Perhaps you have already been looking for information on forex brokers on the Internet and are wondering which company is most reliable and whose trading conditions are best for you. Unfortunately, the information in the articles on this topic that are shown first on Google search results is not only incomplete but also unreliable in most cases. Nevertheless, this article will destroy the popular myths about forex brokers, give clear instructions as to what you need and what you do not need to consider when choosing a trading partner, and also it will point out some important aspects that nobody speaks of.

Table of Contents

Myths About Forex Brokers

First of all, I would like to comment on the recommendations of certain websites on how to choose a forex broker. Some projects even offer a free broker selection service, although they earn on affiliate programs. But that’s not the topic of our conversation right now.

Let’s consider the three main myths that are firmly established on the Internet. I highly recommend separating the truth from fiction and making decisions about the selection criteria independently.

MYTH No. 1: IT IS NECESSARY TO SEPARATE KITCHENS FROM NOT KITCHENS

I hope you started this course from the beginning and have not missed any lessons. If so, then you probably remember that in the first lesson we talked about the model of work on the forex market. There, I explained that, unlike the stock exchanges, when trading on forex, there is no common center where all the traders’ applications are collected. Your trading partner will always be your broker and there is nothing wrong with that.

When trading forex, you are trading a derivative called a CFD (contract for difference). If you still do not know what it is like, please, go back to the first lesson and supplement your knowledge of the trading tools you will be working with.

The main conclusion is as follows:

All the forex brokers, without exception, work according to one business model. This model does not prevent the trader from making money.

In the first lesson, I also wrote about the possible conflict of interests between the broker and the client. In order not to repeat, I will immediately conclude: yes, there is a conflict of interest, but nowadays brokers do not affect the trading positions of clients at all. If a trader can earn money on the market, nobody will prevent him from doing this. Dishonest brokers have existed in many markets like forex, stock markets, cryptocurrencies, and so on. I will try to write about such brokers. As soon as the information appears in our chat, I will publish it.

Of course, there may be those who do not agree with me on something, so please post comments on this lesson, I read everything and I always answer.

I hope you understand my position about forex kitchens, so let’s move on to the next myth.

leverage

MYTH No. 2: IT IS NOT WORTH WORKING WITH THE OFFSHORE COMPANIES

Today, most Forex brokers are registered in countries that are considered to be offshore zones. It is mainly the Republic of Cyprus and various island states. Stereotypes about such companies live in the minds of the traders because of the lack of understanding of what offshore company is. Offshore is a country or territory with special conditions for conducting business for foreign companies.

Registration in the offshore zone does not mean the uncontrolled financial operations, the shadow economy and the lack of taxes.

Companies open such offices in offshore territories for one simple reason. Registration in an offshore zone provides the normal conditions for interaction with most countries of the world.

This means that the company does not incur additional costs for financial transfers, such as receiving and sending money to traders when replenishing or withdrawing from trading deposits, optimizing taxation, and so on. Thus, offshore is a technical tool used by international companies to work with clients all over the world.

You can argue with me in the comments to the lesson, but I’m convinced that the registration of an office in the offshore zone is not a minus or the reason for distrust.

MYTH No. 3: BEFORE OPENING AN ACCOUNT, YOU SHOULD STUDY THE REVIEWS ABOUT THE BROKER

If you have seen my ratings, you probably noticed that there are not many comments or reviews on it. The point is that almost all the reviews about brokers that you see on the Internet are fake. To understand this, it is enough to think: Can you imagine a situation when you visit some website on purpose, to write a few good words about your broker? Most likely, it will not happen and not because you are ungrateful. The problem is that by registering in some kind of service or starting to work with a company, we already presuppose that it will work normally, and we will not face any unpleasant surprises.

Yes, when a trader encounters a conflict with a broker, he begins writing negative reviews about the broker. That is why if you consider positive and negative reviews, it’s better to consider complaints. They really can contain true information.

In most cases, the information in the negative commentary is not enough to understand who is right and who is wrong. Most often, such comments contain more emotions than the constructive proposals. But here it is also important to understand at least 3 obvious things:

- Even if the trader has had a conflict with the broker about any particular transaction, we do not know how it was finally resolved. Perhaps the broker pleaded guilty, apologized, and made up the losses to the client if they existed. Do not laugh; this happens, as top-level brokers worry about their reputation. In this case, the client continues to trade with him, and the negative feedback remains on the website forever.

- A negative review can be written by a competitor. Competition on the forex market exists not only between traders but also between brokers. This leads to the fact that the reviews can be used as a competition tool. Unfortunately, there is no way to control such reviews, so I also try to very carefully moderate everything that people write on the pages of my reviews of forex brokers.

- I guess we sort of figured out the myths and speculations, so now let’s talk about the points that I recommend to pay attention to when choosing a broker.

WHAT TO PAY ATTENTION TO WHEN CHOOSING A BROKER

- Re-quotes and Slippages;

For me, this is a key parameter when choosing a broker, even the spreads and other trading conditions are not so important in comparison with the presence/absence of requotes and slippages of the broker.

Re-quote is a situation when trying to make a transaction at the current market price (for example, opening or closing a trading position), the terminal issues an error without accepting the order. Most often, at that moment, the trader sees the message “No price” followed by a correspondent sound signal.

Slippage is a situation where the order opens above or below the desired price. This can happen with both urgent and pending orders. Slippage occurs when the broker fails to execute your order at the price you want, and the transaction occurs according to the nearest quotation that follows. In reality, this can lead to the following consequences:

- The order is executed at a less favorable price for you.

- The price seems to skip over a pending order, which eventually failed.

Slippages may occur due to market reasons. The most popular one of them is the sudden changes in quotations, for example during important economic events. Taking into account the speed of the signal, the position just does not have the time to be opened at the desired quotation, and it opens according to the updated one. What exactly will happen in this situation, whether a re-quote or a slippage, depends on the settings of the broker’s trading server?

Based on everything written above, one can draw an important conclusion about trading during the release of economic news, trying to quickly catch a great price movement. In most cases, this is a rather thankless job.

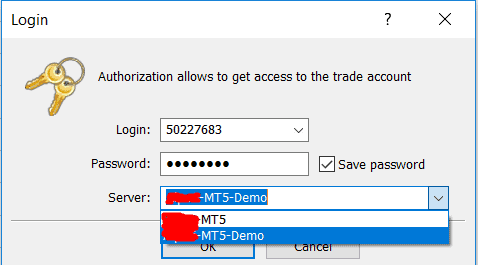

Returning to the choice of the broker, unfortunately, it is only possible to evaluate the work of the trading server, as well as check the presence of re-quotes and slippages of the broker, by opening a real trading account and by starting to trade small volumes. It will not be possible to evaluate the quality of the execution of orders on demo accounts, since demo and real accounts are administered by different servers which is confirmed by a list of servers in the login window of the MT4 platform.

If your funds allow you to start trading with several brokers at the same time, I recommend opening accounts with several brokers from my list and see where it is more convenient for you to work.

- Spreads and commissions for basic instruments;

As I mentioned in the first lesson, spreads and commissions can play an important role in the profitability of a trading strategy. If at the end of the month you calculate the aggregate spread based on all the positions, most likely it will be a small number. In my opinion, this is the main reason for the inefficiency of scalping strategies in forex; however, we will talk about that in more detail in one of the following lessons.

At this point, it’s important to clarify the spreads exactly for those tools in trading which you are potentially interested in. Most brokers have about the same conditions for trading the most popular instrument, the EUR/USD currency pair. Also, if you compare the spreads to, for example, an Apple share or the Ethereum cryptocurrency, here the trading conditions may vary greatly. If you are sure that most of your transactions will be based on the same instrument, it is not necessary to compare the trading conditions of all the other instruments. I usually compare the trading conditions on this website. There’s a convenient chart where you can customize the columns you want.

- Commission for replenishment and withdrawal of funds;

Many brokers declare the absence of commissions for replenishment and withdrawal, but quite often they either add a small text, or name the costs with other words. Before opening an account, I recommend finding the following information:

- Deposit and withdrawal methods, as well as a full list of possible costs, including fees for payment systems.

- Full description of the withdrawal procedure, including the minimum amount and terms of withdrawal.

Often, in compliance with the rules of regulators, brokers allow you to withdraw funds only with the help of the method by which you have replenished the account, as well as by bank payment. If you want to replenish the account with one payment system, and to make a profit to another, please clarify this point with the broker support service.

By the way, all the brokers that are listed in my rankings have a support service, and calling there is much faster than studying the website. The broker records all the calls, and misleading the client by phone equals suicide. If you have any questions, the employee is obliged to answer any question in detail. Also, it will save you significant time.

- The availability of deposit for recharge, rebate, and other bonuses;

For historical reasons, I do not trust various bonus offers from brokers. Most often, the bonus is that you add credit facilities to your real account. The facilities are involved in trading, but not available for withdrawal. If you think, in fact this means that the broker gives you additional leverage, that is, increases the margin available for trading positions.

If this thesis remains unclear, I recommend re-reading the paragraph several times, as well as returning to the lesson about the leverage.

In any case, I do not see anything bad in bonuses and contests for traders if they do not affect the trader’s trading strategy and do not force them to take on additional risks. In the right hands, a bonus can be a great tool. If you read this course from the first to the last lesson, I’m sure you will understand how to deal with special offers from brokers. In any case, if there are special offers from brokers, it is worth spending time studying them, maybe you will find something really useful.

For example, some brokers offer a rebate service for free. This means that they are free to return the part of the money that you paid in the form of spreads when you reach a certain trading volume per month. For example, if you trade 100 lots in a month, you will be returned 10% of the spreads. Under no circumstances do I advise you to purposefully increase the volume of trade and violate the principles of your trading strategy, but if it is enough to put one tick to receive a small additional payment every month, why not do it?

- Trading platforms

I do not perceive the number of trading platforms as a significant advantage of the broker since I believe that MetaTrader is better than all the existing ones. Nevertheless, if the broker has his terminal, this implies a good capacity, a large programming staff, and may indicate the level of the company as a whole.

As part of the course, I do not recommend any platforms other than MT4 (or MT5) to my subscribers.

- Having a demo account

Many people do not know that not all brokers have a demo account. Even if you are not going to trade in demo mode, the lack of this type of account is a reason to think over the level of the broker.

- Account types

Any Forex broker has at least several types of accounts. Usually they differ in several parameters.

- Spread or commission.

a) The first variant is a spread. As we already know, this is the difference between the purchase price and the sale price. Accordingly, we lose several points each time opening and closing a trading position.

b) The second option is the commission. In this case the spread is minimal (usually it is less than one point), but for each trade, a fixed fee is charged and it is expressed not in points, but the base currency of the account (for example, in dollars). This is supposed to be more profitable for traders with large accounts where the size of the commission calculated in real currency will be significantly more profitable than the standard spread on the other types of accounts.

c) Combined variant: spread + commission. In this case, the difference between the bid and ask price is less than the standard one, but in each trade you are charged with a fixed commission expressed in the account currency.

- Fixed or floating spread

Sometimes you are already familiar with a fixed spread. A floating spread means that depending on the market situation, the difference between the purchase price and the selling price may increase or decrease. Traditionally, the spread increases with the sellers and buyers activity increase is on the market, for example, at the time of the release of the important macroeconomic data.

- Trading robots or expert advisors can or cannot be used.

Brokers can make separate types of accounts for traders who use automated trading systems or advisers. It is not entirely clear what the reason for this is.

- Availability or the absence of swaps.

Swap is a commission that the broker charges for the transfer of trading positions overnight. That is, if you hold a position longer than for 1 calendar day, several swap points can be automatically written off. It is worth noting that the swap always differs for long and short positions. Another interesting feature is the following one: very often a swap can be positive, that is, when you move the position the next day, several profit points will be allocated to you.

The swap chart for each instrument can be found on the website of your broker. Since the Islamic countries are not allowed to receive interest according to Sharia laws, brokers have introduced so-called Islamic accounts, also called swap-free, and, as you may have guessed, they have no swaps. Instead of this, such accounts have a bit larger spread/commission than the usual ones.

- The minimum trading lot and the minimum deposit

As a rule, the bigger minimal deposit that is required by the trading account, the less there are spreads/commissions on it. It only remains to say that it is important to carefully watch what minimum size of the transaction (in lots) is possible on one or another type of account. Some brokers have so-called cent accounts where the minimum item value is not $1, but $0.01, that is, 1 cent. Such accounts are positioned as the training ones for beginner traders, and they are actually analogous to demo accounts, since earning or losing a large amount of money is almost impossible here.

WHAT TO DO IF THERE IS A CONFLICT WITH A BROKER

Here is a list of actions that I advise you to take in case of a conflict situation with a broker (as a rule, it is a question of slipping a price, an unexecuted order or some hidden fee, for example, when deducting items):

- Quietly collect all the materials, formulate the question and contact your broker (write a ticket in your account or email), wait for the official answer.

- Text me in the comments for this lesson or in our chat.

- If you are sure that the broker is guilty and the official answer seems to you as confirmation that the broker violated the regulations, you can carefully ask the broker’s representatives how to send a complaint to the regulator who supervises your broker (for example, FCA). Most likely at this moment you will be taken as seriously as possible and your problem will be addressed by the most competent employee of the company. Further action depends on how substantiated your claim to the broker is. But in general, the complaint to the regulator to date is the most powerful lever of pressure on the company.

WHEN TO SWITCH FROM A DEMO ACCOUNT TO THE REAL ONE

Since you have already begun trading on a demo account (some of you are probably already trading on a real one), I would like to finish today’s lesson with the advice on when it is worth moving on to trading with real money.

Of course, before switching, you need to form your trading strategy which usually consists of:

- The descriptions of the entry point of the transaction;

- the descriptions of the exit point from the transaction;

- the descriptions of the principle of the formation of the trade volume of the transaction; and

- recording of the maximum risk for the transaction and the day.

It must be understood that trading on a real account is significantly different from trading on a demo account. Even though charts, prices, and even the speed of orders’ execution are the same, on the demo account there appears a whole range of emotions, which prevents you from following the strategy correctly.

Due to this, I advise you to switch from the demo account to the real one when:

- You have formed a trading strategy, drove it through a strategies tester and traded on the demo account for at least a few days.

- The money you want to put on the account is not your last and you have at least the same amount in the form of savings.

- The money you want to put on the account is not significant, and you are potentially ready to lose it all. This is very important, since if your account has a significant amount for you, at one point you simply will not be able to close the unprofitable transaction on time.

Trust me, everybody lives through it.

On this note, I would like to finish the last lesson of the second level and congratulate you on the transition to the most interesting block of the course, which deals directly with trading strategies, testing, and improvement.

See you at the next level!

Yours sincerely, Pipbear

KEY TERMS OF THE LESSON

Offshore | Re-quote | Slippage | Rebate | Commission | Swap | Islamic account

KEY CONCLUSIONS OF THE LESSON

- All Forex brokers work according to the same model, just some of them work well, and others are not very good.

- The country of registration of the company does not matter.

- Most reviews about brokers on the Internet are fake.

- The availability of re-quotes and slips can be checked only by trading on a real account.

- Having a demo account is important.

- If there is a conflict, you may contact the regulator.

- My rating of brokers is here.

In 2015, when Alpari went down, I had an account with them… to be honest until today I have never received a penny of my money. All they are doing is taking me round and round. My question is, do the FCA regulations really work? Are our monies segregated?

Brokers reviews are fake sometimes especially the online reviews… I would recommend getting in touch with a trader who has the experience working with a broker.

Admin, which are the best brokers in terms of territory, I trust UK brokers more because of the FCA how about those in other territory even in Asia?

I once scalped and a broker shut me off, closed my account completely, why are some brokers against scalping?

Excellent work here

Should I trust market analysis done by the broker, including technical and fundamental analysis? Thanks!

Some brokers offer mirroring services, I doubt they have good intent…

Which brokers according to you admin are best for a beginner?