I am sure that you have already heard the term “consolidation” in the Forex market. Probably most if you do not fully understand what it stands for and how to treat it on the price charts and how to apply it in the trading process. In this article, we are going to answer all these questions and discuss the level consolidation pattern in detail.

Before reading the article and writing your questions in the comments section, I recommend to watch this video. It’s not long but covers the biggest part of questions on the topic.

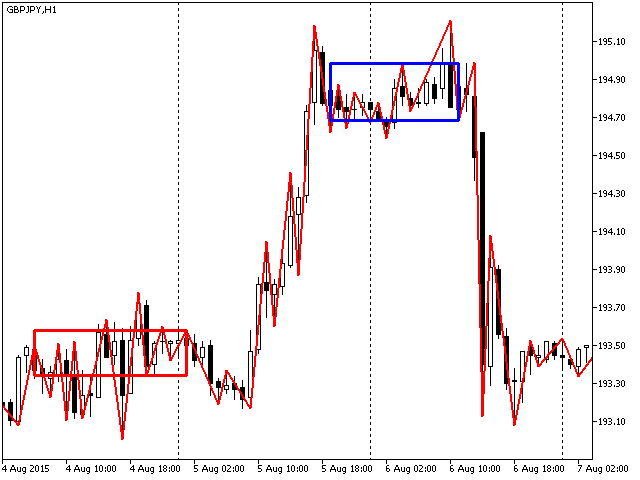

So, what does this market consolidation mean? Consolidation on the Forex market is a kind of sideways (flat) price movement on a currency pair chart. The borders of such price consolidation can fluctuate in the range from 20 to 100 points (naturally, it depends on the chosen Forex timeframe). This movement contains at least three candlesticks (in a row).

The more candlesticks in a row there is in consolidation (for example, 7-8 or more), the greater the strength of this pattern and the stronger will be the movement in a certain direction. Of course, such power is quite rare on the market but they still exist.

Consequently, consolidation of the price levels is a candle model formed at the important support/resistance levels. The candlestick bodies of the level trading pattern should not break through this important level and there should be no less than three bars.

Well, we have finally learned how to treat it on the chart. Let’s consider models for opening the transactions under the price level consolidation pattern.

First, you need to understand a few important things before applying the price level consolidation on the Forex market:

- Define consolidation only (!) at the important support/resistance levels (one of my recent article was devoted to the level strength). First, trading from such levels provides a clear understanding of the most likely price movement direction. Second, you will be able to put the short Stop Loss order (beyond the level).

- The best timeframes for the pattern are the H1 and higher (you should better take the day charts but it will take much more time waiting for the signals).

There are two models for entering the market under the price level consolidation pattern:

- Following the trend (the trend transactions):

The first Figure shows us an uptrend on the Forex market. You can see the breakout of the resistance level from the bottom to the top, then the consolidation above the level and further upward movement. That is a signal for opening the buying positions. The second picture represents a downtrend, a breakout from top to bottom, consolidation below it and a further downward movement. That is a good signal to open the selling positions.

- Against the trend (a counter-trading strategies):

Both examples here have the situations on bouncing from the level. The price reaches the level and starts consolidation without breaking it out. After that, it goes in the opposite direction.

How to Enter the Forex Market under the Price Level Consolidation Pattern?

You may open a position on consolidation from the level at least on the 4th candlestick after you are confirmed that the pattern is forming. After that, you do need to set a pending Limit order near the level. The Stop Loss order should not exceed 30 points (the most important thing is to set it behind the level).

- If the price didn’t activate the pending order (after it was set) and passed 2 stops from the entry point, we should cancel the transaction and expect the formation of a new model.

The value of the take profit for the position must be at least 3 stops (ie S/L*3). After the price passes the 2nd stop on the profitable side, we transfer the transaction in the black.

Look at the example of implementation of the Buy Limit order (a reversal trade against the main movement and consolidation below the resistance line):

The Sell Limit order (also trade against the trend and consolidation above the support line):

To sum up, I would like to say that the price level consolidation pattern is considered a really strong pattern of the Price Action method, which can result in 80% of the profitable trades. Of course, in case you use it properly at the important levels.

If you have any additions or questions about consolidation on the Forex market, you are welcome to leave a comment!

good trade but cut now…i did same trade but banked my profit at the support lows..

Have been looking for this for while….. consolidation and breakout is a great strategy both in the longterm and medium term. Thanks for sharing

completely changed my game, my success rate has increased since following you. Excellent information which can be easily applied to all strategies. I also check keep checking for any new articles

These trades last a few days,and I was reading somewhere that it is important to not try to force trades on the market. That there are times when the market is filled with a lot of noise or sideways movement and that during these times it is best to just stay out of the market all together. Considering this, on average, how many trading opportunities like these would you say present themselves within a given year?

Hi pipbear, does this apply to all trading? And by that i mean trading shares and indices. thanks!

Where can I find this indicator sir?

Does it work for all time frames ?

Very clear explanation, clear examples…. Thanks

Awesome explanations