One of the key rules taught to every beginning trader is to use stop-loss orders. A stop loss is a surefire way to reduce your possible losses if the price starts to move against you. There is no denying that loss management is one of the key tools in a trader’s skillset. Nonetheless, placing a stop-loss order is not the only way to avoid losses in the Forex market. In this article, we’ll discuss alternative ways to play it safe.

Table of Contents

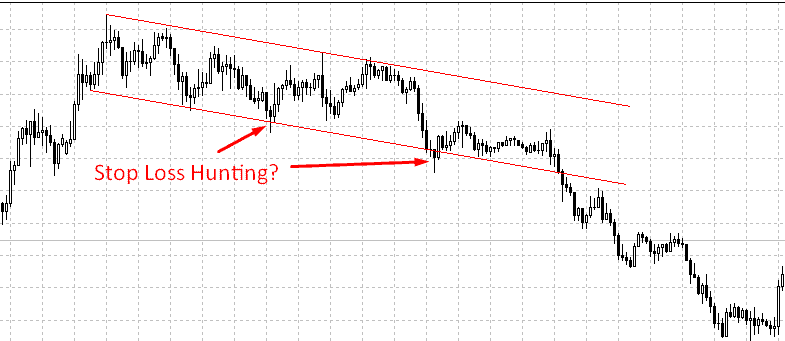

STOP LOSS IN FOREX: A TRAP FOR THE CROWD

The main problem with stop losses in Forex is that there are standard rules for setting them, i.e. above or below local extremes, support/resistance levels, etc. Most amateur traders religiously follow these rules to place their stop-loss orders. This is a weak spot market makers benefit from. It’s not uncommon that the price, before starting to move in the main direction, rushes in the opposite direction activating stop losses placed according to the standard rules. Among traders, this phenomenon is known as “stop hunting.” As a result, traders, who opened their trades in strict accordance with the principle of technical analysis rules, suffer losses.

Alternative loss limitation methods include some “multi-pass combinations.” According to these techniques, a trader should start with a small-size position. Then, as the market situation unfolds, the trader can increase their position. As a result, a trader’s position will include a series of orders that may have different opening prices, different sizes and even different directions.

Let’s take a closer look at the alternative methods to cut your losses in Forex.

LOCKing

When using the locking technique, you open a second position of the same size but in the opposite direction. The opposite position can be opened manually or by using Sell Stop or Buy Stop pending orders. As a result, a trader holds two opposite positions of the same size which eliminates the possibility of losses. Several “unlocking” methods deserve a separate article (and we have it). If you’re using the locking strategy skillfully, you have all chances to limit your losses and even close with a profit.

When placing a lock, you need to take into account a variety of factors, such as the availability of size of a swap, the size of a deposit and margin, flat price, etc.) We won’t linger on these issues in this article, though.

Position Reversal

Reversing your position is similar to the locking technique. However, this time the opposite position needs to be bigger than the first one. Like with locks, you can open a trade manually or use pending orders. For the most part, this method is used for trading support/resistance levels. If the price breaks a support/resistance level, there is a high chance that the price will continue to move against your first trade. The profits from your second position can cover the losses from your first trade.

AVERAGING into a position

If the price is moving against your open trade, you need to open a second trade in the same direction but at a better price. As a result, even with a minor price correction, you’ll be able to break even on your overall position.

It’s not uncommon that traders use the Martingale method to average into a position. According to the Martingale strategy, you need to increase your position size progressively.

Averaging into a position is a countertrend trading method that requires excellent self-discipline and accurate risk assessment.

Of course, each of these loss limitation methods deserves a closer examination. At the same time, no theoretical descriptions or recommendations can beat a real-life trading experience in the Forex market. However, acquiring so much needed skills may come with a high price (I’m talking here about inevitable losses). Unless you want to make a hole in your budget, be sure to use a demo or cent account. This is how you can hone your skills in applying alternative loss limitation methods without going bust!

Trading without stop is like swimming naked with sharks

With good money management skills stop loss aint necessary

I have realized that often stop loss will get hit before take profit

Stop loss is what is hunted by market makers

Stop loss is a guaranteed loss of money

Never try it with market makers/ Dealing desk coz itsa must hit

Trail stops the best…

Something prompts me to not be using stoploss and replace it wth TRAILS.