The Denmark indicator is an oscillator designed to identify the overbought/oversold zones through assessing the current demand and risk levels. The instrument was created by Thomas Demarker, a recognized trader and analyst. Demarker’s ambition was to develop an ideal indicator that would be drastically different from its predecessors. Although Demarker failed to discover the Holy Grail, his indicator is still worth the attention.

Before reading the article and writing your questions in the comments section, I recommend to watch this video. It’s not long but covers the biggest part of questions on the topic.

The indicator compares price tops and bottoms over a pre-set number of periods. According to Demarker, these data allow us to assess the potential of the emerging trend and identify price exhaustion points that precede a trend reversal.

Widely known among traders, the Demarker indicator is built into such platforms as MetaTrader, think or swim and live chart. To be able to use the oscillator, you need to set the overbought level at 0.7 and the oversold level at 0.3.

Table of Contents

How it works

For binary options, the Demarker indicator generates two major groups of signals:

Crossing the overbought and oversold levels

- If the Demarker line crosses the 0.7 level from above (going from the overbought zone), this is a signal of the trend reversal and you should buy a put option;

- If the Demarker line breaks down the 0.3 level from below (going from the oversold zone), this is a signal of the trend reversal and you should buy a call option.

To respond to the signals faster, you can install The CandleCountdown indicator.

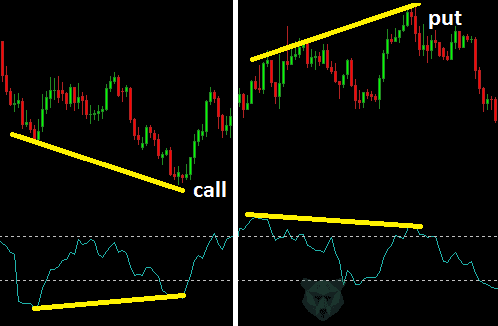

Divergence

- If the indicator doesn’t confirm a new low on the chart, this is a bearish divergence and you should buy a call option;

- If the indicator doesn’t confirm a new high on the chart, this is a bullish divergence and you need to buy a put option.

- By pairing the Demarker oscillator with any trend indicator (e.g., TRIX), you can filter off most of the false signals. The two indicators must move in the same direction. Otherwise, you may be dealing with an unstable trend and opening a trade may be too risky.

Wrapping it up

- DeMarker is, hands down, one of the best tools to identify trend reversals. However, like all oscillators, the Demarker indicator generates plenty of false signals for binary options when the market is trending. Be sure to combine the Demarker indicator with trend indicators to weed out fake signals.

- Demarker is available on major trading platforms. If you still want to download this indicator, click the button below:

I am new student here at Pipbear, and first of all i want to say thanks for your wonderful work. I am learning quite a bit by reading and watching your videos. I read elsewhere that relying on these indicator is not right…. Please comment on that

Awesome job

Nice read… will definitely come for more

Hi, Thanks for the piece, do you have more elaboration and examples on this area

Can I use Demarker for stock trading?

Thank you coach. I have seen you discuss a number of indicators so far. My question would be do you have a lesson that shows the best indicator combinations for optimum results

Can I get a PDF document with all these lessons put together?

Excellent work!!! Keep up doing the magic you are doing online.

Thanks!!!