Are you familiar with any situation in which you start trading and the price immediately starts to act against you despite your confidence in a good entry? And what about the situation in which the price touches the stop-loss and spoils the whole trading? I’m sure you face such situations regularly. Moreover — I’m sure that many of the readers have taken the opposite side of our initial position and made profits. I am talking about “unfaithful” trades.

Before reading the article and writing your questions in the comments section, I recommend to watch this video. It’s not long but covers the biggest part of questions on the topic.

False breakdowns happen quite often (Picture 1). This is the result of the mentality of the crowd when people buy at the peak or sell at its very bottom. Being the skilled workers of price action, we have an excellent opportunity to take advantage of such false breakdowns/breakouts and weaknesses of the retail crowd.

The power of false breakdowns/breakouts, fakes and extraordinary inputs allow many experienced traders to profit from the mistakes of others. Yes, it’s a sad story, but the markets look like that – statistics show that the majority (95%) lose money while the minority profits.

So think of false breakdowns/breakouts as of the opportunity to make money against the retail crowd. I mean those misconceptions that make traders enter the continuation of the trend exactly at the same moment when the market is ready to turn against them.

Table of Contents

What is a false breakdown?

Let us pass to the most interesting. De facto false breaks is a market’s “fakey”. The price tests the level breaks it and then rotates and comebacks in the other direction. The key part is of course the close. Since there is no close above/below the key level, the break is false — it does not lead to a continuation. Such false breaks are a great way to determine the further movement of the market and we have to learn how to use them in our favor.

In its essence, a false break is a dissonant movement that “sucks” the erring part of the market. The challenge is to wait for the price to move in one clear direction and then traders will have to close their positions on a strong turn in the other direction. As a rule, such obvious traps catch the beginners that enter the market right before it turns against the trend. These inputs are also often found on the main support/resistance levels or breakdown of the side channels.

Because of the crowd mentality, traders enter the market only when it seems to them to be the most “safe”. However, it is a trap, a false feeling. Trading on emotions and emotional sensations is the reason why most traders lose money. They are deceived because the market seems to them so strong or very weak, so they think, “damn, I’ll just get into this strong movement and ride with the price”. However, the market is a wavy matter and it never goes on smooth long trends, never. It returns to its average value, which we have already discussed in previous lessons.

Therefore, we will have to use logic and anti-intuitive, dissonant inputs to earn on the thinking of the crowd and its delusions. This means, you have to keep total discipline, selling false breaks and kickbacks, and that’s why I just adore them.

Types of false breakdowns

- Classic bull and bear traps at major levels

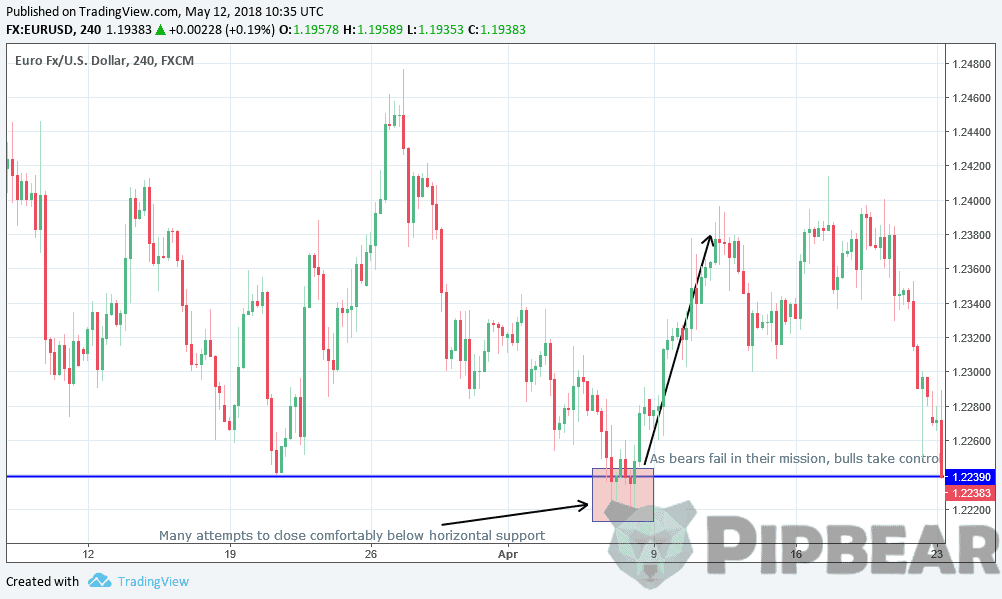

Bull or bear trap is a model of 1-4 candles that demonstrates a false break of the key level (Picture 2). Such a false break occurs after a strong directional movement when the price is approaching an important market level. Most traders believe that the break will take place, as the price approaches the level quickly and decisively. As a result, they try to trade for the break of level and often the market simply “deceives“ and they fall squarely in the trap.

A bear trap is formed as the price moves below the major level. Traders watching a strong impulse cannot resist the temptation and jump into the trade right on the level or below the major level because they are sure that at the moment the price is strong enough to break it confidently. The market then moves slightly below the level, sucking into all sell stop orders for the break and then quickly reverses and continues sharply higher. This setup leaves enthusiasts trapped in a short position. The moment they start leaving the trade, the price moves higher more.

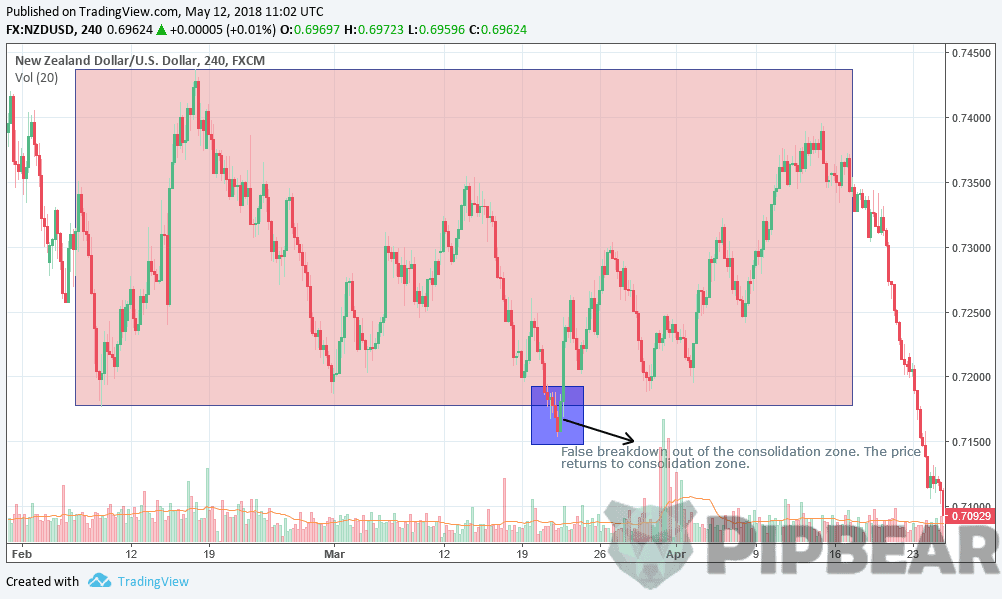

- False consolidation break

The false break of the trading range (consolidation) looks quite similar. It is easy to fall into the trap of delusion, assuming that the corridor will be broken, but instead the price returns to the range again (Picture 3). The easiest way to avoid such a situation is to wait until the price stably closes outside the channel and then look for signals of the price action in the direction of the break.

- Fake break with the bar

Fake break with the bar is one of the most common setups to trade. By studying this setup you will gather more understanding of the market dynamics. In this particular case, we have a fake break of the big resistance level but with a big bar/stick to the upside (Picture 4). The price pushes higher but fails to close and rotates sharply lower.

False break can cause long-term trend reversal

Being traders that use price action, we can use false break in our favor, especially from the basic levels. Since there they often cause a sharp reversal of the price or even a change in the trend of these levels.

We have to watch closely at the tails (shadows) of the candles near the main levels. Ask yourself — how did the price work during the day and when were the candles closed? Their closing is the main daily level and if the market cannot close higher, it can become the basis for a strong false break out (Picture 5). The bigger the level is where the market fails to create a continuation of the break, the higher possibility of the trend reversal is.

Often prices try to test the level and to break it, however, at closing the daylight candle rolls away from this level and draws a long tail, thereby demonstrating a false break or a false test of the big level. If the market cannot close above the main level and only hit it with a shadow, this is the basis for a strong pullback or trend change. Therefore, closing of the candle is the most important level, especially on the daily chart and I would focus on it.

Here is a graphic example illustrating this concept. The daily chart of EURUSD and a false break of the main level, built on the closure of two candles, which led to a strong price reversal.

About false breaks

If we cannot learn how to identify false breakouts and work with them, we will leave the money on the table to those who can. Hence it is better to focus on price action around the main levels on the daily chart since the most false breaks happen around major levels.

If I could give only 1 most important advice regarding your trader career, I would advise you to quit everything and study the false breakdowns as well as trading the opposite. So you will immediately be ahead of 95% of traders who are obsessed with using typical misconceptions and inefficient trading methods.

Both false breaks and setup fakes developed by me are the basis of the whole course and we will pay enough attention to them to make everything clear. I sincerely believe in this style of trading the opposite and I teach students on this particular topic for many years. Practical application has proved that such an approach is extremely effective. So if one has to choose his trading strategy, the chance is high that he chooses this setup to trade.

Psychology of false breaks

Practically speaking, false breaks are important psychological events in which traders of two types take part — professionals trading by logically based systems and pre-thought models and amateurs who focus on intuition and enter the market when “the time seems to be auspicious”.

It is easy to assume that the most emotional traders buy at the very peak of the upward motion or the bottom of the descending one. Why? Because of the price gathers pace in one direction, it instantly attracts more and more traders. Gradually, the price is approaching the zone where the traffic is over, and traders that used to sit sideways in boredom cannot resist the temptation and jump into the train. At this particular time the market is ready to turn in the opposite direction since everyone is familiar with the matter and tries to take part in it. At the same time, professionals have already closed trades and made money, and amateurs are on the verge of very impressive losses (including because they like to take risks).

As a result, the market sweeps out all amateurs which buy at the peak or sell on the bottom and accelerates in the opposite direction, until every one of those who trade using emotions and “intuition” is destroyed. After that, the market is ready to restore its movement to correction and goes further on the trend.

This is the phenomenon of false breaks. It occurs when all beginners have already jumped into the train and there are no more in different people. False breaks occur both in the trend market and at the peak/bottom of the market. For that reason understanding of psychology that lies behind false breaks will help you to understand better both the price movement and the market dynamics.

Emotions for bull and bear traps

As we have already discussed such traps are false breaks at the bottom/peak of the market. The market moves in one direction and then it usually ends in some form of a false break. It can be a PinBar that “flushes” the level with its shadow, fakes or a better-hidden trap.

Investors that trade without a clear plan follow simple price action setups and then enter trades blindly. As a result, they constantly buy at the peak and sell at the bottom, and the market constantly goes against them, as if it is a personal thing. While the price action traders take advantage of the above-mentioned misconception by exploiting the obvious turning areas of the market, or by trading in obvious trends the simplest price models that reflect the emotions and unavailability of the beginners in the market.

Pin bars can also act as traps. If a pin bar is formed after a strong movement into one direction and hints at the possibility of reversal, then such a hint should be regarded as a trap. Those spots that seemed to be attractive for the beginners for buying are visible on the chart. The bull trap caught the last bulls and the cell slammed shut.

Pin bar and false breakdown

Pin bars often work like false breakouts and not necessarily as fakes. They may also work as a candle, that falsely breaks the level with its shadow (and it simply is not able to break the internal bar, so there is no fake). On the chart below you can see pin bar candlestick setup (Picture 6). It usually gives a sign to price action traders that potential reversals may happen in the market. Almost every time there is a long stick to downside or upside, the price rotates and creates a trend reversal. This is especially strong when we approach major resistance levels around 114-115 in USDJPY, three times we have seen rejections after hitting this level and also creating pin bars.

Pinbar false breakdowns is a very strong price model and one of my most favorite tools. I often trade them and advise you to act ditto. You can use them both in the trend markets and the outset.

False breaks

The classical main fake is formed where the mother candle falsely breaks through. For the slight fake, one of the inner bars is broken through, but not the mother candle. Such patterns should be used only on the daily chart and we will discuss it in the lesson devoted to fakes.

The psychology of a fakey is very entertaining and no less interesting than bull/bear traps and false breakdowns by pinballs. It can be explained by the conditions under which the market is formed.

If the market is in the trend and creates fakes, indicating a work in the direction of the trend, then the reason for its formation is traders who are trying to seize the peak or bottom of the market, which is not yet ready to return to the average value. In general, amateurs not only buy at the peak and sell on the bottom, but they also always try to enter at the peak/bottom, which looks not very logical, however, it is quite understandable.

Traders who work under the influence of emotions always come into strong movement last. It happens either because they do not follow their trading strategy, or they do not have it at all. They just wait until the “suitable time” for the entrance and this is just before the market turns around. Fakes are very often formed after the last amateur enters the market, and professionals push him to the other side, which causes the closure of poorly planned positions. A similar psychology forms the basis of false breakdowns of support and resistance levels when a fake is created after an unsuccessful breakdown of the p / s.

Therefore, it is much better to wait for a real break in order to trade kickbacks to the broken level, rather than trying to guess which breakdown is real and which is false.

Fakes are formed in trend markets when amateurs try to find their peaks or bottoms. As the trend market remains stable or consolidates for several days, many traders are confident that it will turn around and convince themselves of this, believing that the turn is inevitable (even though there are simply no confirmatory price action setups).

When the market completes a short move against the trend, professionals kick into action entering the position on the rollback, as for them it is an opportunity to get a good price in the direction of the uptrend and to “gobble up” all weak orders, due to which the market will return to the movement in the general trend.

Valuable Insights

Summarizing the talk, you have to understand — you cannot trade simply under the influence of emotions, “intuition” and “it seems that it shall go up/down”. You should have a clear, definite reason for entering the market, for example, the existence of an explicit price action setup or an important structural area where several elements combine at once. In any trade, you MUST identify stop loss level first i.e. ask yourself where am I wrong in this trade?

Professional traders do not buy at the peak and do not sell on the bottom of the market, and do not chop and change in an attempt to find the spot where the price breaks off. They do not use such strategies, because they know perfectly what they are looking for. They have mastered their trading strategies perfectly instead of making entrances under the influence of emotions. Naturally, professionals also lose money at times, as all traders lose one way or another. However, professionals can make money on the emotional misconceptions of the majority traders, because they can overcome their emotional shortcomings and perceive markets only as a logical mechanism.

It implies not only a strict compliance with the trading strategy but also the ability to resist temptations to risk too much or to overtrade. A professional trader can buy in the upstream market or sell in a descending market, but only if he sees a suitable or valid price model for that reason. Such a professional doesn’t do anything because of “Wow, the price goes up fast, I should start buying”. They can also enter at the top/bottom of the market, but only if they see a suitable anti-trend setup. And not because of “the price will break off this peak, oh I’m so excited”, although the market does not demonstrate logical zones for entry at all.

False break is about emotion and everything about emotions. They are formed as a result of the work of traders, guided by feelings, not by logic, fantasies, and not by plan. Therefore, for successful work in the market, we need to trade exactly what we see happens at the moment, and not what we think “should” happen. Along with effective risk management and work with senior TFs it will make us achieve market success.

Delighted to have found you. Your explanations are concise and very helpful!

I do appreciate your analysis and the simple and concise explanations in simple terms with concrete examples. I have of late invested heavily into cryptocurrencies and have found there is a drought in the amount of quality content explaining the market. Thanks I will keep following you

I always been confused with false breakout and losing money, but this video is really helpful. I will never been trick again…

Thanks coach

Dude you are doing such a commendable job

Very helpful. Thank you very much

The most informative and educational page online!! Learning a lot from it. Thank you so much!

witch frequensy are you trading? D1? H1? W1?

Thank you sir