The OsMA Indicator (Moving Average of Oscillator) is quite an irregular indicator, the main purpose of which is to identify bearish and bullish divergences (inconsistency between the directions of the oscillator and the price). This tool is not very popular among the traders as it is very similar to the famous and popular MACD Indicator. Nevertheless, they have some differences and if we compare these tools, the “big brother” would not always win.

Before reading the article and writing your questions in the comments section, I recommend to watch this video. It’s not long but covers the biggest part of questions on the topic.

Like any other technical analysis tool performing in a proactive mode, the OsMA Indicator has its pluses and minuses that we are about to discuss.

Table of Contents

Description of the OsMA Indicator

You can see the performing principle of the OsMA indicator from its name, which stands for the “Moving Average of Oscillator”. This indicator is calculated as the difference between the values of the MACD oscillator and its signal line. That line is the so-called moving average. The results are displayed on a chart in the form of the bars that grow or fall about the zero line.

- The larger the distance between the MACD and the SIGNAL, the longer the bar (and vice versa). Consequently, its length represents the strength of the current trend. If the values on the MACD coincide, nothing will be displayed on the histogram.

The OsMA Indicator is a part of many popular trading platforms including the MT4 platform. You must set four key parameters while adjusting the Moving Average of Oscillator.

- The slow EMA is the exponential moving average of the price for a relatively long period. By default, its value is set to 26.

- The fast EMA is another moving average with a short period (12). The MACD value is calculated as the slow EMA minus the fast EMA.

- The MACD SMA is a simple moving average of the MACD values (the signal line), which is designed to smooth a histogram. It usually has a very short period and in our case, it is set to 9.

- You can use any source data for the price type parameter. It is usually the price of closing the bars but it can be various average prices and the price minimum/maximum or the opening price.

The OsMA Indicator and the Divergence

Practically all the modern oscillators can determine the divergence, which has always been considered a strong trading signal. The Moving Average of Oscillator is a leader of its kind.

You can see the divergence when the price chart differs from the OsMA histogram.

When the bearish trend is forming (the most favorable period for selling), the price starts to grow steadily and the peaks of the Moving Average of Oscillator move in the opposite direction on the chart.

So is it a bullish or a bearish trend that gives us a signal to buy?

Experience has proved that in most cases it turns out that you should trust the oscillator. The price will soon start to fall and it is better to get rid of the assets right now. Things go the same way in case of a bullish trend but the charts are moving in opposite directions compared to the previous example.

The price line may give a signal for selling but usually it is the best time for buying.

Trading upon the OsMA Indicator

As we have mentioned before, the OsMA Indicator is tied up close to the MACD Indicator. You can notice that by analyzing various trading signals for both indicators simultaneously.

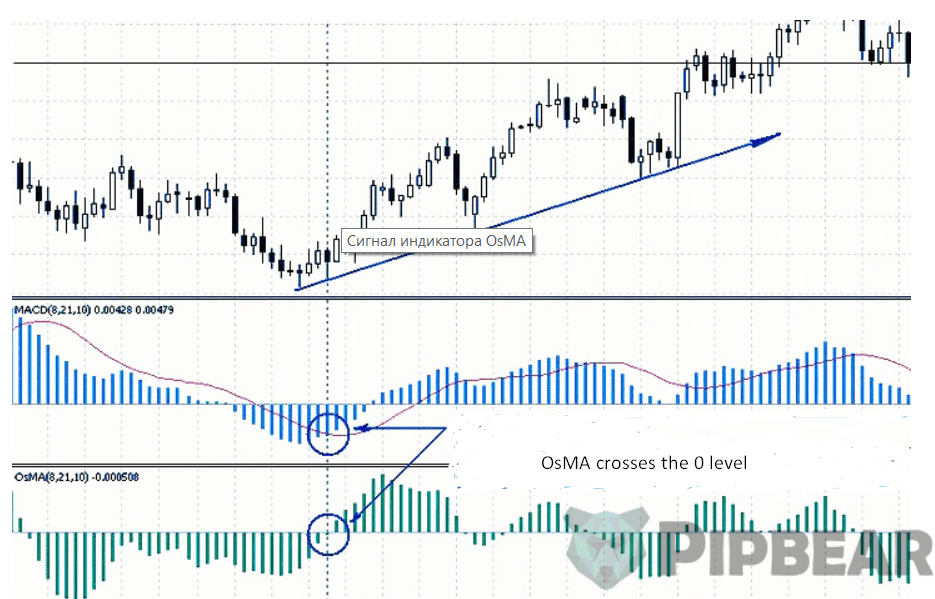

Let’s start with buying. You will get a signal about the opportunity to buy when the OsMA histogram crosses the zero level bottom-up. If the bars keep growing, you can say that the bullish trend is getting stronger. If you look at the MACD Indicator having similar settings at that moment, you will see that the histogram is crossing the signal line in the same direction and at approximately the same speed. When the curve on the chart slows down, stops or reverses, the columns follow it on the Moving Average of Oscillator. When it happens, you may consider the trend getting weaker and think of closing the transaction.

The things are almost the same in case of short. The histograms crosses the lines top-bottom on both charts. At this point, we can be sure about the forming of a bearish trend, which will grow stronger or weaker depending on the further behavior of the bars. I think we should remind them about the overwhelming amount of false signals. However, it is an inevitable expense. You should use other technical indicators to avoid trading against the trend and to help to determine the most profitable market entry points.

Conclusion

Many traders believe that the Moving Average of Oscillator is nothing more than a copy of the MACD Indicator and it does not deserve any attention. This is the only explanation why this tool is rather unpopular. Certainly, the OsMA Indicator has its minuses, the main one of which is the excessive number of false signals. It is a typical problem of all the indicators working in proactive mode. However, you already know that the amount of the signals can be significantly reduced by using additional tools of technical analysis.

The main advantage of the OsMA Indicator is that it determines timely the divergence moments and displays the balance between the bullish and the bearish trends on the market. Even a non-believer will have to admit it.

You do not have to choose between these two indicators. The experts suggest using these tools in conjunction to each other.

They would complete each other and increase the accuracy of analysis and consequently the amount of the true predictions.

Straightforward explanation. Nice job

Can you trade in real life…. I think it would work better

Coach hi, we would love other signals to combine with OSMA … in my understanding one should not work with a single indicator

Are there specific timeframes and commodities that work best with this indicator?

Thanks so much…. This is good job

Awesome

Awesome

clear explanation and easy to follow

Believe me I LOVE YOU… FABULOUS EXCELLENT KNOWLEDGE MY DEAR… TNXX

Brilliantly explained