Most traders give preference to short-term and medium-term strategies. If you’re one of these traders, you must know that it’s very time-consuming as you have to monitor the market situation and manage your positions daily. Traders using long-term strategies are few. Nonetheless, long-term Forex strategies are worth exploring as an alternative money-making opportunity.

Before reading the article and writing your questions in the comments section, I recommend to watch this video. It’s not long but covers the biggest part of questions on the topic.

For some people, trading is not the only source of income. Working full time, a trader can’t monitor the charts all the time. This is where automated trading systems may come in handy. However, some traders have a hard time trusting the systems designed by other people. The only solution that is left is long-term trading.

When trading long term, you open a few positions but keep them for days, weeks or even months. It’s worth noting that long-term trading is not for everyone. A trader’s traits play a huge role. To succeed in long-term trading, you need to have a big amount of patience and discipline.

To predict how the price will behave in the future, you need to be proficient in fundamental analysis. The ability to identify trends is another must-have skill.

Beginners can find plenty of insightful recommendations on choosing the best trading timeframes. Most experts recommend starting with long-term positions. Once you’ve got the hang of trading and mastered major techniques, you can switch to lower timeframes. This tip mostly applies to stock and commodity futures markets. When it comes to Forex trading, you need to have a good starting capital to withstand price fluctuations. For many novice traders, this requirement is a major deal-breaker. Now let’s take a look at the pros and cons of long-term Forex strategies.

Long-term trading: Pros and cons

To be able to make the right choice, you need to weigh all the pros and cons of long-term trading. We made the task easier for you by listing the factors that are worth considering.

Advantages of long-term trading

- No need to monitor the charts around the clock. You simply need to check your positions from time to time and adjust them, if needed. Instead of sitting in front of the computer 24/7, you can spend your free time doing the things you enjoy.

- No need to worry that your stop-loss orders will be triggered. Long-term strategies require that you place your stop losses far from the entry price. This rules out the situation when your stop-loss orders are activated due to price volatility caused by major news releases and market manipulations.

- High profits. A long-term trader has all chances to capture hundreds or even thousands of pips.

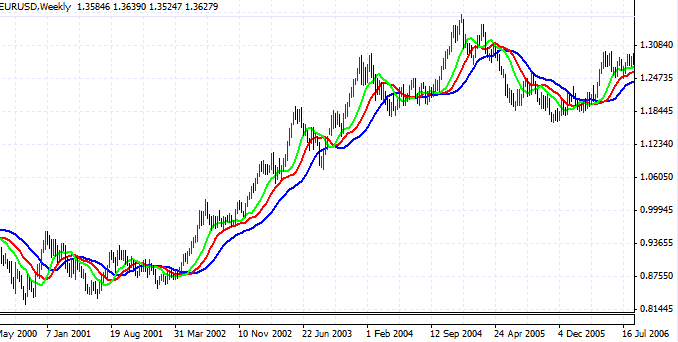

- Accurate trend identification. By using daily and weekly charts, you can recognize trends with a high degree of accuracy. Long-term impulses are more sluggish, and therefore more accurate. Take a look at the timeframe in the EUR/USD chart above.

Disadvantages of long-term trading

- Trading capital. To avoid margin calls during high volatility, you need to have a significant amount of money in your account.

- Commissions. Although you don’t have to pay transaction fees, swap fees may take a toll on your trading account. The only exception is when you open a position in the direction of a swap.

- Potential losses. While the risk of losses in long-term trading is very low, it is still there. Since your stop losses are placed far from the entry price, one losing trade may blow a big hole in your budget.

- Ineffective use of capital. Since you have to keep your positions for weeks or even months, big amounts of money in your account will be blocked throughout that time. Needless to say, this is not the best way to use your trading capital.

As you can see, long-term Forex trading is not everyone’s cup of tea. To become a successful long-term trader, you need to have a solid knowledge of economics and finance. A fat trading account is also a must. With all the necessary information at your fingertips, we hope you can make the right choice that fits your personality and budget.

Very resourceful indeed.

Good job.

Glad to have landed here.

is makes me feel like I want to know everything in forex world ,yet in the shortest span of time.

Traders trading strategies are distinct in application and results

TAKING IT TO THE NEXT LEVEL

Quick way …quick monie

This is where patience in trading get tested