A flat is a situation known to every trader. If you’re trading in low-volatility markets, you must have seen plenty of flat periods on your charts. There is no unanimous opinion on whether you can monetize on such a market situation. Nonetheless, some traders prefer to trade the instruments whose price moves in a range most of the time. Let’s find out whether a flat has a strong trading potential.

Before reading the article and writing your questions in the comments section, I recommend to watch this video. It’s not long but covers the biggest part of questions on the topic.

Table of Contents

What is a Flat Market?

For a trader, the ability to “feel” the market situation and interpret it correctly is a must. You must know that a price does not always fluctuate strongly. It’s not uncommon that instead of trending, a price moves in a narrow range.

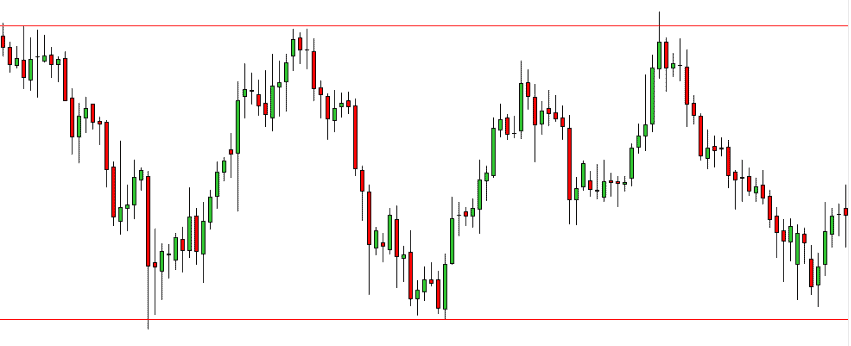

Flat refers to a situation when a price stays within the same range. In other words, a price doesn’t make new highs or lows but moves within the boundaries of recent highs and lows. Naturally, there is no strong trend in the market.

At the same time, FLAT doesn’t necessarily mean that a price moves in a straight line. It still fluctuates but within a certain range. An instrument can trade within a narrow horizontal corridor for a very long time.

The upper and lower boundaries of a range act as support and resistance levels. According to many experts, a flat market is not the best time for Forex trading. Others believe that an accomplished trader can make money in any market. What’s even more, some traders only trade currency pairs that are consolidating most of the time. Here are the most common reasons for the flat:

- trading session is ending;

- trading volume is dropping;

- no news has been released for a long time.

If you think about how common these factors are, it’s not surprising that a market spends much time “sleeping.” According to experts, even high-volatility currency pairs consolidate up to 60% of the time. If you learn how to trade flat periods, you’ll be able to make consistent profits!

Keep in mind that the timeframe you’re using plays a big role in trading consolidations. For example, a consolidation may show on low timeframes and be absent from high timeframes.

The more time a price has spent within a range, the stronger will be the trend when a price finally breaks the support or resistance level. If you’re trading with the trend, be sure to stay alert and monitor sideways movements closely.

Flat Market and Low Volatility

To understand the correlation between these two market conditions, we first need to understand what volatility is.

Volatility describes price fluctuations of a commodity. It refers to how dramatically the price is fluctuating. During high volatility, a price fluctuates rapidly in a short period. This usually happens after major news releases. Low volatility means that an instrument’s price is steady. However, the flat market and low-volatility markets are not the same thing. Low volatility can be spotted in a trending market, whereas a consolidation is anything but trending.

If an asset is trading flat, you can say that the market is having low volatility. At the same time, the reverse statement is not true. A market with low volatility is not necessarily flat.

Consolidating currency pairs

Each trader has their favorite strategies and trading styles. Some of them prefer to trade flat markets with consolidating currency pairs. This is a surefire way to avoid stress and unnecessary risks. Plus, consolidating markets provide great learning opportunities for novice traders.

Another advantage of consolidating currency pairs is that they have one of the lowest spreads.

All pairs with AUD move sideways most of the time. During the Pacific trading session, all instruments are moving in narrow ranges. (At the same time, GBP/AUD is one of the most unsteady pairs in the Pacific session.)

Plus, the low-volatility USD/CHF may move strongly following the publication of interest rate news. With that said, you should better identify steady pairs yourself. To do that, you just need to trade during uneventful periods when prices aren’t affected by important news or other external factors.

How to make money in consolidation?

Making profits in consolidation is a piece of cake. You simply need to open trades at support/resistance levels and profit from pullbacks. The most important thing is to correctly identify when a price breaks out of a flat zone. This trading style is perfect for traders who prefer to open short-term positions and lock in small profits. By using flat trading, scalpers can earn pretty good money.

Furthermore, flat trading is great for using automated robots and advisors. If previous orders closed with a loss, an automated trading tool will increase your next lot to make up for the losses.

How to trade consolidations:

- Unless you’re using scalping techniques, choose high timeframes where you can easily identify a sideways movement.

- Don’t trust the levels that formed late in a trading session above/below the real support/resistance levels.

- Despite a low level of risk, don’t forget about money management and risk management rules.

When it comes to trading consolidations, technical indicators are your best helpers. The market usually leaves the consolidation zone suddenly, dramatically increasing its trading volume. Continuous consolidation is easily seen on the candlestick and bar charts, so you don’t need any additional indicators.

Sooner or later, any trend comes to end and then a price changes its direction. A trend reversal is a major change in price behavior which opens up lucrative money-making opportunities. To open a profitable trade, you should use indicators or identify support/resistance levels.

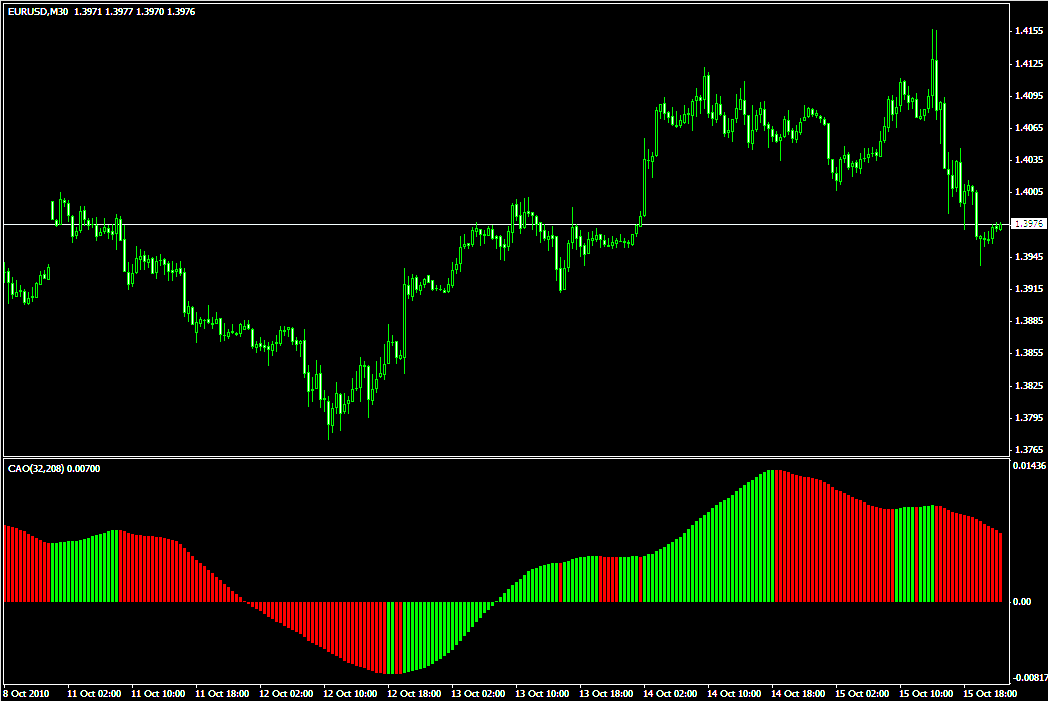

Stochastic in a flat market

Stochastic is a commonly used tool to identify flat zones. It generates reliable entry signals, allowing traders to successfully trade pullbacks. Unfortunately, due to its lagging signals, Stochastic is no good at detecting when a price leaves a consolidation zone.

Pulse Flat

The indicator known as Pulse Flat can identify the direction of a sideways trend, uptrend, and downtrend. Be sure to use this tool to spot the end of the flat movement and make a profitable entry.

Ivar

Ivar is another smart tool for identifying flat and trending markets. Plus, it’s very easy to read. If the Ivar line is above 0.5, there is a trend in the market. If the Ivar line is below 0.5, the price is moving sideways. A word of advice: be sure to pair Ivar with an oscillator for more reliable signals.

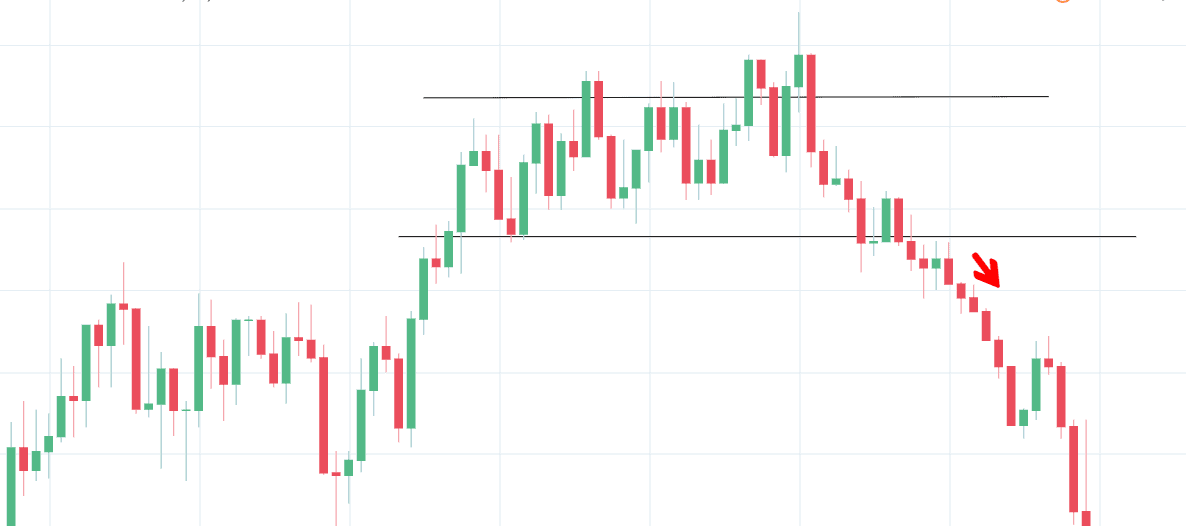

Breakout strategy (Canadian dollar)

Let’s take a look at a basic strategy for trading breakouts in a flat market. We’ll be using a low-volatility currency pair with the Canadian dollar (CAN). The good thing is that this strategy doesn’t use any technical tools.

Here are some notes on this case study:

- As you can see from the chart, a price moved sideways between 17:00 and 02:00 Ottawa time.

- The strategy works best on Н1 timeframes.

- As this is a low-volatility period for the Canadian dollar, the range is narrow.

Rules for going short:

- A price must not break the upper boundary.

- After the breakout of the lower boundary, you need to wait for a price to retest the level and form a pullback candlestick. The candle must touch on the broken level but close below it.

- A price must retest the level after 5-6 candles occurred following the breakout.

- While a price may pull back into the range, it must not touch on the upper boundary.

- Once a price leaves the range in the direction of a breakout, you can make an entry.

If, after retesting the level, a price went too far, you should ignore this signal as unreliable.

For opening a long position, the opposite rules apply.

You need to place a stop loss within at least 30 pips from the upper boundary. Your take profit must be 3 times bigger than your stop loss. In addition to (not instead of!) a stop loss, you can also use a trailing stop.

With this strategy, you have a chance of capturing 100-300 pips. For bigger profits, you can build and trade an entire portfolio of currency pairs with the Canadian dollar.

Like any other market condition, consolidation can be both beneficial and destructive for your trading account. Nonetheless, you can hardly find a better learning environment for novice traders. Trading in a flat market comes with low risks, which is exactly what a beginning trader needs. Whether you’re a beginner or just want to take a break from stressful and demanding techniques, we strongly recommend exploring the potential of consolidation strategies.