In this article, we’ll cover one of the most exciting and profitable strategies that uses fractals. A fractal is a pattern discovered by Bill Williams. Read on to find out what a fractal breakout is and how to use it for stellar trading results.

Before reading the article and writing your questions in the comments section, I recommend to watch this video. It’s not long but covers the biggest part of questions on the topic.

Forex traders can choose from a stunning variety of advanced strategies. The selection includes both conventional and out-of-the-box trading systems. In the hands of a disciplined and smart trader, each of them can become a goldmine. At the same time, some trading strategies should be ignored by all means, especially if you’re a rookie. Here we’re talking about deceptive techniques that attract naive traders with mind-blowing profits. By paying $10 for a “magical” trading system, a trader hopes to become a millionaire overnight. Do we even need to say that such strategies simply don’t work? The only person who benefits from them is the seller.

As you can see, a big selection of trading tools can be a curse and a blessing at the same time. The more you look, the more clearly you see that human laziness and greed have no limits. Finding a reliable strategy takes a lot of effort. If you’ve managed to discover a time-tested strategy that fits your personality and trading style, consider yourself lucky! This article looks at fractal trading. Not only is this method free but it is also easy to use.

Table of Contents

What is a fractal?

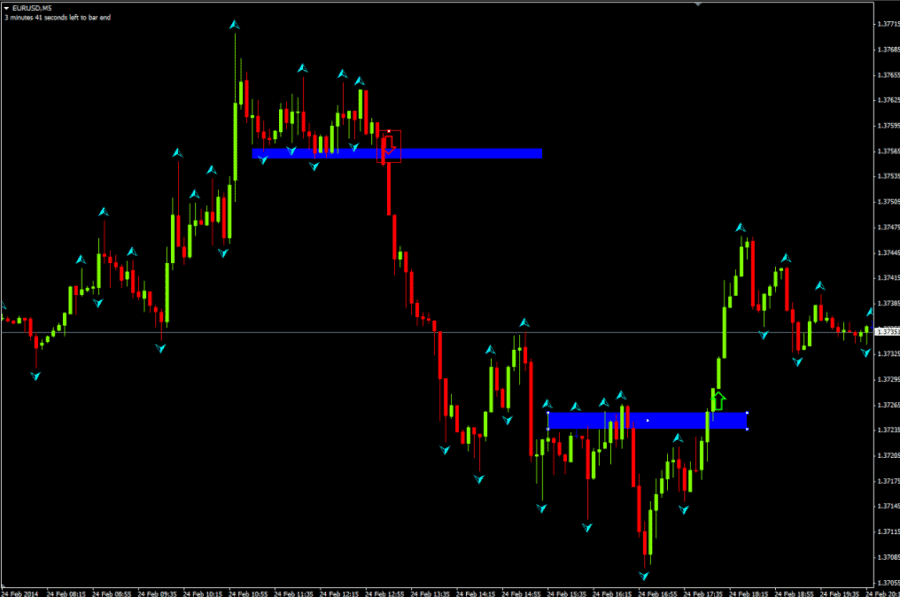

A fractal represents a local low or high hit by a price. How do you recognize a fractal on a chart? A fractal is a pattern consisting of five candles (bars). Out of all five candles, the middle candle always has the highest high/low. On a chart, a fractal is marked with an arrow pointing upwards (if it’s a high) or downwards (if it’s a low).

A fractal was introduced by an American trader Bill Williams. According to the author, a fractal may have a varying number of candles. However, a 5-candle pattern is the most common formation. It grew popular among traders after it had been included in the standard set of tools in MT4, a major trading platform.

What gives fractals an edge over other technical tools? The thing is that a fractal is a multi-functional tool. Along with identifying local highs and lows, it also recognizes the key support/resistance levels, which are essential to successful trading. Keep in mind that a fractal is 2 or more candles late. Unfortunately, there is nothing a trader can do about it. Lagging indicators present a big threat to a trader’s purse. An unaware trader may look at the chart and see an ideal fractal formation, while in real life a price may have already moved in an unfavorable direction.

How to trade fractals

To correctly identify entry points, you need to filter out market noise and focus on the information you need. If you’re determined to earn a fortune using fractals, be sure to follow these guidelines:

- Start with choosing a currency pair. We recommend using EUR/USD, which is a very popular choice among traders.

- Choose a timeframe. We’ll be trading an H1 chart. The problem with lower timeframes (M5, M10, etc) is that they’re full of market noise and generate plenty of false signal H1 chart is safe in that regard.

- Now to indicators. Our first indicator is Smoothed Moving Average (SMMA) with the following settings: Price = close, Smoothing period = 135. Our second indicator is Fractal. As our strategy is based on fractal breakouts, the Fractal indicator will be our right hand.

The magic of trading

Bill Williams recommended using fractals as a part of strategies based on fractal breakouts at significant price levels. According to the author, if a price is moving at least one pip above or below the level of a previous fractal, it’s safe to say that a price has already broken that level. If a price rises above the previous fractal, which is directed upward, this is a buyers’ breakout. If a price falls below the previous fractal, which is directed downwards, this is a sellers’ breakout. According to Bill Williams, a buyers’ or sellers’ breakout should be considered a surefire entry signal.

If you already have some trading experience, you won’t have trouble making a correct entry. Here is a checklist to help you out:

- If a price moves above the SMMA, you should look out for buying opportunities

- If an up fractal forms above the SMMA, place a trailing Buy Stop order.

- Place a take profit at level 115. (If you’re using a 4-digit broker, your take profit will amount to 1150 pips).

- Place a stop loss at level 60-70.

- Once your profit reaches 30 pips, add a buy order.

Here is a checklist for selling:

- If a price moves below the SMMA, you should open a short trade;

- If a down fractal forms below the SMMA, place a trailing Sell Stop order;

- Set a take profit at level 120;

- Set a stop loss at level 35;

- Once your profit hits 80 pips, add a sell order.

Wrapping it up

If you’re tired of identical strategies involving familiar indicators like Stochastic and RSI, it might be refreshing to trade fractals. Before putting your hard-earned money on stake, be sure to test Bill William’s strategy on a demo account. Once you feel confident about it, you’re ready to open real-money trades. If you follow the rules, the fractal breakout strategy will deliver great results. On the web, you can find multiple tools that help you trade fractals. Fractals Trader is one of them. With this trusted advisor, you’ll be rolling in money. And once again: be sure to get the hang of it on your demo account first.

Trading this strategy on the daily time frame and managing it on the lower, 4hr time frame is a great way to trade this strategy.

yes that’s a very good point, the best systems are always tailored to suit personality and trading style.

Thank you!

Well elaborated

Nicely put…. Clear explanations.

which time frame is good for this method ?

Good tutorial. Thank you 🙂

nks bro… u simplify the breakout strategy… very good job

Awesome