For successful Forex trading, it’s important to understand what the terms “overbought” and “oversold” mean. How do you identify overbought and oversold areas? How do you use them to your advantage? We’ll cover these issues and others in this article.

Before reading the article and writing your questions in the comments section, I recommend to watch this video. It’s not long but covers the biggest part of questions on the topic.

Table of Contents

What are overbought and oversold market areas?

As you might’ve guessed from their names, the terms “overbought” and “oversold” have to do with something excessive, over-the-top.

An overbought market is a situation when a price has reached its highest point and can’t go any higher. The demand for an underlying asset has been met. As a result, the price is about to go down. Oversold market is the complete opposite. It refers to a situation when a price has hit its lowest point and can’t go any lower.

If no external factors are affecting a trend, a market fluctuates between the overbought and oversold conditions.

- Let’s take a down-trending EUR/USD currency pair as an example.

- Traders, who have bought the asset earlier, are eager to sell it before the price has dropped too low.

- Other traders are buying the asset at a low price hoping to make a profit when the pair will be trading higher again.

- However, buyers are few, and sellers have to drop prices to attract buyers.

- The market reaches a price when sellers don’t want to sell anymore. As a result, the downtrend is weakening.

This is a textbook example of an oversold market. Traders, who are willing to profit from a future price increase, are pushing the price higher to stimulate others. As this process is gaining momentum, an uptrend is emerging.

Important! A trend can’t change its direction immediately. When a price is in the “in-between” area, we say that an asset is overbought or oversold.

How to identify overbought and oversold areas?

The art of trading is to timely predict a trend reversal. How can you tell that the current trend is about to change its direction? Here are a few signs:

- If a price is changing fast, you see an almost vertical line on a line chart.

- If a price is changing drastically, you see a candle with a large body on a candlestick chart.

- If a price is going up in leaps, a trend is losing steam.

For a more accurate overbought/oversold identification, the following indicators are useful:

Let’s find out how each of these tools work.

Stochastic

Stochastic oscillator (or simply Stochastic) is one of the best tools to detect overbought/oversold levels.

Important! Stochastic is a technical indicator that shows a percentage ratio between an asset’s closing price and its high-low range over a given period of time.

When a trend is changing its direction, a price stops near a high/low. Stochastic uses this behavior pattern to recognize overbought/oversold areas.

Stochastic moves into overbought and oversold areas above 80 (overbought threshold) or below 20 (oversold threshold), respectively.

Overbought/oversold areas on Stochastic chart

As you can see from the chart, this method is not 100% accurate and needs confirmation.

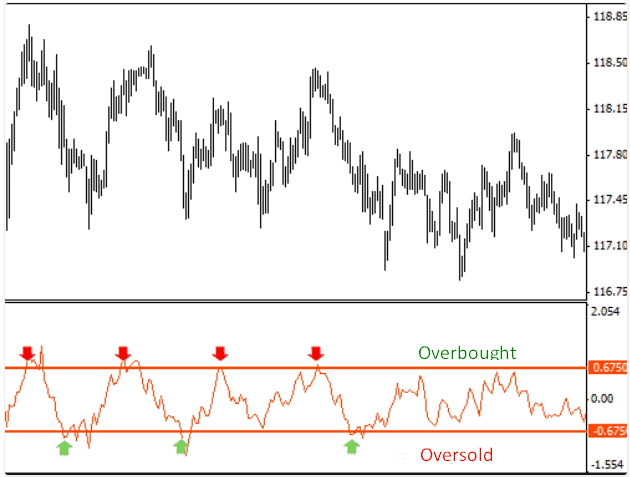

MACD

MACD stands for Moving Average Convergence/Divergence.

Important! MACD signals when a price starts trending after moving in a trading range (flat). However, Forex traders have learned how to use this tool for recognizing overbought/oversold levels.

For that purpose, the standard MACD chart with two MAs had to be retrofitted. Divergence between MA values was plotted as a histogram. For a clearer understanding, see the chart below.

Overbought/oversold areas on the MACD chart

The biggest shortcoming of this method is that MACD issues lagging signals in the short term.

Bollinger Bands

Bollinger Bands (BB) is an indicator that shows the deviation between the current price and MA values.

On a price chart, Bollinger Bands are plotted as three lines. The middle line shows the moving average of prices over a given period. The two other lines are arranged in such a way that 95% of the current prices fall in the range between them.

Bollinger Band displays a graphical area (band) between the upper and the lower lines. The width of the band is determined by price volatility.

Bollinger Band and breakouts.

To identify overbought/oversold areas, you need to plot BB on a candlestick chart. If the body of a candle protrudes beyond the Bollinger Band, this situation is known as a breakout. This method is easy to use:

- narrowband – flat movement;

- wideband – trend;

- upper band breakout – overbought market;

- lower band breakout – oversold market.

Keep in mind, though, that you’ll have to deal with false breakouts during flat movement.

Practical tips

Despite a variety of smart tools and strategies, you can predict market behavior with 100% accuracy. There is a reason why Forex trading is often compared to gambling. Both trading and gambling have to do with unpredictability and risk. Nonetheless, we’ve outlined a few useful tips that can help you boost your trading performance.

Relying on 1-2 indicators may be very risky. A wise trader is the one that gets confirmations from as many tools as possible.

- Rule of thumb sounds like this: a strong trend comes with strong signals and sideways movement comes with multiple false signals. This is especially true for Stochastic and, to a lesser extent, for Bollinger Bands. Be sure to use MACD to detect when the market starts trending.

- How do you know that a breakout out of a Bollinger Band is trustworthy? In this case, you need to remember that the jittery price movement is an indication of an overbought/oversold market. The larger the body of a candle, the lower the chance of a false breakout.

- MACD issues lagging signals. If there is a strong trend, MACD is no good.

Even among the best tools, there is no such indicator that wouldn’t lag, at least a little. To make money on Forex, you also need to see into the future. How do you do that? There is no magic involved! Simply use reliable analytical reports from recognized trading experts.