If you know a thing or two about trading, you’ve probably heard about copy trading, too. This is a very popular service that comes in a variety of forms and types. In this article, we’ll find out what stands behind copy trading, how it works, and which copy trading platform to choose.

Table of Contents

What is copy trading?

Copy-trading, also known as mirror or social trading, is a service that allows a trader (copier) to connect their trading terminal to the terminal of a more experienced trader (master) to replicate their trading transactions.

For example, a master opens a long 1-lot trade on USD/JPY. You open the identical trade on your platform and get the same result.

For the most part, copy trading is a fully automated process. All open positions are copied via a broker’s platform. Copy trading is a good source of passive income. Plus, it can be of great help to beginning traders who lack the expertise to make consistent profits in the Forex market. At the same time, different brokers offer different copy trading conditions, so you need to be careful when making a choice.

Advantages of copy trading

Copy-trading has no lack of advantages, both for copiers and masters.

For copiers

The best thing about copy trading is that it saves you lots of time. Otherwise, you would have to spend hours analyzing the market, identifying trends, and doing other preparation work. With copy trading, you don’t need to worry about all this. All the hard work and responsibility lie on your master’s shoulders.

By analyzing the trades opened by a consummate trader, you can learn the fundamentals of Forex trading faster than if you read tutorials and trade on a demo account.

Another advantage has to do with psychology. You’ll probably agree that it feels good to get stable profits with zero effort.

For masters

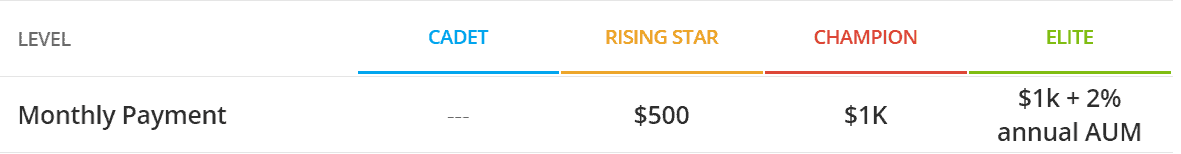

For their services, master traders earn additional income in the form of a fee. Money is hands down, the main driving force that makes experienced traders open master accounts.

Disadvantages of copy trading

The major con has also to do with money. If a copied trade was successful, a copier must pay a certain percentage of the profit to a master. While a copier realizes that it’s a justified payment for the services rendered, some traders find it hard to part with their earnings.

The good news is that some trade copying services don’t charge copiers a cent. You can benefit from other traders’ experience absolutely for free. We’ll come back to this issue later.

Another con is that you’re putting your trading capital at stake. We’re all human, and even seasoned traders make mistakes. There is no guarantee that all copied trades will be profitable. At the same time, a master is interested in showing a good trading performance as they only earn a fee for successful transactions.

It’s important to understand that risk is an indispensable part of Forex trading, whether you copy trades, use a PAMM account, or trade by yourself.

Copy-trading and PAMM accounts

It’s worth noting that copy trading and PAMM (Percentage allocation management module) accounts are not trading instruments or capital management tools. Those are types of trading.

What’s the difference between copy trading and PAMM? In the case of PAMM, an investor allocates a part of their money to the account of a seasoned trader or money manager. When it comes to copy trading, your money remains in your trading account and you’re the only one who decides how to invest it.

PAMM accounts are considered a more passive instrument that minimizes the involvement of an investor. The only thing an investor needs to do is to monitor their trading account and withdraw profits promptly.

Copy trading offers more freedom and control to an investor. An investor can cancel a trade, adjust its size, etc.

There is no unanimous opinion as to which type of trading is better. I think that both methods can be highly profitable if used wisely.

Copy-trading: Reviews

Traders’ reviews about copy trading are diverse, to say the least. I’ve read all kinds of comments, from “Everything’s great! Many thanks to my manager!” to “Give me my money back!” If truth be told, there are more positive reviews than negative ones. I’m afraid that negative experience is mostly explained by the incompetence of a copier. Me and my fellow-traders have nothing but good things to say about mirror trading. Today, copy trading and PAMM are the two most beneficial trading opportunities.

While copy trading seems like a lucrative option, don’t get carried away. Be sure to keep your head cool and choose a broker wisely. Remember that the savvy approach is the cornerstone of successful trading.

Now let’s examine top copy trading services. I’ve put together a list of the best offers that can boost your finances.

CopyFX from RoboForex

Our rating opens with a copy trading platform from the RoboForex broker.

The platform uses a classical scheme described earlier in this article. A trader registers a personal account, makes a deposit, and chooses from a list of master offers.

You can set an investment period and investment amount (the minimum threshold is $10).

A fee paid to a master trader comes in two main forms:

- A percentage of profits earned by a trader.

- A percentage of a trading volume.

Sometimes, there is no fee at all. It’s a common practice among aspiring masters who want to move higher in the rating and build a good reputation.

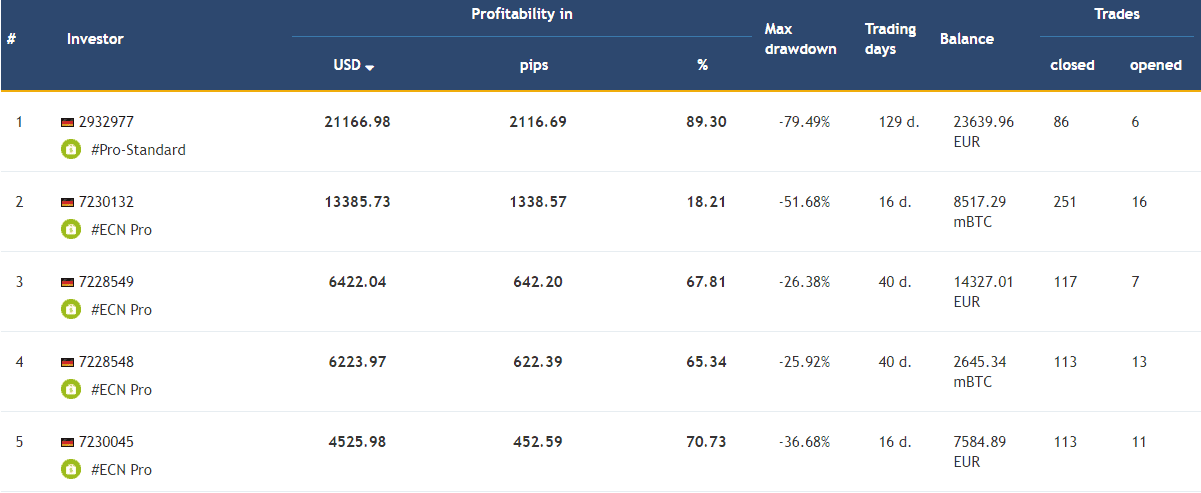

Master rating on CopyFX

You can manage the rating by setting different parameters, such as offer duration, profitability (in US dollars, pips or percent), trading balance, number of copies, number of open trades, maximum drawdown, level of risk, etc.

Also, you can filter offers by the type of reward. This is a fast way to find masters that are willing to provide their expertise for free.

To get more information on a selected offer, simply click on it. You’ll be redirected to the trader’s page, where you can see profitability charts and other data on the master’s trading performance.

In the “Trading History” tab, you can see all trades made by the master, with all the relevant parameters (traded instrument, time, etc.).

You can visualize trading stats in the form of charts and diagrams.

Trader rating on CopyFX

Along with a traders rating, CopyFX offers a copier rating.

You can visit a copier’s page and see what offers they’re connected to and how much money they’ve earned so far. I think this is a great option that makes new users feel more confident.

Wrapping it up, I can say that CopyFX is a time-tested copy trading platform that is worth exploring. Reliable and secure, it has earned a good reputation among traders.

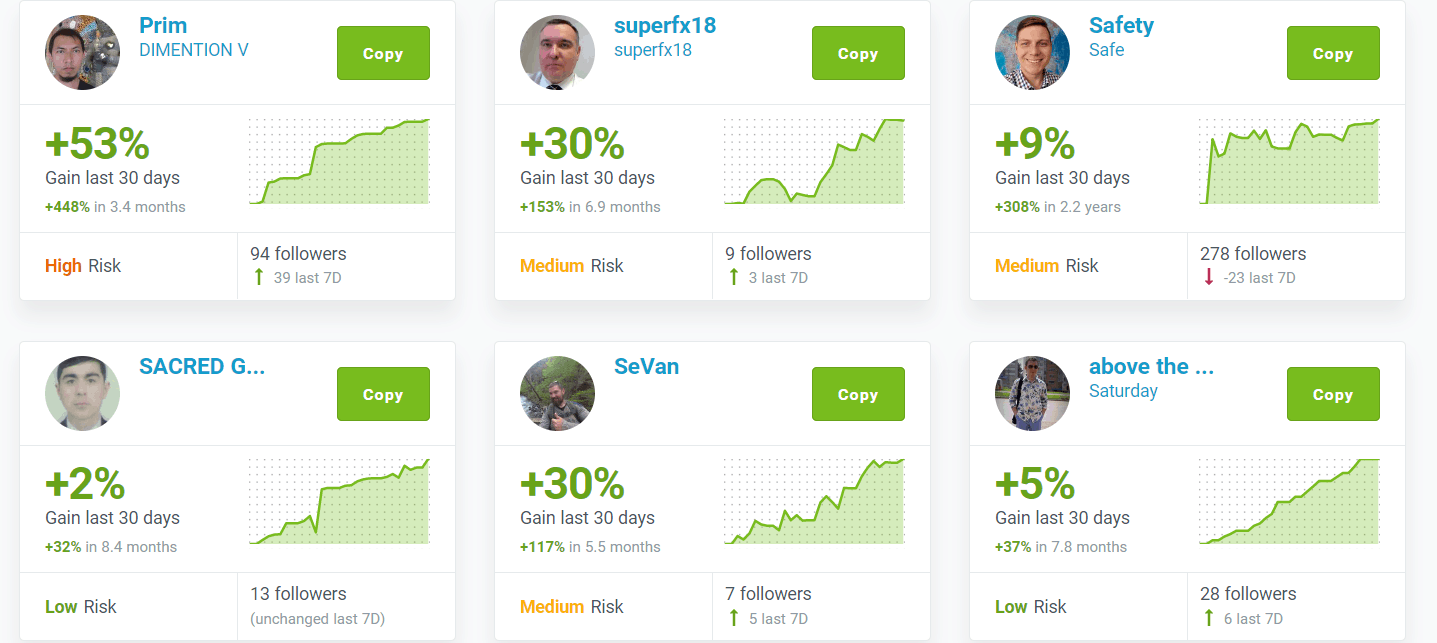

Traders’ rating on Share4you

On Share4you, master traders are called “leaders” for a reason. The rating only includes highly experienced traders with a consistently good trading performance. This is no place for random traders. This is what a leader rating on Share4you looks like.

To filter the offers by certain parameters, use the menu on the left. Detailed information on a master is available on their page.

Note that Share4you provides even more information about its masters than CopyFX.

You can check profitability, balance, drawdown, several copiers, traded instruments, and many more. This way, you can get a complete picture of a master’s skills.

An investment calculator is another useful feature that allows you to calculate your potential profits.

One of the things I like most about this platform is that copiers can leave feedback right on a trader’s page. This is a great feature I’d like to see on other copy trading websites.

For those willing to learn more about the Share4you platform and copy trading in general, the broker runs informative webinars. Participation is free.

CopyTrader from Etoro

CopyTrader is not just a copy trading platform but a strong trading community with 4,500,000 active users.

Users can copy trades in MT4 or any other trading platform, share ideas and suggestions, develop investment strategies together, ask advice from experienced traders, and have a good time in the company of fellow traders.

Bottom Line

As you can see, there is no lack of copy trading platforms. It won’t be a problem to choose a service that meets your individual needs. Trade copiers are an effective tool that offers vast benefits for both novice and professional traders.

Whether to choose copy trading or explore other options, depends entirely on your personality and trading goals. Anyway, it’s good to know that there is another hassle-free opportunity to receive passive income!