Trading has simple but extremely effective things that allow us to confidently profit each day. A vivid example, which is confirmed by this thesis, is the Ross Hook – a unique pattern that provides an opportunity to make an accurate forecast based on price movement, but not any indicators or other unhelpful things.

Before reading the article and writing your questions in the comments section, I recommend to watch this video. It’s not long but covers the biggest part of questions on the topic.

Below we’ll consider this method, named after Joe Ross, the most experienced trader, and analyst who has devoted his entire life since 1935 to working on financial markets.

“Hooks” were created based on one of the popular patterns of chart analysis, known as 1-2-3. This formation encouraged Ross to make rework, which turned out to be very simple and effective and today it is used by all successful traders.

Table of Contents

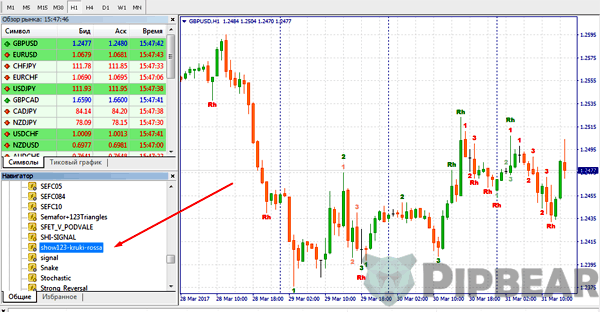

Ross Hook indicator

Download the indicator, pass to the “File” menu in the running MT4 platform and click on the “Open Data Catalog” to open it. Pay attention to the fact that after copying the file to the indicator folder, the trading platform must be restarted, and then find the tool on the left in the Navigator window and move it to the desired tool chart.

It’s easy to use the Ross Hook indicator since it finds all the appropriate chart models while determining the price movement proportions. Below will be described details about the trading system based on it.

What is the way to use Ross theory in practice successfully?

Joe Ross published a book which teaches to use “hooks” in practice and requires traders to understand the way to succeed.

- All, even the best trading methods, will not succeed if the trader does not observe the iron discipline.

- It is important to immediately accept the fact of periodic losses existence when it comes to trading on the exchange or the foreign exchange market. Success can be immediately forgotten if chasing the achievement of 100% success when opening a trade since losses are inevitable and an experienced trader can achieve them to not critically affect his deposit while covering them with the total profit amount.

- The trader’s work should be treated as its business establishment while weighing the initial and regular expenses with the total profit amount.

Fixing profits on Ross

Before considering the Ross Hooks, it should be noted this technique is a ready-made strategy in fact, where the author pays special attention to the correct position holding. He recommends to divide the position into three parts after opening it and closing it as follows:

- the first part should be closed while having the first opportunity, as soon as the accumulated profit will allow the stop-loss to be blocked if the price turns around and the protective order triggers for the remaining 2/3 of the original scope;

- for the second part choose a short-term goal, for example, this can be a fixed profit amount to a loss of 2:1 or the nearest strong level;

- the remaining third of the position is held as long as possible – ideally until generation of the reverse signal for opening which demonstrates the market has turned around.

Basis for Ross pattern charting

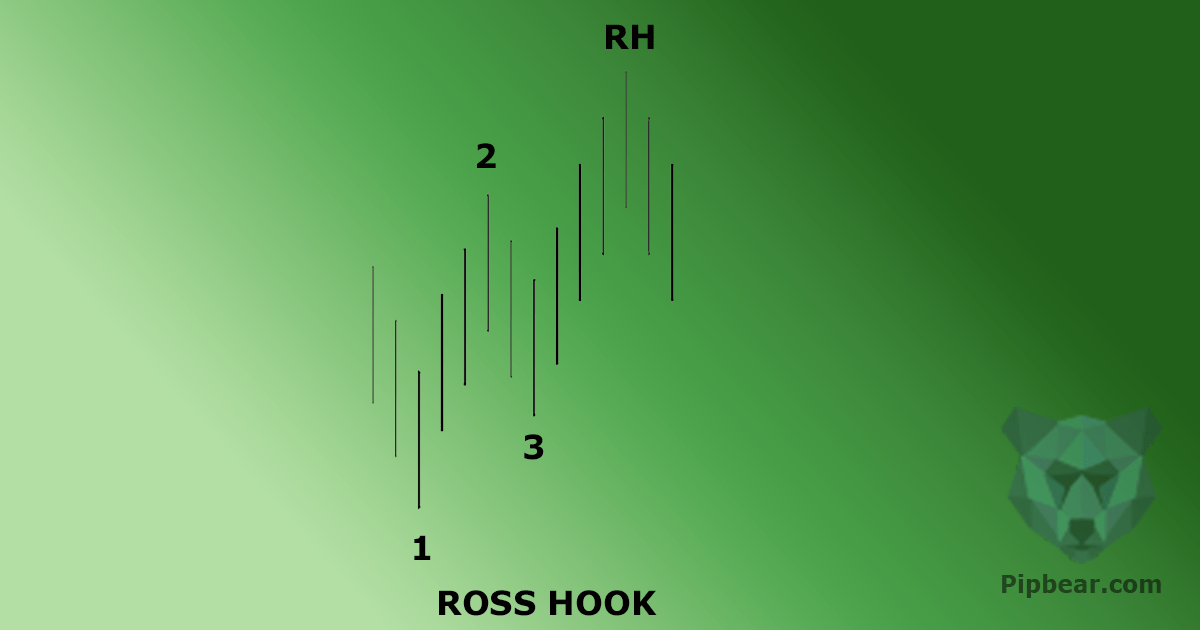

Ross Hooks are based on the chart reversal pattern, known as 1-2-3. It is important to understand the formation of this pattern from the market participants’ reactions, so we will describe it briefly.

For example, let’s take a situation where a reversal formation 1-2-3 is formed at the downtrend termination.

Point 1 is always a new extremum. In this case, it sets a new local minimum.

Point 2 is a rollback after a new successful attempt to rewrite local targets.

But here’s the most interesting. If we have a trend reversal, strong players fix their profits on segment 1-2 and start to open longs.

In this case, segment 2-3 can be either an attempt to test the proposal or a wish of those who are late for the trend to enter its continuation.

If this is so, point 3 – the new local minimum – will be above point 1, which indicates the inability of the main driving force (bears in the example considered) to continue the trend.

If the new local minimum is lower than the previous one, then it is assigned figure 1 instead of 3. Then there is considered a new opportunity of reversal pattern 1-2-3 emergence.

The inability to rewrite the extremum at point 3 also indicates that key players have already been taking positions in the opposite direction. Therefore, the considered pattern does not just show us the model on the statistical probability basis but describes the psychology of decision making by major participants.

Despite seeming simplicity, it is not always easy to use 1-2-3 model in practice since it rarely provides a beautiful drawing on the chart. Therefore, Joe Ross has completed it while adding a condition which significantly improves the trading effectiveness.

Since the formation he created had a fundamental difference from the classical model of technical analysis, he was forced to give it a new name and called it Ross Hooks for the similarity with the grappling hook of the corsairs.

The way hooks are formed and how to recognize them

If looking at the example above, it’s possible to see that the difference between the Ross Hook and normal 1-2-3 pattern is in an additional impulse and correction from it, which together visually resemble a grappling hook, and also point to a similar function – fixing.

When using model 1-2-3, the entry point is usually the horizontal level break drawn through point 2. Ross rightly noted that such operation strategy is fraught with great risks since the local resistance/support breakdown at point 2 is often false.

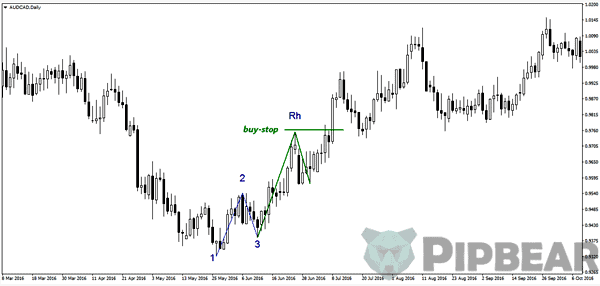

Therefore, he proposed to wait for a straight-line movement formation after the breakdown at the point 2 and a pullback from it, which will be fixed above the level. It looks the following way on the chart.

Joe Ross recommends to follow the individual stages of Hooks formation to choose the best moment for opening. For example, the distance from point 3 to Rh (pulse termination) should fit within reasonable limits. It should be understood that a short segment 3RH will not allow to talk about a sufficiently strong impulse, which confirms the strength of the players who developed it. On the contrary, a long segment 3RH is fraught with opening risks before the correction which appeared due to overbought or oversold assets.

The author notes that the optimal value of the 3RH segment should be no less than segment 1-2 and not more than its double value. In addition to the impulse, we are also interested in the correction after the RH point for obvious reasons. Here, Joe Ross recommended opening the market no earlier than at least 3 candles in the opposite direction.

The way to use the pattern in practice

Trading with Ross Hooks is so much easy as with 1-2-3 model. There opening took place at the level of 2 breakdown, and in this case, the order opening occurs as a deferred limit order, which is set to the Rh mark.

The screenshot which is located below shows an example of an opening by the pending buy stop order, which is set a couple of points above the Rh point.

As for stop-loss, it makes sense to set it if having hook pullback or existing resistance and support zones. It’s not difficult. But take-profits have a bit another situation since the author does not give clear recommendations with goals for the Ross Hooks trading system.

it’s possible to suggest the following scheme given the approach to the lot division which is advised by the author:

- close the third position at the ratio of profit to loss 2:1, which will allow to transfer the remaining 2 parts of the volume into a breakeven;

- to hold the second part while moving on local highs/lows or installing trailing;

- to cover the third part when receiving a return signal to the opening.

Some traders are guided by a fixed stop size, but this approach has several disadvantages that do not allow them to get the highs from the market. Therefore, it is worthwhile to refrain from such inefficient to avoid missing a part of the profit.

Also, it is worth considering the trend is formed from a series of Ross Hooks, so it’s possible to increase the volume together with the trend development. This gives even more profits on long-term trends.

Alternative improvements and signals filtering

When using Ross Hooks, the author in his trading system started to apply the Fibonacci grid to determine the goals while pulling it onto the price chart and noting the significant levels around which the price turn is likely to occur.

Also, Ross noted some circumstances which improve the quality of the commercial signal. In particular, he recommends:

- to always use limit orders while placing them several points above/below the key price points, which itself serves as a filter for random price fluctuations while allowing to enter the market when the strong impulse is developing on the market;

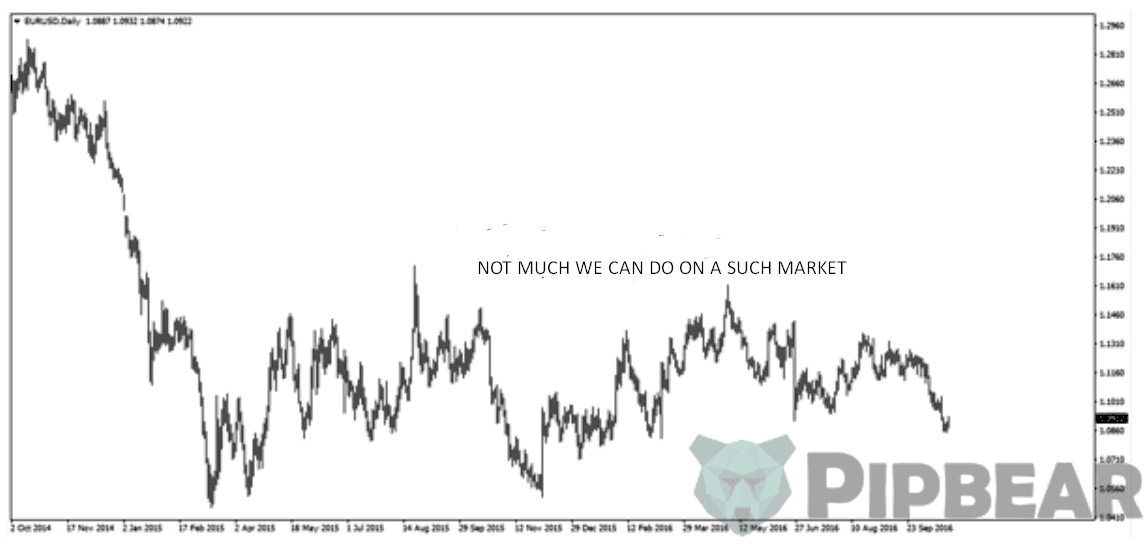

- when considering the opportunity to enter, it is worth paying attention to the market volatility while trying to refuse from trading when it is too large or, on the contrary, insignificant;

- when placing stops, always pay attention to their distance while trying to avoid the trade, where the potential losses magnitude will be too large.

Where and when is it better to use hooks

The best result of Ross Hooks’s application is seen on trading assets, which often draw beautiful long-lasting trends.

The author used the developed trading system on the futures contracts for goods and currencies. the most popular currency pairs with the Japanese yen are the best ones In Forex, which often generate beautiful trend movements even on small M5-M15 timeframes. We are talking about USD / JPY, EUR / JPY and GBP / JPY first of all.

The pattern has proved to apply to the popular EUR/USD currency pair worst of all, so it is better to exclude it and other assets that spend a lot of time in the outset.

Hooks Ross Hooks Ross chart model application will be perspective in trading on goods – gold, oil, wheat and others, where the strong trends often appear.

Pattern’s advantages and disadvantages

If acting carefully while applying all the author’s recommendations, Hooks are guaranteed to bring a stable income. The price itself is the leader here in contrast to strategies with indicators. Such approaches have proven themselves a long time ago, for example we can remember Price Action or VSA-analysis.

Advantages, in this case, are obvious – the market gives a clear unambiguous signal, based on the psychology and the work specifics of large participants. If joining the nascent movement initiated by the market maker, success probability and trade potential are very high.

The disadvantage is the complexity while using the trading system by newcomers. To effectively trade with Ross Hooks, it is necessary to get experience by learning to find the pattern itself, determine a favorable fundamental background, select appropriate trading tools and so on. Also, it’s necessary to accurately determine the time for opening while analyzing where the impulse or correction started and terminated. Of course, the indicator, which download link is located above, makes the task much easier, but much still depends on the trader.

It is worth mentioning the trader himself is one more factor of success while concluding the conversation about Ross Hooks! The pattern will give a lot of false signals, that’s why it’s important to show discipline, not to violate cautious money-management to easily recover after a series of failures and earn!

Okay… okay….. this was a hard nut to crack

It is worth trying…. Will definitely give it a shot

Thank you for your invaluable insights

That will not work for me….. the system is not likely to be self fulfilling

Do you make use of some of these methods? Have you tested this in the longrun?

Can I use this for any stock including cryptocurrencies

Well explained, such a difficult task to explain…

Thanks

Okay… okay….. this was a hard nut to crack

It is worth trying…. Will definitely give it a shot

Thank you for your invaluable insights

That will not work for me….. the system is not likely to be self fulfilling

Do you make use of some of these methods? Have you tested this in the longrun?

Can I use this for any stock including cryptocurrencies

Well explained, such a difficult task to explain…

Thanks

Hello, You have incorrect informations. Pattern 1-2-3 is formed on extrems and if it is full correction that mean it is 1-2-3. I see on pictures so much of mistakes. And the Ross Hook is totaly bad here. Rh is formed when next candle is lower/higer then the first one thats Rh. From Rh it can be again 1-2-3 pattern on the extrems.