of the importance of keeping a trading journal. If for some reason, you missed this lesson, I strongly advise you to return to it.

- Evaluate the size of the trade; did you risk too much capital?

- How many trades were there during the past month? Are those losses very different from the average indicator? Perhaps your strategy is profitable, but, because of just a few trades that are not carried out according to the system, you have ruined the overall picture.

In my opinion, it is extremely important to ensure that the maximum loss on the trade is not too different from the average loss.

On the other hand, this piece of advice has nothing to do with the profitable trades. If you have caught a great movement and did not close the position too early, it only indicates your professionalism. By the way, in classical trading literature you often come across the following instruction:

- Cut losses;

- Let the profits flow (grow);

In other words, the perfect strategy of risk management which is described by the classics of exchange trading implies a short stop loss and a long take profit.

Honestly, I have not managed to fully apply this approach to the forex market, but if I advised a beginner on a specific approach to risk, I would advise this one. I will share my thoughts on risk management a bit later.

Let’s talk about the average profit and loss of the trade. If you are not tired yet and you follow the logic, you have already guessed that the most correct advice, in this case, sounds like this: the average profit per trade has to be bigger than the average loss per trade. Not bad, huh? But, in reality, a strategy can be successful even if the average loss exceeds the profit.

Take a moment and try to figure out in which case this might be true.

Have you guessed? Then let’s continue.

We will also combine the remaining parameters into the common group of “sequential actions”.

- Maximum Consecutive Wins ($) is the longest series of profitable trades (in brackets the amount of profit for all the transactions is indicated).

- Maximum Consecutive Losses ($) is a similar thing for the unprofitable trades.

- Maximal Consecutive Profit (count) is the maximum profit in successive trades (the number of transactions in a series is indicated in brackets).

- Maximal Consecutive Losses (count) is a similar thing for a loss.

- Average Consecutive Wins & Losses is the average number of profitable and unprofitable transactions.

Out of all these parameters for the analysis of risk management strategies, I use only the last one, and only for the unprofitable trades. The number of successive unprofitable trades is directly related to the Maximum Drawdown indicator.

In the example screenshot, we can see that the maximum average series of unprofitable transactions is 17, and the maximum series is 16. This is far from the ideal situation, but if the average profitable trade brings more than you lose on the average unprofitable one, the strategy is practically bulletproof.

THE DEPOSIT DRAWDOWN IS THE KEY PARAMETER OF RISK MANAGEMENT

I believe that all those who are beginning to build their trading strategy and testing it in the real market should, first of all, think about the actions during the drawdown of the deposit. Virtually in any standard article about risk management on forex, even in those written by non-professionals, the following sign is present.

| 25% | 33% |

| 50% | 100% |

| 75% | 400% |

| 90% | 1000% |

Can you guess what these numbers mean? The table shows the amount of profit necessary to restore the deposit after the drawdown. For example, if your initial deposit is $1,000, after dropping by 25% there remains the amount of $750. To restore the amount to the initial level, the profit margin should be not 25%, but 33% of the account.

If you lose 90% of the account, you need to make 1000% of profit to return to the initial level, which seems to be practically impossible and it implies maximum risk. That is why, in risk management books, there is the information about such a parameter as the maximum transaction risk. This parameter determines how much you allow yourself to lose in each trade to keep the risk at an acceptable level. I see only 2 ways to stick to the maximum allowable loss in each transaction:

- Always put the stop loss at the level of maximum allowable loss;

- Do not open the positions in which the required risk level exceeds the maximum allowable one.

For obvious reasons, I advise the readers to remember the second rule. If you still do not understand why to ask in the comments below this article. I will write this point in more detail.

HOW TO CALCULATE THE TRANSACTION RISK?

By way of example, let’s try to understand the real situation in which you calculate the risk of a trade. Let’s suppose you look at the EUR/USD chart and see a situation in which the price pushes away from an important support point and begins to go up.

You will want to open a long position and put the stop loss to the support point. That way, in case the price reaches the breakout, your position will be closed.

You know the following parameters:

- The current bid price by which you open a long position.

- The Stop Loss level that is required within a framework of your strategy.

- Spread size (to make calculations as quickly as possible, it does not need to be taken into account when considering risks).

Let’s suppose that by abstracting the stop-loss rate from the current one, you earned 30 points. That’s how much you will lose if the deal turns out to be unprofitable (without taking spread into account).

In every-day trading, it’s enough to use the calculator.

Position Size Calculator

Position Size Calculator widget is provided by DailyForex.com – Forex Reviews and News

If you have not figured out how to use a calculator, please ask a question in the comments to this lesson, and we will calculate it according to your terms.

Daily Risk

I want to advise you to use one more indicator which can seriously influence the success of your trade. It does not directly relate to the success of a certain trading strategy, but it has a direct effect on the result of the trader’s work.

Unfortunately, psychology will always affect the trading decisions of a person. It is impossible to teach the right attitude to trade; any beginner will sooner or later break up which will lead to losses. Failures can seriously knock a trader off balance, and the trader in such a state begins to execute unsystematic trades, discard the planned strategy, trading journal, and ignore all his rules.

Since preventing such moments is almost impossible, the best thing would be to introduce such a parameter as a maximum loss per day into your trade.

Loss can be calculated:

- In the currency of the deposit (for example, “I stop trading after losing more than $100 a day”);

- In percent of the deposit (for example, “I stop trading after losing more than 5% of the deposit in a day);

- In the number of transactions (for example, “I stop trading after three unprofitable trades in a day).

I will not impose any particular variant out of these three; the best thing will be to choose the one that suits your strategy. If the trading approach implies that 80% of your trades are unprofitable, and 20% are profitable, the third variant will not suit you. In my opinion, the most universal way to count the maximum daily loss is in % of the deposit. Unfortunately, following the rule of turning off the terminal when reaching the maximum daily loss is extremely rare. Like in the casino, the trader is overwhelmed with the excitement and in this state it is extremely difficult to stop on your own.

In prop trading offices (I explain what it is in one of the last lessons of the course), there is usually a special person, a risk manager, or special software that automatically closes all the trading positions and turns off the trader’s computer when it reaches the established daily level of loss.

If you learn to stop yourself, it will not only advance your trading to a new level but will also significantly help in life.

FOREX MONEY MANAGEMENT

In order not to write trivial and useless things which you can read in the standard articles on money management in forex, I will immediately move to practice. In my opinion, money management needs to be applied primarily to influence the Maximal Consecutive Loss statistical indicator that was mentioned above.

A risk management mechanism looks like this: You change the trading volume of a trade after a profitable or unprofitable trade.

VARIANT 1

Your standard trading volume is 0.4 lots. After each unprofitable trade, you reduce the trading volume by 2 times. For example, after the first unprofitable transaction, you will open the next trading position with a volume of 0.2 lots. If it also becomes unprofitable, you will open the next with a volume of 0.1 and then trade the minimum volume. As soon as a profitable trade occurs, restore the trading volume to the original 0.4 lots.

The main objective of such a money management strategy is to reduce the loss in a series of trades and to control emotions. When you reduce the volume of trade, the desire to recoup losses does not influence your mind anymore, and you are still able to think rationally.

This approach will be suitable in two cases:

VARIANT 2

Your standard volume is 0.4 lots but, after each unprofitable trade, you do not reduce. Rather, you increase the trading volume. This is very close to the Martingale system and to the concept of averaging which we will soon discuss in one of the following lessons when we begin to study trading strategies.

The main objective of such money management is instant recoupment and deposit recovery. At the same time, you have probably guessed to which extent such an approach threatens with the loss of the entire deposit. As with other strategies with similar money management rules, there are three things necessary for such an approach:

- A deposit size that is sufficient enough to withstand the significant drawdown.

- Very, very strong nerves and iron tranquility. It may seem that approaching several unprofitable transactions in a row rationally is not difficult but, in real life, it, is a very serious test for the mind.

- Patience and the ability to continue following the intended tactics to the extreme.

All in all, such an approach is acceptable in case of deposit overclocking, and also if, statistically, your profitable trades yield an order of magnitude more than your losing ones. Nevertheless, such an approach to money management is in no way recommended to a beginner.

VARIANT 3

This is an application of the first and the second approaches to profitable trades. Here, it is a little harder to choose the optimal solution. It is difficult to formulate in what cases it is worth increasing the volume of trade after a profitable trade, and in which cases it is worth reducing it. I can advise you to test different variants directly on your trading strategy.

THE UNIVERSAL RULE OF MONEY MANAGEMENT

In addition to the options I described above, I want to advise all my readers of one universal rule that I use myself. Here, the goes like this:

Reduce the volume of the trade when your emotional state is not stable.

In other words, it is necessary to limit the probable losses as much as possible in the conditions when:

- You did not sleep well;

- You are ill or feel bad;

- You are upset, something happened in your personal life; or

- Something is annoying you (for example, bad weather) or your mood is just terrible.

All the people have to live through good days and bad days. Unfortunately, trading is a domain in which a person has to demonstrate a high level of responsibility every day. Bad days can significantly affect the state of the trading account.

With the express aim of this it is recommended to avoid trading at such moments, and the reduction in trading volume is suggested as an alternative. So, if you still want to trade with a bad mood or while not feeling well, the best choice would be to devote time to working on the quality of implementing your trading strategy while trading with a minimal volume.

All in all, we summarize the topic of forex risk and money management with the main conclusions of the lesson that need to be remembered.

THE MAIN CONCLUSIONS OF THE LESSON

- There are no common rules for risk and money management, you will have to create them yourself as part of your strategy.

- Key statistical indicators based on which it is worth building a risk and money management system are: Maximal Drawdown, Average Wins & Losses, and Average Consecutive Wins & Losses

- The most important parameter of your risk management strategy is the drawdown of the deposit.

- Maximum transaction risk and risk per day are two easy ways to reduce your losses.

- The main objective of money management is to reduce the maximum drawdown of a trading account.

- The biggest problem in risk management is not the shortcomings of a trading strategy, but your emotions.

HOMEWORK

Find any extended MT4 (MT5) report on the Internet and analyze the strategy from the perspective of risk and money management.

Today’s lesson is one of the main ones in the course. Considering the nonsense that is published on most forex trading websites, here I try to outline my personal experience in the hope that it will be useful for beginning traders. I expect that today’s lesson has consolidated the basic sense of risk management. If some aspect remains unclear, please ask a question in the comments; I will be happy to answer or add certain information to the article if I forgot to say something important.

If everything is clear, let’s move on to the next lesson.

Yours sincerely, Pipbear

well-briefed, and hit the mind directly, good, thanks

Great one for me and remember to trade with capital one is ready to loose.

I like the well illustrated explanation, thank you

After reading this several times I will be more aware of my “plan” as I set up future trades… Thank you for sharing such valuable information.

Have been trading for almost 10 months now. But always have a problem setting the Stop Loss.

Very useful article Pipbear could you please write some article about trade management I mean. Most importantly how to stay confident even when trades go against me

This was my missing link, I feel moving forward I will be a better trader.

I have been looking for this piece and finally found it, very well explained