When you look for one of the key indicators for your trading system, you probably will turn to the experience of several generations of successful traders. The indicators which they use really work with and which really bring profit; it is easy to check based on their growing capital. Well, if such an indicator is included by default in most trading platforms, then this is also not an ulterior motive.

Before reading the article and writing your questions in comments section, I recommend to watch this video. It’s not long, but covers biggest part of questions on the topic.

You must have at least heard of WPR (Williams Percent Range) indicator . It will be useful to learn it’s mechanics, so maybe it can become your reliable trading assistant.

Today we will talk about Williams Percent Range indicator (WPR, %R or Wm%R), developed by Larry Williams. Williams Percent Range (% R) is a dynamic indicator that determines the state of overbought/oversold.

As you know, stochastics lines were introduced by George Lane in the 50s of the last century. All calculations had to be done manually, and a group of traders developed formulas for oscillators, consistently giving them names: %A, %B, %C, etc. Only three proved to be working: %K, %D and %R. The first two curves are known as Lane’s stochastic, and the latter is named after Larry Williams. This indicator was introduced in 1973.

Larry Williams, in the words of J. Lane, “sharpened and improved” the indicator %R invented by a joint effort. Williams even published a book with a promising title “How I Made One Million Dollars Last Year Trading Commodities.”

Table of Contents

Characteristics of the indicator

- Platform: any

- Currency pairs: any

- Timeframe: any from H1 and above

- Trading time: round the clock

- Type of indicator: Oscillator

Historically, it was the stochastics that became the most common indicator for traders (especially for the Forex market). This indicator is often used to build trading systems, can be combined with moving averages, Bollinger bands and many other indicators which determine the direction of the trend. The %R indicator is much less well known, despite the fact that software developers never forget about it. The meaning of the indicator is as follows: it measures the ability of bulls and bears to close prices every day near the edge of the range for the past period. The Williams index confirms trends and warns about their future changes.

The basic principles of the interpretation of oscill¬ators, considered in the previous articles, are applicable to the oscillator %R. The main signal factor here is also the discrepancy in the areas of overbought and oversold, or the so-called divergence. To build the %R indicator in an inverted scale, its values are usually assigned a negative sign (for example -30%). Values of the indicator in the range from -80% to -100% indicate a state of oversold. Values ranging from -0% to -20% indicate that the market is overbought. The Williams Percent Range indicator has a feature: it can accurately predict the price reversals.

Williams %R takes into account the position of the last closing price in relation to the range – the “highest-lowest price” for the recent period. It expresses the difference in the closing price, which took place a selected number of days ago, and closing prices “today” as a percentage of the range over the recent period. If the WPR chart goes above the upper line, this indicates the strength of the bulls, but also the market being overbought. If WPR falls below the bottom line, we can conclude that bears are very strong, and the market is oversold. The indicator reflects the balance of forces of bulls and bears at the time of market closure. It shows whether bulls can close the market near the top of the range for a recent period or whether bears are strong enough to close prices near the bottom of the range.

Indicator settings of Larry Williams %R

In the MT4 platform, the indicator is called William’s Percent Range, and allows you to set the averaging period, the signal line levels (the default is -80 and -20), as well as the display style (color, line thickness, etc.). Larry Williams recommends using a 10-day period for calculations (by default, MT4 is set to 14). It has the boundaries of overbought and oversold zones at 90% and 10%, respectively (note, not 80 and 20, as in the terminal).

The indicator can be used for different time intervals: daily, during the day or weekly. The weekly %R is usually changed a week before it happens with the weekly MACD histogram. Bending of %R indicates the need to more strictly review the goals and stops, or close the profitable trades. Finally, it should be noted that one cannot always be guided only by the intersections of the %R lines, since the indicator operates quite differently in the ridge and trend markets.

Williams recommends using a 10-day period for calculations. It has the boundaries of overbought and over-sold zones at 90% and 10%, respectively. The rules for us¬ing the% R line are practically the same as those already des¬cribed for stochastic lines.

The value of market cycles when choosing the calculation period

A special way to use %R is to use it in Theory of Cycles. It is recommended to take 5, 10 and 20-day segments, corresponding to the calendar periods: 14, 20 and 56. But for a more accurate calculation, a time period of 1/2 the len¬gth of the cycle is used.

So, when calculating the Wilder’s RSI index, period 14 is us¬ed, which is ha¬lf of 28. Suffice it to mention that twenty-eight calendar days (or twenty exchange working days) represent the dominant mont¬hly trading cycle, which is harmoniously subordinated to other time intervals. It is thanks to the trading cycle in 28 days that the spr¬ead of a five-day stochastic analysis, a ten-¬day pace indicator and a fourteen-day RSI index can be explained, each of which, in fact, covers a period of time equal to 1/4 or 1/2 of this cycle.

Calculation

Strictly speaking, its calculation is a modified formula for %K from the Stochastic Oscillator indicator :

%R = -(MAX (HIGH (i — n)) — CLOSE (i)) / (MAX (HIGH (i — n)) — MIN (LOW (i — n))) * 100

where:

- CLOSE (i) — current closing price;

- MAX (HIGH (i — n)) — the highest for n previous periods;

- MIN (LOW (i — n)) — the lowest minimum for n previous periods.

The value of the last closing price is deducted from the maximum value fixed for a certain number of days. Then the difference is divided by the value of the price range for the same period. The indicator varies from 0 to -100%. It is 0 when the price closes at the very top of the range.

Advantages and disadvantages

Often overbought/oversold indicators remain overbought or oversold for a long time, while the price continues to rise or fall. When opening a short trade, only because of the seeming overbought, you can mistakenly leave the market long before the obvious signs of its weakening. Especially often this happens with long, established trends: at this time, the indicator can walk within the overbought and oversold areas for a very long time. In general, catching a trend reversal has always been considered a very difficult task, which is not suitable for a beginner.

Nevertheless, with a competent analysis, for example, when working on a trend on rollbacks, WPR well shows turning points. The indicator also proves itself under low volatility and works in the ridge markets.

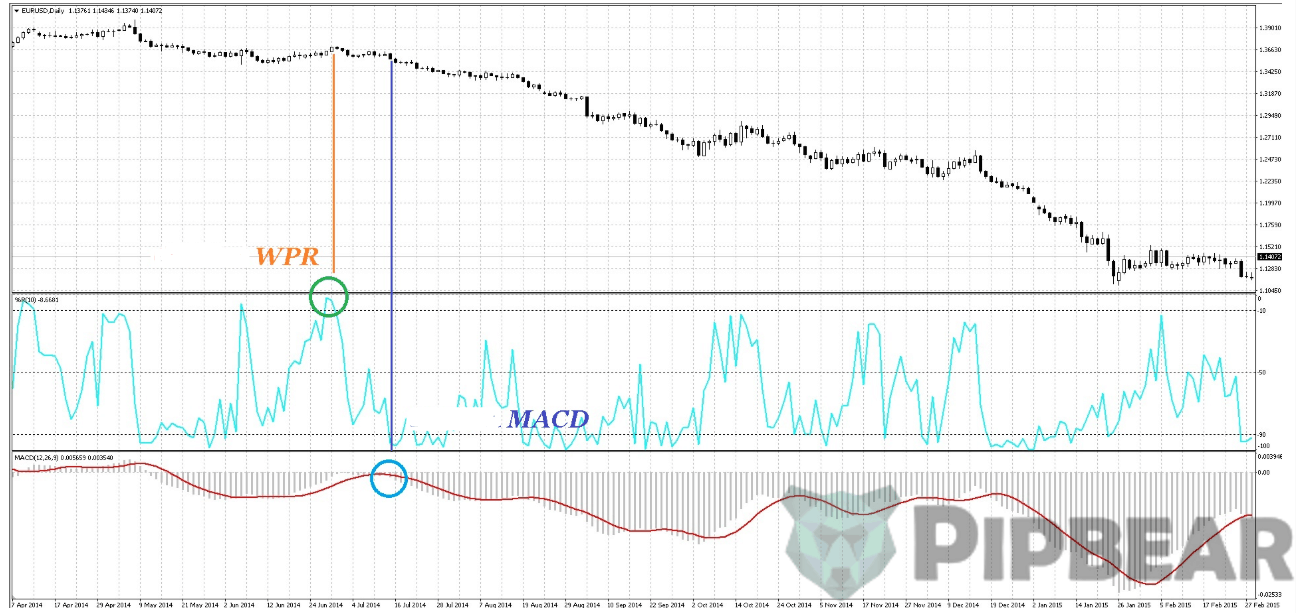

As it has already been mentioned above, the WPR indicator reacts indeed very quickly to short-term changes in the direction of the instrument’s price. For example, the signals of the WPR indicator on the daily charts are usually at least a day ahead of the signals from the MACD indicator.

Signals from the Larry Williams %R indicator

In general, the analysis of this indicator is exactly the same as for any other oscillators. Therefore, I will not dwell on the methods of its application. I will provide only the main ones.

Indicator %R, being an oscillator, gives signals of overbought/oversold markets, crossing their signal lines. It is also often may be useful to wait for the indicator to exit the area, and then open trades. As I have said above, with obvious trends, the indicator gives a lot of false signals against the trend. All in all, like all oscillators do. In general, when working on a trend on rollbacks in conjunction with WPR, the Bollinger Bands indicator is a great fit. Other channel indicators, for example, Envelopes and Keltner Channels, are also suitable.

With the WPR indicator, the Price Action patterns work well, such as doji, rails, absorption model, inner bar, pin bar and others.

Regarding the choice of the timeframe, when working on PA, the D1 and H1 periods are best suited. In addition, the WPR indicator proves itself perfectly when scalping and pipsing.

Conclusion

Today we have got acquainted with another remarkable classic indicator. Of course, it has the same shortcomings inherent in all oscillators. Nevertheless, the WPR is very fast and sensitive, due to which it is the most popular scalping oscillator, on par with the CCI indicator, and maybe even more popular. But never forget that no matter how perfect the indicator used, it is important to combine its readings with other signals and always adhere to your trading plan under any circumstances, and then success will invariably accompany you.

Thanks man once again, you are good and I like your way of thinking and precise planning.

Can you please show where to download this moving average with alert and email alert from. Thanks

I think I have success in different systems based off of the market conditions. Every system I use focuses on support and resistance. I believe that S&R is the most important aspect of trading.

Thank you for another awesome strategy

How does the Williams indicator compare to moving averages and other indicators…??

thanks for your sharing, but i am not sure how to combine rsi with williams range together? I think they would bring up something good

Absolutely right….

Beutifully put together

Great mind