Today we will talk about one of the oldest traditional indicators, the relative strength index, or RSI for short. This indicator is included in all trading platforms, it is used in thousands of trading systems in all markets. Any investor knows this indicator, notwithstanding, not everyone understands how to apply it correctly. That is why I want to lay out in this article all the peculiarities of the use of this great indicator, and even share the extended version.

Before reading the article and writing your questions in the comments section, I recommend to watch this video. It’s not long but covers the biggest part of questions on the topic.

Table of Contents

Characteristics of the RSI indicator

- Currency pairs: any

- Timeframe: any

- Indicator type: Oscillator

- Trading time: depends on your strategy

History of creation

The indicator was developed by wells Wilder (J. Welles Wilder) and posted in Commodities magazine in June 1978. Later, Wilder wrote the book “Fresh opinions in trading systems”, where he gave a detailed essence of the relative strength index. After the publication of the book, the RSI became quite popular among traders and undoubtedly helped almost all users to appreciate the power of the market.

Wells Wilder is a stock trader, one of the leading experts in technical analysis and the developer of many trading systems and indicators. By education Wilder is an engineer, he worked both in the specialty and real estate market, but he was fascinated by futures trading. For many years, Wilder was engaged in research on technical analysis, the results of which were several books (“New Concepts in Technical Trading”, 1978, “The Adam Theory of the Markets”, 1987) and “The Delta Phenomenon, 1991”).

In the early ’80s Wells founded the “Delta Society International”. The society aimed to study financial markets. The company that owns this company, Trend Research Ltd, develops trading software.

Wilder is the author of such known indicators as Average True Range, Relative Strength Index, Directional Movement Indicator and Parabolic Stop and Reverse.

Now J. Wells Wilder Jr. is perhaps the most famous of the currently living market gurus. A retired trader lives on the beautiful South Island in New Zealand. The experience of lived years reflected in his last book “The Wisdom of the Ages in the Acquisition of Wealth.”

He says that if he had known in his youth what is written in this book, he would have been much richer than now. Its indicators are considered basic for many technical analysis programs and are included in almost all modern trading terminals.

Wells Wilder Jr. remains an active trader and consultant on technical trading systems and methods, the author of many articles, speaks on radio and television.

And finally a couple of interesting quotes of this remarkable trader:

“You can not cope with emotions – get out of trading.”

“Some traders are born undisciplined. Life will teach them. It will hurt.”

General description of the indicator

The indicator RSI is an oscillator, and therefore it oscillates in a certain zone, limited by the maximum and minimum values. The Relative Strength Index is set on a scale of 0 to 100. Best of all, it works by reaching areas of extremes. The criterion for evaluation is two lines drawn at levels 30 and 70. It is believed that over 70 is overbought, and below 30 is oversold. Therefore, when the value of the Relative Strength Index reaches and rises above 70, there is a threat of a drop in prices; movement below 30 is perceived as a warning of a near rise. Some analysts advise accepting the levels 30 and 70 as boundary only with lateral trends, and 20 and 80 with strongly pronounced bullish and bearish.

Of course, exceeding levels 30 and 70 does not mean that you need to immediately begin trading. After all, the market may be in a state of overbought and oversold for a long time, and the oscillator, warning about a change in the trend in advance, does not explain when exactly this can happen.

Introducing RSI, W. Wilder recommended using his 14-day option. Later, 9 and 25-day RSIs were also distributed. Often, as a period, take 5, 7, 9, 14, 21 or 25. Most programs offer one of these numbers as the default value.

Daytime RSI will be based on price data covering the last 9 or 14 days. The weekly schedule will include the past 9 or 14 weeks. Minute, of course, 9 and 14 minutes.

The number of single periods in the calculation of RSI can vary, so I recommend experimenting with them to choose the most suitable option. The shorter the calculation period of the RSI, the more sensitive the indicator to the current price changes.

How to choose the optimal period? The fact is that for different timeframes of the same currency pair, it will be different, so it will not be possible to use once successfully selected indicator period on all time scales of the pair you need. As a rule, the smaller the timeframe, the longer the period should be and vice versa. It is not difficult to find the optimal period for the RSI indicator – you need to consistently look through the periods and look at the overbought and oversold zones. As soon as the main highlights (reversal, key) highs and lows on the price chart begin to be reflected by the indicator in the overbought and oversold zones, and the rest will be (at least most of them) outside these zones, consider that the optimal period is found.

As usual, the smaller the period we use, the more sensitive the curve and the more signals we get. The shorter the period is selected, the closer to the extreme values of the scale are the indices of the RSI index corresponding to the “overbought” or “oversold” market conditions. The greater the number of days in the period when calculating the index, the smoother will be its indicators.

Calculation formula

Since the computer does all the calculations for you, there is no need to memorize the formula. And yet, its knowledge will help you better understand the operation of the indicator, and this is the key to its proper use and interpretation of the signals it provides.

Wilder argues that there are two main problems in constructing a price-rate curve (based on the price difference). The first is due to the chaotic movement of the tempo curve due to the frequent sharp differences between the values of prices in the period under review. A sharp increase or decrease in prices that occurred ten days ago (in the case of a ten-day pace indicator), today can cause a sharp curve turn-even if current prices remain relatively calm.

Therefore, to minimize such distortions to a minimum, the tempo curve must be smoothed. The second problem is related to the need for constant boundaries of the oscillator band for comparative analysis purposes. The formula of the RSI index allows us to solve both these problems: it not only smoothens the curve but also provides a constant vertical scale from 0 to 100.

It should be noted that the term “relative strength” is used by Wilder to some extent erroneously and often misleads those who are familiar with this concept of analyzing the stock market. “Relative strength” is traditionally understood as a ratio curve of two different objects. As for Wilder’s relative strength index, it does not measure the “relative strength” of the various objects, and therefore the meaning to which the author gives this term is not entirely accurate. Nevertheless, the RSI index solves the problem of chaotic motion of the oscillator curve and allows to establish constant upper and lower oscillation limits.

For the calculation of RSI, positive (U) and negative (D) price changes are used. The day is called “upside” if the closing price today is higher than yesterday.

![]()

The day is called “down” if the closing price today is lower than yesterday.

![]()

If the closing prices are today and yesterday are equal, then U and D are equal to 0. After the values of U and D are smoothed by an exponential moving average with a period of N, the “Relative Strength (RS)” is first calculated:

![]()

Based on RS, the RSI itself is calculated:

![]()

It is easy to see that:

![]()

In many sources, not an exponential moving average (EMA) but a simple one (SMA) is indicated.

When calculating RS, it is necessary to take into account the situation when the denominator turns out to be zero. This is possible when using a simple moving average (SMA), when for the entire averaging period the price only went up and, accordingly, all the values of D = 0. In this case it is necessary to take RSI = 100.

Of course, any price for calculating the indicator can be taken. For the MT4 platform this is the closing price, openings, highs or lows, average, typical and weighted price. It is also possible to build an RSI on the data of another indicator.

Overbought and oversold levels

The values of the RSI index are plotted within the vertical coordinates from 0 to 100. When the indicator is above 70 or below 30, the index records the state of overbought or oversold, respectively. Two horizontal lines corresponding to 70 and 30 are plotted on the oscillator plot. These lines are often used to obtain signals for buying and selling. As has already been mentioned, the value of the oscillator below 30 indicates that the market is oversold.

Let’s say a trader believes that the price drop is about to reach the limit, and is waiting for the opportunity to open a long position. He sees that the oscillator curve falls below 30, finding itself in the oversold area, and hopes that in the dynamics of the oscillator in this region some discrepancy or a double bottom will form. When the curve crosses the border again – this time climbing, many traders regard this as an affirmation that the oscillator’s tendency has turned up.

Conversely, re-crossing line 70 when the curve falls from the overbought area is often regarded as a signal to take a short position. Of course, exceeding levels 30 and 70 does not mean that you need to immediately begin trading. After all, the market may be in a state of overbought and oversold for a long time, and the oscillator, warning about a change in the trend in advance, does not explain when exactly this can happen. Always watch closely the intersection of lines 70 and 30. During a strong uptrend, there is nothing unusual in that the RSI oscillator rises above 70 and stays there for quite some time.

This is usually a signal of a strong uptrend. In such cases, it is probably best to ignore the oscillator for a while, while it remains above 70. The intersection is below 70, especially if it occurs after a long time, often gives a good signal about the trend change.

Many traders consider the intersection below line 70 as a sell signal, and the intersection above line 30 is a buy signal.

It is not necessary to use 70 and 30 levels. Experiment with the levels. For a bullish market, 40 and 80 are better, and for a bearish market, 20 and 60. To reduce the total number of signals and increase their quality, you can use levels 20 and 80. I recommend using a 5 percent rule: draw a line so that the RSI remains behind it 5 percent of the time in the last three months, for example, if you trade on daily charts. Correct the reference line if necessary.

In a very quiet market with low volatility, you may notice that fluctuations in the RSI line remain between 70 and 30. You may want to try to increase the amplitude of the RSI fluctuation by shortening the period. Try to pick a lower period, for example 7 or 5. The reverse case involves a situation where the RSI line is too variable. Frequent transitions above 70 and below 30 become less significant, it is difficult to determine between actual signals and market noise. In this case, it is necessary to reduce the amplitude of the RSI line by increasing the period, for example, to 21. This will abolish many minor movements and help identify those that have value.

Signal for purchase is when RSI out of the oversold zone, the signal for sale is when RSI leaves the overbought zone. Such signals are taken only towards the main trend. The signals against the trend are ignored! It is better to combine these signals with signals from other indicators or with technical analysis. The signal to exit the position is when the overbought or oversold zones are reached. For example, when the RSI reaches the overbought zone, we close the positions to buy or pull the stops closer.

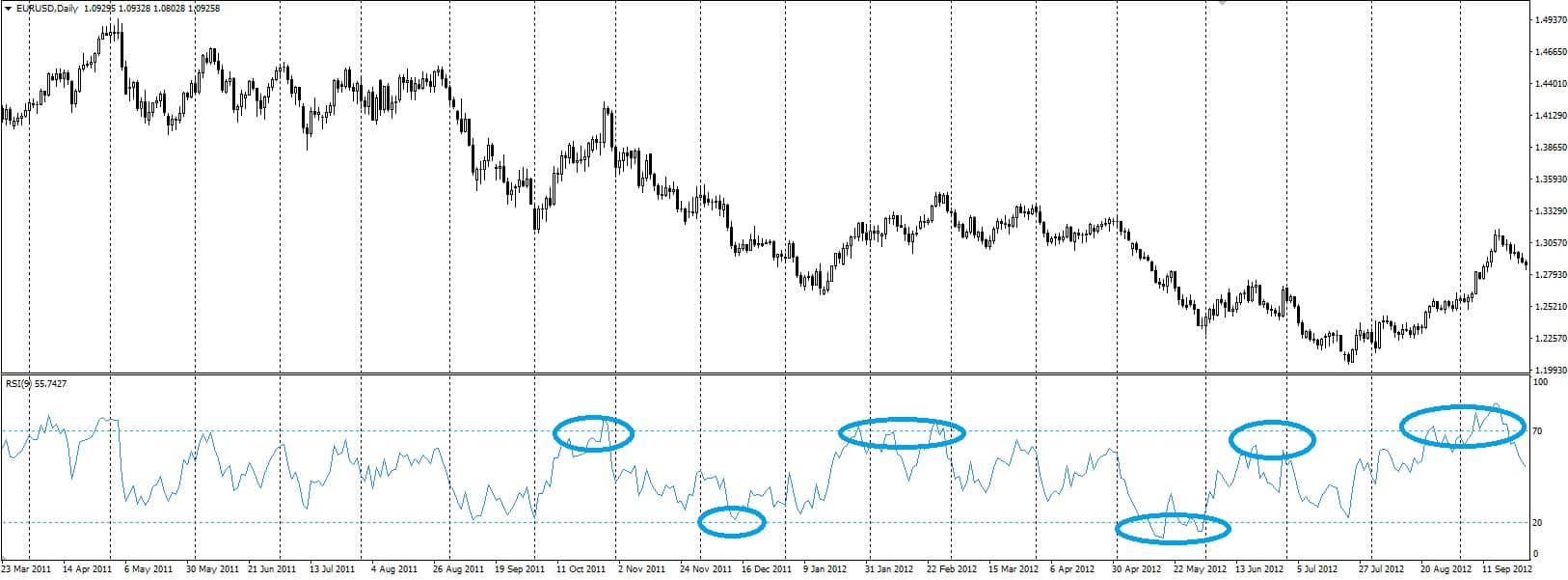

Most often, the RSI indicator is used in their work scalpers in periods when the market is a narrow flat. Pay attention to the figure with examples of entry points for the RSI indicator: the euro/dollar rate entered the overbought zone – 70, crossed it from the top down and we go on sale, and as soon as the price entered the oversold zone – 30, we enter the purchase. This tactic is very effective in flattening when position traders are waiting for clarity in the Forex market, then scalpers with the help of the RSI indicator simply poke their pockets with money here with such precise short trades.

40/80 and 20/60 Levels

As I said above, with an uptrend it is advisable to use levels 40 and 80. In doing so, we only make purchases when the indicator level drops to level 40.

In a downtrend, it is advisable to use levels 20 and 60. At the same time, we consider only long trades when the level of the indicator rises to the level of 60.

Defining the trend by 20/60 and 40/80 levels

When applying levels 20/60 and 40/80 everything goes pretty smoothly, but how to understand when to apply what levels? It is pretty easy. So, in a downtrend, the RSI indicator constantly drops to level 20 and never falls below level 80. At the ascending one, it stops at about 80 and does not want to go to 20. Therefore, when the situation occurs, as in the picture above, we can talk about changing the trend from descending to ascending in our case. The indicator on the downtrend several times fell to the level of 20, while never reaching the level of 80. But once RSI broke through level 80, from now on, you need to be cautious, the trend is expected to change. The next decline of the indicator, which did not reach the level of 20, confirms the trend change.

Level 50

Although the RSI oscillator is focused on oversold and overbought lines, line 50 is also important. You may notice that on strong trends, the price often finds resistance at this level.

If you are looking for confirmation of the up-trend, then make sure that the RSI is above 50. If you think that the market is in a downtrend, then make sure that the RSI is below 50. Let’s say you have found an uptrend, but you doubt its strength. To avoid false signals, wait for the moment when the RSI crosses the level above 50, thereby confirming the assumption. Now we can say quite confidently that the trend has formed, crossing the RSI level above 50 is a good confirmation. You may notice, for example, that during the correction in the upper trend, the RSI line will often find support on line 50 before it returns. During the lower trend, the rebounds of the RSI line will often stop near line 50.

Use the signal line 50 to confirm the trend. If RSI is above line 50, the trend is upward and it is recommended to enter only in purchases, if below, we only consider sales.

A Failed Swing

When index indicators are in oversold or overbought zones, a special model can be formed on the oscillator chart, which Wilder calls “failure swing”. The “failure swing” in the position of the vertex lies in the fact that with an upward trend the next peak of the indicator curve does not reach the level of the previous peak, after which the curve falls below the level of the previous recession. The “failure swing” in the base position occurs when the falling indicator (below 30) still does not fall below the level of the previous recession, and then, rising, exceeds the previous peak.

Nevertheless, despite the reliability of the pattern, it should not be used blindly and without confirmation by other tools. At a minimum, you need to filter the transaction by directing the trend.

Levels and trend lines

On the chart of the RSI indicator, classic graphical analysis works quite well.

In the figure above, a normal horizontal level is plotted on the chart of the RSI indicator. In this case, the support points of the indicator coincide with the support points of the trend line on the price chart. Notice how the RSI told us about the breakdown of the trend line for 4 bars before this event. Example of a trend line:

Classic behavior of the indicator in the breakdown of trend lines: many touches, then breakdown and almost always a mandatory retest of a broken trend line gives an excellent opportunity to enter the transaction at the best price. The best signals are taken in the overbought and oversold zones. In this case, you need to act exactly as in the analysis of price charts – the more touches, the higher the timeframe, the longer the model, the more reliable the signal.

Graphic figures

In addition to the levels and trend lines on the chart, RSI also often analyzes technical analysis figures, such as head and shoulders, triangles, wedges, rectangles, and others. With their help, one can predict the dynamics of the Index movement, as well as the time when the price trend should change.

RSI often forms graphic models, which on the price chart may not be indicated. Nevertheless, such figures can be quite good signals to enter the position, often outrunning most other methods.

Divergences

Another tool for forecasting prices using the Relative Strength Index is to investigate the discrepancy that arises between the direction of the Index’s movement and the price trend. By divergence we mean two cases:

1. RSI is growing, and the price is falling or is on the same level.

2. RSI falls, and the price grows or does not move.

The discrepancy, in this case, is a strong reversal indicator. And although it does not occur at every turn, it is often met in especially serious turning points.

The divergence between the RSI curve and the price movement curve with index values above 70 or below 30 is a serious signal, which is dangerous to neglect. Wilder himself calls the discrepancy “the most significant indicator for the index of relative strength.” In this case, the index curve shows either a double base or two rising bases. In this example, the oscillator’s signal very accurately indicated the beginning of the price correction and the need to fix the profit on the bearish market.

The RSI indicator shows quite well the divergences (divergences) between the price indications on the chart and the values of the oscillator itself.

As mentioned above, discrepancies are formed when the price reaches a new maximum (minimum), but it is not confirmed by a new maximum (minimum) on the RSI chart. In this case, prices usually adjust in the direction of the RSI movement. More information on divergences and their types can be found on the pages of the blog.

RSI and Moving Averages

Most traders use the RSI indicator only in the traditional manner of analyzing overbought and oversold levels. The chart below shows how simply adding a moving average to the indicator creates an anti-aliasing effect and shows the trend direction of the RSI indicator.

The moving average (red) indicates the direction of the RSI indicator’s movement, as well as finding the index itself relative to the moving average (higher or lower), which also indicates the current trend. Also, the moving average can act as a resistance level for the indicator.

Once the application of one average to the relative strength index gives such good results, then the two averages should be quite a grail.

This, of course, is not entirely true, but still, when taking into account the direction of the trend, one can get good signals at the intersection of two moving averages constructed from the RSI data.

How to determine the trend using the indicator RSI

When John D. Rockefeller was asked how the price of Standard Oil would behave, he allegedly replied: “I suppose it will fluctuate.” Price fluctuations, of course, are the essence of the market that the buyer and seller are facing. Prices can fluctuate in a range having a lower and upper limit, which are often called support and resistance levels. In other cases, prices may fluctuate within an upward or downward price channel. When prices break through the range and move to their ultimate goal – up or down, you can talk about a trend.

Determining the presence or absence of a trend is one of the most important tasks of technical analysis. The classic indicator used in the trend market is the moving average, as the price, moving in a trend, tends to remain on one side or the other side of the correspondingly chosen moving average for the greater part of the trend. The main drawback of the moving average is the delay. It can not reflect the current reality; based on historical data.

RSI is based on a price change and, thus, it is an indicator of the speed of the price. With this in mind, when most price changes occur in the direction of growth, you can expect that the RSI will be 50 or higher, indicating that the moving average with the same period as the RSI has a positive slope. The converse is true for the case when most of the price changes occur in the direction of decline, and the RSI is below 50.

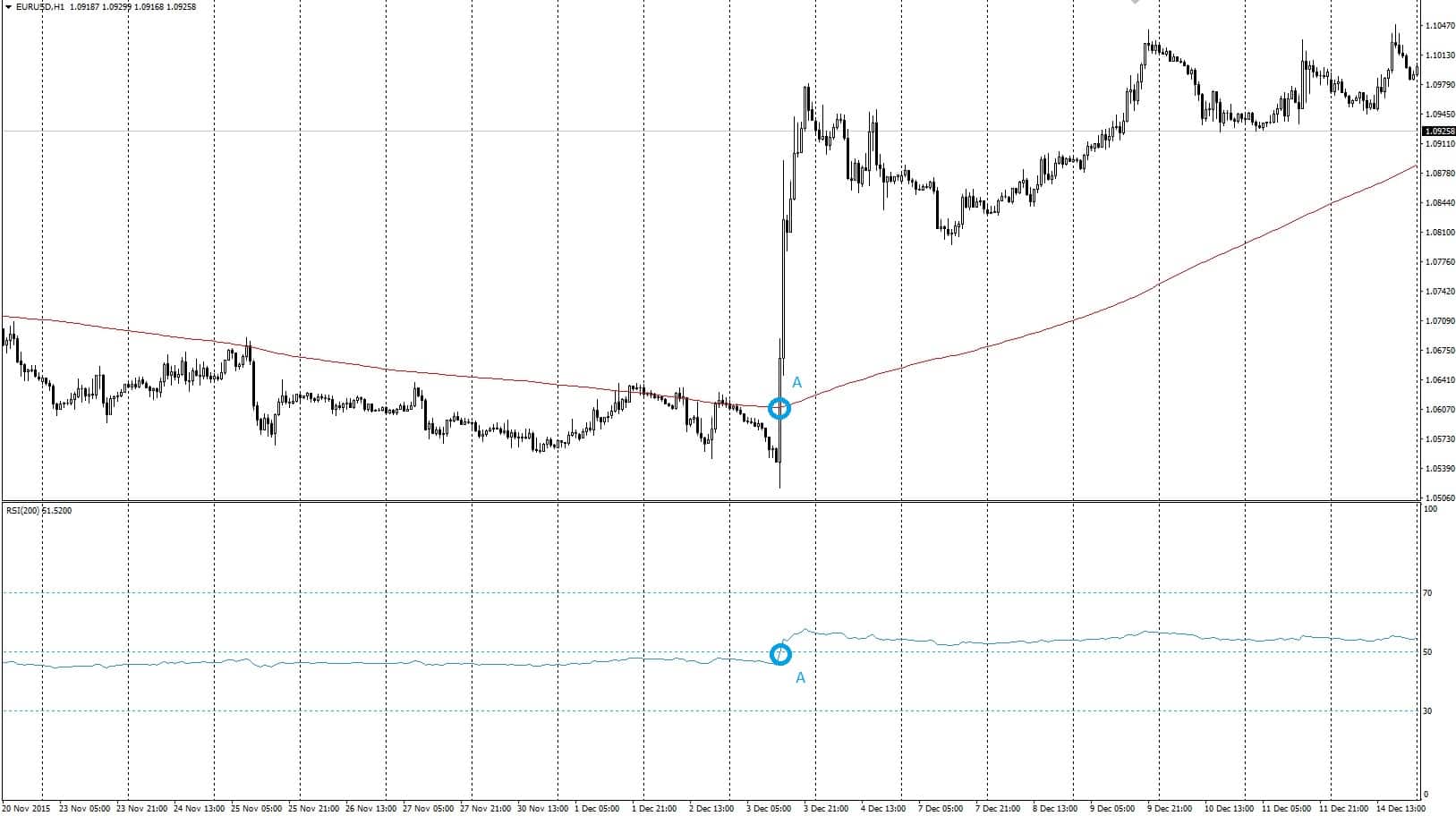

A simple moving average (SMA) with a period of 200 is shown with a red line, and RSI (200) with a blue line. Level 50 is indicated in blue. At point A there is a change in the slope from the descending to the ascending, while the SMA 200 turns up, and the RSI 200 decisively grows above 50. Note that it is difficult to determine the change in the slope of the moving average on the eye, but it is easy to see the fall of the RSI. We have seen that RSI can determine the change in the slope of the moving average when it goes into the zone above or below 50. But this is not the same as determining the trend since the slope of the moving average price during the main trend can be temporarily smoothed out or even unfolded.

One way to solve the problem is to use the simple moving average of the RSI index itself as an indicator. Moving averages with periods of 100 and 200 are shown in green and red to determine the trend. The 100-day average of the RSI 200 is shown in red, with a horizontal line at 50. As mentioned earlier, the trend change occurs when the RSI line crosses level 50. The same applies to the moving average RSI. RSI signals occurred a little later than the intersections of moving averages (points 2 and 6 against 1 and 5). But pay attention that SMA 100/200 prices had saw-tooth movements at points 3 and 4. Also, there were several sawtooth price movements with the intersection of SMA 200. 100-day moving average RSI 200 – on the contrary, did not have such movements during this period.

A more sensitive method is to compare RSI with its moving average. The figure above shows the RSI 200, built with its own SMA 200. The RSI 200 crosses its SMA 200 from bottom to top at point 1 and from top to bottom at point 2. Note that the signal at point 1 appeared earlier than the intersection of moving averages. This method shows us most of the upward phase of the market.

Using Channel Indicators

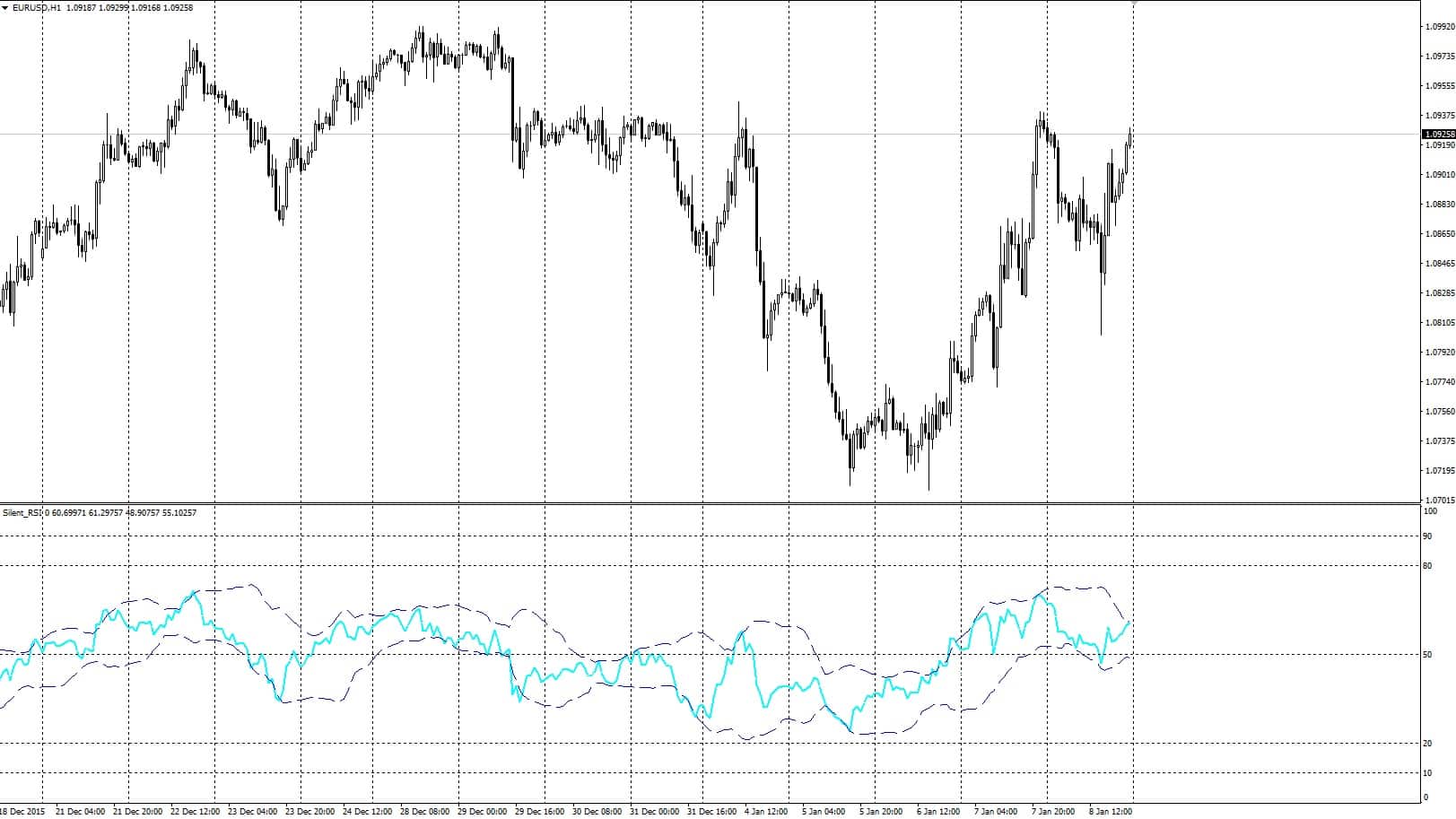

The use of channel indicators somewhat simplifies the interpretation of RSI signals, since in this case the overbought and oversold levels become dynamic and move together with the relative strength index chart. Also, the direction of the channel itself indicates to the trader the direction of the trend. For example, you can build the Bollinger Bands by the values of RSI.

Just as the RSI chart as a whole repeats the price schedule, often ahead of the price reversals, and the Bollinger bands, built on the values of RSI, in some cases may generate earlier or more clear signals to open positions. The effective use of the Bollinger Bands indicator based on RSI values will give you several additional advantages, especially if you take into account other signals generated by the RSI indicator. You can also medium Envelopes, or, for example, TMI, as well as any other channel indicator.

I prefer TMI, the application of which can be seen in the figure above. Also, as a midline 50 some traders use moving averages based on RSI values.

RSI on different timeframes

The RSI indicator shows good signals, but still its readings must be filtered. One of such possible filters can be RSI from an older period. While at the M15 period, the RSI signals oversold, the H4 indicator may be in the overbought zone. In this case, the input according to the RSI reading on M15 may result in losses.

In the figure above, two RSI indicators with a period of 14 are plotted on the EURUSD H1 chart. The upper one is built on the period of H1, the lower one is based on H4, all other settings are the same. The red dots indicate the outputs of the RSI indicator at the period H1 from the overbought zone, the green ones from the oversold zone. Orange and blue circles are the same, but for the RSI indicator built on the H4 period. Pay attention to how well small fluctuations are filtered and only really large movements remain when the indicators of both indicators are combined.

Silent_RSI indicator

And at last, I want to tell you a little about the indicator which I wrote specially for this article. It includes most of the signals discussed in this article, therefore, having studied the theory I have stated, you can use it as efficiently as possible.

What is the essence of the indicator?

The indicator is a classic indicator RSI with some “bells and whistles” and “additional equipment.” Let’s break it down in order.

So, the basis of the indicator is the classic RSI. Also, as in the standard indicator available in the MT4 terminal, it has the following settings:

RSI_Period – period of the RSI indicator

RSI_Applied_Price – the price for calculating the RSI, is made in the form of a drop-down box with the option to select the price necessary for the calculation.

There are also many additional settings which make the application of the indicator more convenient and effective:

RSI_Timeframe – the period of the indicator’s operation is the same timeframe from which the data for calculation is taken. Also executed as a drop-down menu with a list of all available periods.

The following settings serve to visualize the more pleasant and flexible setting of the RSI indicator line:

RSI_Style – style of rendering the indicator line RSI (solid, dashed, dot dotted and so on). It is executed in the form of a drop-down menu.

RSI_Width – the thickness of the RSI line is from 1 to 5 (from the thinnest to the thickest).

RSI_Color – RSI line color

The RSI indicator line changes its color when it rises above the overbought level or falls below the oversold level. This is done for the convenience of visual perception of the indicator. Naturally, like everything in this indicator, colors can be customized:

RSI_overBought_Color – RSI color for overbought

RSI_overSold_Color – RSI color for oversold

Now let’s consider the parameters of the indicator levels:

overbought and overSold – none other than the same levels of overbought and oversold. At the intersection of these levels, the indicator will change color. They also serve to get signal number 1 from the indicator, but we will get later to it.

MaxoverBought, MaxoverSold – these are also overbought/oversold levels, but higher/lower, for them the indicator goes less often. They serve only to receive signal number 2.

Visual display of levels can be disabled by setting Show_RSI_Levels=false, or you can simply configure them:

RSI_Levels_Color – color levels

RSI_Levels_Style – style levels (similar to the RSI line)

RSI_Levels_Width – thickness of the level drawing.

In this article, we have analyzed several examples of the application of moving averages, calculated according to the RSI indications. The indicator is added the ability to analyze the intersection of two moving averages (signal number 3).

If at the moment you do not need moving averages, you can safely turn them off using the parameters Show_MA1 and Show_MA2. Of course, signal number 3 will not be given.

If you still decide to use them, you must first configure them:

MA1_Period and MA2_Period – Moving Average Periods

MA1_Applied_Price and MA2_Applied_Price – prices for calculation

MA1_Method and MA2_Method – method of calculation (simple, exponential, and so on).

The following settings traditionally allow you to change the appearance of moving averages:

MA1_Style and MA2_Style, MA1_Width and MA2_Width, MA1_Color and MA2_Color

Having told about the use of channel indicators for RSI analysis, I just could not help but include Bollinger Bands and. They generate a signal number 5 and can also be turned off: Show_TMA and Show_BB.

Color settings, line thicknesses and drawing style are the same, with one change: for the upper, middle and lower channel lines, you can choose your color.

Both channels can be applied together, but then TMA will be used to calculate the signals.

TMA settings: HalfLength, DevPeriod, Deviations.

Bollinger Bands Settings: bb_period, bb_dev, BB_Method

Well, now let’s go directly to the signals.

show arrows – show the arrows when the RSI indicator leaves the overbought/oversold zones. Signal number 1.

showMaxZoneArrows – show the arrows when the RSI indicator exits from additional overbought/oversold zones. Signal number 2.

showMACrossArrows – show the arrows at the intersection of two moving averages, constructed from the RSI indicator. Signal number 3.

showed – show the arrows when the “failure swing” pattern occurs. Signal number 4.

showChannelArrow – show arrows when the RSI indicator crosses the channel and then returns to the channel. Signal number 5.

show50cross – show arrows when crossing level 50 with the RSI indicator or one of the moving averages. You can select an indicator to track the intersection using the cross50 drop-down menu.

RSI parameters for determining the trend: RSI_Trend_Period (period) and RSI_Trend_Applied_Price (price for calculation).

Parameters МА — MA_Trend_Period (period МА), MA_Trend_Applied_Price (price for calculation) and MA_Trend_Method(МА calculation method).

Also there is UseTrendFiltration parameter, which in the true position shows signals only on the current trend, determined by RSI.

Also, you can adjust the distance from the arrows to the price parameter ArrowDelta – it’s just an indent in the pips from the highest or lowest point of the candle on which the signal appeared, right up to the arrow.

Well, as always, in addition to the fact that each arrow has a signal number, you can also customize the color of the display of each arrow separately.

And the last few parameters relate to convenience or these are service settings.

Play_Alert – use the alerts when they occur fresh signals.

Play_Sound – play a sound when a signal is received.

UseSnapShot – make a screenshot when you experience a fresh signal. Drawings are in the .gif format and are saved in the terminal MQL4Files data directory folder.

UseSendMail – send notifications to the e-mail when fresh signals occur.

UseSendPush – send a push notification when fresh signals occur.

UseReconnect – when working in real-time, in case you stay outside the terminal access and you have one of the types of Notifications configured when the terminal is disabled, you will not be able to receive the news by skipping the potentially profitable sign. When UseReconnect=true, the indicator tells the server when you turn off, but if not it certainly will help, arrange a reconnection to the current account, to remain in the network.

UsePanel – small sidewalk displays help information:

By clicking on the minus button, which I indicated with the arrow and the number 1 in the figure, the panel collapses and the screen becomes free again.

Topsfield, DataField, ExpNameCol, TextCol – digital panel options.

Conclusion

Many traders do not like classic indicators and even indicators in principle. I believe that they simply do not know how to prepare them. In this article, a lot of interesting signals from a classic indicator called the Relative Strength Index were analyzed. Nevertheless, many of the nuances of its application can not be easily considered within the framework of one article.