A gap is a blank space that occurs on a chart after a price has moved sharply up or down. If major news is released after the exchange has already closed, you’ll probably see a price gap on a chart the next day.

Before reading the article and writing your questions in the comments section, I recommend to watch this video. It’s not long but covers the biggest part of questions on the topic.

Table of Contents

Why does a price gap occur?

A price gap may form due to several reasons. Sometimes, an exchange fails to timely obtain the information on how a price is changing. This results in blank spaces on a chart. However, traders are more interested in situations when a gap occurs due to “natural” reasons. This is when we can talk about a drastic change taking place in the market.

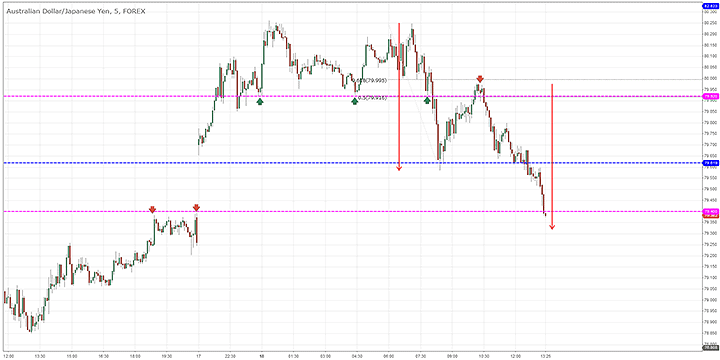

For example, if the market opens with an up gap, there is a high possibility of a strong uptrend. If the market opens with a down gap, the price will likely form a continuous downtrend.

Such gaps mostly occur between trading sessions. Why? Suppose, a major news release is published after an exchange has already closed. Once the exchange opens the next day, the news causes a sharp rise or fall in a price. As a result, we see up or down gaps on a chart. As mentioned earlier, a gap may occur due to technical failures in the operation of an exchange. For example, you may spot a technical gap on the M1 chart, especially if you’re trading tick charts. Technical gaps have nothing to do with the market situation and must be therefore ignored.

How to interpret Forex gaps

How do you read and trade gaps in the Forex market? Forex gaps are usually caused by unexpected events. Such gaps are usually not big. For the most part, the opening price and the closing price are very close.

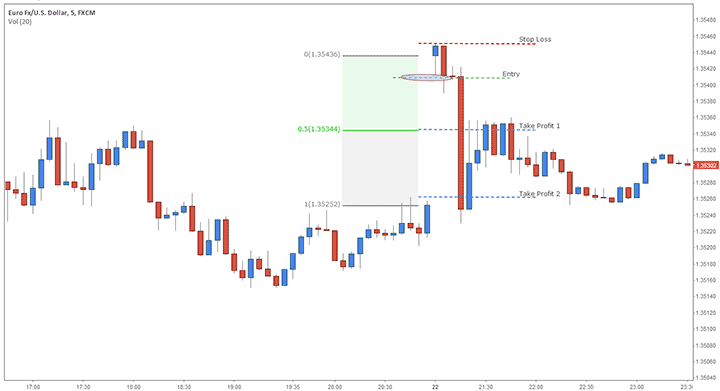

One example of a profitable gap trading strategy is to open a position against a gap, hoping that the price will fill it.

Why does a price fill a gap? It has to so with big market players known as “market makers.” It’s not uncommon that market makers push the price too high or too low, especially between trading sessions. Having massive resources at their disposal, market makers trade against the trend which would otherwise continue in the direction of the gap.

By closing the gap, market makers confuse traders even more. After the gap has been closed, they may start trading in the direction of the gap, forming a strong trend. To be able to make money amidst such chaos, you can view the filling of a gap as a signal for action. If you see a gap, there is a 70-80% chance that it will be filled. (Keep in mind that in high timeframes, a gap may take years to close!)

John Murphy on Forex gaps

According to John Murphy, to be able to effectively use gaps as a predictive tool, you must be able to differentiate between them. Murphy divided price gaps into 4 categories:

- Common gaps;

- Breakaway gaps;

- Runaway gaps;

- Exhaustion gaps.

A common gap is the least interesting formation when it comes to predicting price behavior. It usually occurs in low-volatile markets or the middle of a trading range. It indicates the lack of traders’ interest in the asset. A common gap is susceptible to the smallest investment.

Most analysts ignore this type of gap.

Unlike a common gap, a breakaway gap offers real money-making opportunities. Breakout gaps may form at the end of price patterns or precede major market changes. While you can spot this type of gap in most patterns, it’s a rare guest on charts.

It’s worth noting that breakaway gaps usually come with a major increase in trading volume. Breakaway gaps are not normally filled. (And if they get filled, it’s not in full.) The bigger the trading volume that accompanies a breakaway gap, the lower the chance that it will be filled.

Runaway gaps occur in the direction of a trend. A runaway gap indicates that the trend is strong and is gaining momentum. If you have an open position, it’s a sure signal to hold your trade longer.

Most runaway gaps form amid a trend. Find out how many pips a price moved before the gap and multiply this number by two. The resulting number is how many pips the price is expected to move before changing its direction.

Exhaustion gaps form at the end of a trend. It’s a sure sign that a trend is losing steam. An exhaustion gap is usually preceded by a breakaway or runaway gap. You can use this type of gap to open a trade in the opposite direction. To do that, you need to wait until the price moves into the gap and starts to fill it.

Jack Schwager on Forex gaps

Jack Schwager designed his classification of price gaps:

- Common gap;

- Breakout gaps;

- Acceleration gaps;

- Exhaustion gap.

Just like Murphy, Schwager believed that a common gap provided no significant insight for a trader. As for a breakout gap, it occurs when a price breaks out of a trading range. If a price hasn’t filled a breakout gap in several days, it can be used as a reliable trading signal.

Schwager’s acceleration gap is practically the same as Murphy’s breakaway gap. An acceleration gap forms when a trend is picking up steam. According to Schwager, acceleration gaps may form in bunches for days on end.

If you spot an exhaustion gap, be aware that a trend is coming to an end. An exhaustion gap can be used as a trend reversal signal. If you’re trading with the trend, you should take your profit and get out.

Excellent job!!

Gaps in the market should be avoided unless you know what resulted in the gap

If the common gap will be filled, can i take a short position at a high?

Great content as always. Im just still missing why the gaps necessarily have to be filled. What is the mechanism behind? cheers

Do stocks gap up because trading before market opens?

Thank you I was reading the book of Maggie but it was complex but you make everything simple

If a stock rises in a morning spike then consolidates for the rest of the day, until market close, then gaps up in pre market. Would you still consider that an over extended chart, therefore being an exhaustion gap? Or does the consolidation decrease the chances of a morning panic occurring?

Thanks for the tutorial and the whole tips you enlightened us with.