The term “London Breakout” refers to a whole class of strategies that benefit from sudden spikes in the trading volume on GBP/USD pair during the first few hours of the London trading session.

Before reading the article and writing your questions in the comments section, I recommend to watch this video. It’s not long but covers the biggest part of questions on the topic.

Unfortunately, this strategy is no longer effective today.

Why? The thing is that big market players are using MM algorithms that have adapted to traders’ behavior and generate an abundance of false price leaps and breakouts at the beginning of the session. This triggers traders’ stop losses, leading to multiple losing trades.

To avoid this pitfall, we need to trade in the opposite direction, i.e. when a price pulls back inside the range. One significant drawback of MM algorithms is that they expect that most traders will be trading breakouts. We have a chance to monetize on this vulnerability.

Table of Contents

How the London Breakout strategy works

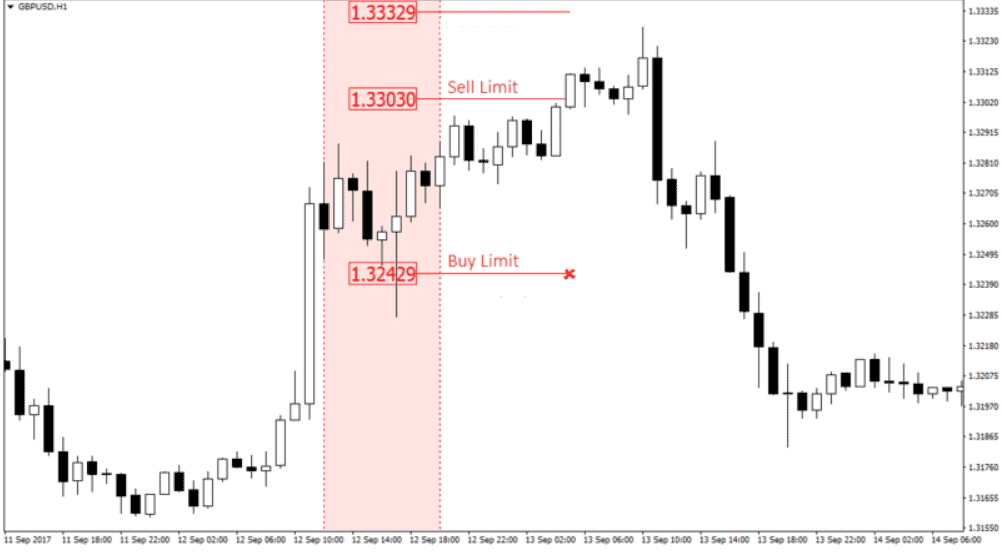

At 9 pm Moscow time, we open a GBP/USD chart and measure the range a price has gone between 12 am and 9 pm. This is the period of the highest volatility that includes the European session and the first hours of the American session.

We need to know the distance between the lowest and the highest price within the range. Let’s designate this price range as 2X. Also, we need to close all orders opened the previous day, whatever their profits and losses.

At 9 pm sharp, we place two opposite limit orders. We set a Buy Limit at the half of the price range (1X) below the current price. We set a Sell Limit at the half of the price range (1X) above the current price. As soon as one of the orders is triggered, we remove the other one.

According to our strategy, a take profit equals the full price range and a stop loss equals to half of the price range. If the price range is more than 80 pips, this is not a good sign for entry.

Case Study

Over the period between 12 am and 9 pm, a price moved 60 pips. At 9 pm, we place two opposite orders 30 pips below and above the opening price of a candle. We place a stop loss of 30 pips above the sell level and 30 pips below the buy level.

As soon as the Sell Limit order is activated, we remove the Buy Limit order. Then the price behaves in a fairly predictable way. It goes up and forms a false breakout (which looks like a market maker triggering stop-loss orders one by one). As a result, a price reverses and starts to go down, which is exactly what we need.

We place a take profit at the Buy Limit level. Don’t forget to close the positions, which were not activated by taking profit, at midnight the next day. Our profit amounts to about 27 pips.

I’d like to remind you that your price range must not exceed 70 pips. Otherwise, we don’t enter the market because this would make the distance to pending orders too big and increase the risk of a late entry. Plus, a too big range may indicate a strong trend or high volatility.

Bottom line

In this article, we focused on the light version of the London Breakout strategy. Luckily for a trader, it doesn’t require advanced trading skills. Plus, it works well without technical indicators. When using this strategy, be sure to monitor the chart to avoid the random execution of pending orders. Alternatively, you can use a script for opening OCO (One Cancels the Other) orders.

Properties of the London Breakout Forex Trading Strategy

- Currency pairs: EURUSD, GBPUSD, USDJPY

- Timeframe: M30

- Time of trading: Several times a day

There are many variations of the London Breakout Forex Trading Strategy but in general, their essence is to catch and follow the first impulse at the beginning or before the opening of the London session. Some people believe that the first impulse shows the direction, in which the price will be moving during the day.

Five years ago, this strategy worked well and helped to gain a profit. However, as the strategy got popular, the market makers started to promote false breakouts and fake impulses. So that’s what happens. The market generates an impulse before or at the beginning of the European session, the orders of the traders following the first price leap are activated and the price reverses a bit later. The stop-loss orders are activated and the market makers safely take their profit. They have managed to fool the simpletons once again.

Nowadays you can see a similar pattern on almost any trading day. So why don’t we put aside the classic version of the London Breakout Forex trading strategy? It will be much more efficient to follow the market makers using the reverse version. That’s what we use.

The System Rules

- Measure the range height between 9 and 18 hours GMT. It is 2X size in pips.

- After 6 PM set the Buy Limit order and the Sell Limit order over X pips below the current price.

- Set Take profit of each order to 2Х and the stop loss to X+5 pips.

- Close and delete all the orders the next day at 9 AM GMT regardless of the profit or losses.

- If the range between 9 and 18 o’clock is greater than or equal to 60 pips, DO NOT TRADE!

- NOTE: after one order is activated, you should delete the second one.

London open is a great time to trade

Use this smartly. stop trying to find a holy grail as he says, the logic is sound, its about using the information to your advantage!

Thank you for taking the time to make this tutorial, With so much spam out there it’s a breath of fresh air finding someone willing to share their experience and great information.

This works! Just placed 3 trades today at 9:30AM on the London Session and gained total of 150+ pips on my first day…. It works but will need more testing.

God Bless…. Some good content here

I am with Smart Trader and need a demo account, where do I find the demo account?

Please back test this guys, it looks like a sound strategy

Hi Coach, how do you handle news with this strategy?

You are doing a wonderful job coach